Monthly Economic Review for September

- Details

- Category: Economic Release

- Created: 15 November 2016

According to the IMF’s October 2016 World Economic Outlook, global growth projections remain at 3.1% for 2016 and 3.4% for 2017. However, growth in the U.S. seemed to continue its momentum over the September quarter rising by 1.4% compared with a 1.2% growth in the June quarter. This was due to real disposable income growth which was revised up and personal consumption as reported by the Consensus Forecasts. The U.K. defied expectations post-Brexit and recorded GDP growth of 0.7% over the September quarter as a result of a strong services sector. New Zealand (NZ) recorded an upwardly revised growth of 3.6% over the June quarter strongly driven by the primary and manufacturing sectors. The revision is due to new data noting an increase in labour force participation rate. NZ expects growth of 3.3% in September quarter driven by robust tourism figures but will be possibly offset by a sharp drop in export goods (meat). Australia experienced GDP growth of 3.3% over the June quarter due to an increase in resource exports, and a 2.8% growth is expected for the September quarter following a contraction of business investment.

The indicators of local economic activities in September were mixed but overall, broadly positive. Higher export of yams and taro contributed to the rise of 77.6 tonnes (11.0%) in total agricultural export volumes over the month (Figure 1). Total marine exports, on the other hand, declined by 21.7 metric tons (8.4%), mainly driven by a decrease in exports of tuna and shark meat (Figure 2). The on-going construction activities continued to boost performance in the secondary sector, supported by an increase in private individuals’ housing loans and business loans for the manufacturing sector. The financial sector remained strong during the month and continued to record higher credit growth. The trade sector advanced over the month, coinciding with a rise in container registrations by 16 registrations (2.0%). Tourism sector however slowed, as reflected by a decrease in international arrivals by 1,873 passengers (18.1%) due to lower arrivals by cruise ships.

The total number of job advertisements for September declined by 4 vacancies with Hotel and Restaurants vacancies declining the most leading to a fall in the vacancies in the Services sector. This indicates that some of the vacancies advertised last month may have been filled. However, the NRBT expects the economy to grow firmly in the near future with increased demand for labour supporting a lower unemployment rate.

Monthly headline inflation fell by 0.3%. The fall in imported prices was more than enough to offset the rise in domestic prices. This was mainly driven by the prices of imported food and transportation which fell by 1.2% and 1.1% respectively.

Annual headline inflation rose by 7% (Figure 3) in September. The main drivers of the annual inflation rate were the prices of the domestic and imported food components which rose by 10.1% and 9.2% respectively; with the new customs duties on certain food products contributing to the rise in imported food prices.

Most of Tonga’s major trading currencies depreciated against the Tongan Pa’anga (TOP) in September, except for the Australian Dollar (AUD) and the Japanese Yen (JPY). As a result Tonga’s Nominal Effective Exchange Rate (NEER) increased by 0.2%, while the Real Effective Exchange Rate declined by 0.2% over the month. By looking at the yearly trend, the NEER continued to depreciate by 5.0% while the REER has reversed to a slight increase of 0.3% which may impact Tonga’s international competitiveness.

Overseas Exchange Transactions (OET) payments were very high in September reaching $61.3 million, the highest it has ever been since December 2012. This is a rise of $8.5 million (16.1%) from last month and was mostly attributed to payments for imports and primary income. Wholesale and retail imports mostly foodstuffs, and construction imports such as cement and timber increased over the month. Meanwhile, the interest payment on government external loans and repatriation of foreign investors’ dividends contributed to the higher primary income payments.

OET receipts grew by $1.6 million (2.7%) over the month to $62.7 million. This owed largely to the receipt of government grants during the month outweighing a decline in foreign direct investments. Proceeds from exports of agricultural products also increased over the month.

For September, the overall balance which is the net change to foreign reserves, recorded a deficit of $2.5 million. The gross official foreign reserves therefore fell to $363.7 million, which is equivalent to 9.2 months of imports cover, well above the NRBT’s minimum range of 3-4 months1.

Broad money grew over the month by $5.2 million (1.1%) to another record high of $496.2 million (Figure 7). This was due to a growth in net domestic assets of $10 million (8.9%), offsetting a $5 million (1.3%) decline in net foreign assets. The increase in bank’s lending contributed to the higher domestic assets whilst a decrease in foreign reserves drove the lower foreign assets. The liquidity (reserve money) in the banking system also rose over the month by $0.9 million (0.4%) to $268.1 million, in line with the banks’ higher deposits to the NRBT vault. Over the year, a rise in both the net foreign assets of $72.8 million (24.3%) largely contributed to a $73.9 million (17.5%) increase in broad money.

Total bank lending reached $362.7 million in September 2016, an increase of $7.5 million (2.1%) from August 2016 (Figure 8). An increase in all household lending categories drove a $5.4 million (2.8%) growth in household loans over the month, particularly growth in housing loans. Business lending picked up in September 2016 by $2 million (1.3%), led by growth in loans to the agricultural sector and public enterprises. The increasing activity in the agricultural sector was partially supported by low interest rates from the Government Development Loans scheme. The annual credit growth as at end of September 2016 was 14.9% ($47 million), much higher than 14% in the same period last year and is expected to grow stronger towards the final months of the year.

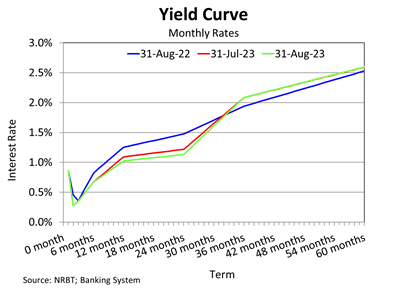

Lower interest rates on business and other personal loans drove the weighted average lending rate lower over the month by 2.3 basis points to 7.88%. The weighted average deposit rate however rose by 7.8 basis points to 2.30%, due mainly to higher term deposit rates. As a result, the weighted average interest rate spread narrowed by 10.1 basis points to 5.58% in September 2016. In year ended terms, weighted average interest rate spread narrowed by 39.5 basis points, due mainly to a decline in the weighted average lending rates and a rise in weighted average deposit rates. Total loans to deposit ratio slightly increased to 73.8% in September from 73.7% last month, which is below the 80% minimum loan to deposit ratio target. This indicates that excess liquidity in the banking system still remains.

Net credit to government fell over the month by 0.1% due mainly to a decline in banks’ government bond holdings following the bond issue in September. Similarly, net credit to government fell by 35.3% over the year which stemmed from rising government deposits. This was due to the receipt of budgetary support during the year.

The NRBT’s expectation for strong domestic economic activity remains in the near term. The level of foreign reserves is also expected to remain comfortable supported by higher expected receipts of remittances and foreign aid, despite the projected rise in imports. Upward inflationary pressure remains in the near term due to amendments made to custom duty and excise tax effective on 1st July 2016. The banking system remains sound. NRBT will continue to closely monitor and review its monetary policy setting to maintain internal and external monetary stability, and to promote a sound and efficient financial system to support macroeconomic stability and economic growth.

1 - IMF projects the level of foreign reserves for 2016/17 to be equivalent to 5.7 months of goods and services imports.

Download the full review: Monthly Economic Review - September 2016