Monthly Economic Review for May

- Details

- Category: Economic Releases

- Created: 02 August 2017

Global developments remained relatively stable over the month, and although slower economic activity was recorded across Tonga’s major trading partners the outlook for growth in the near to medium term remained positive. The Federal Reserve Bank in the US, the Reserve Bank of Australia, and the Reserve Bank of New Zealand all maintained their monetary policy rates unchanged in May. However, unemployment improved in the US, Australia, and New Zealand due to various developments such as population growth in New Zealand, wage growth in Australia, and more hiring in the US. Similarly, inflation rose over the year to May across the US, Australia, and New Zealand economies driven mainly by higher energy prices. The outlook across all Tonga’s major trading partners remains positive.

Domestically, partial economic indicators reflected mixed growth during the month. The total volume of agricultural exports increased by 262.9 tonnes (48.9%). This was driven by better harvest of root crops during the month and the commencement of the watermelon exports to New Zealand. According to the Reserve Bank’s liaison program, the domestic agricultural and fish market had abundant supply to accommodate the increased demand in May and the starting of annual church conferences.

The activities in the secondary sector continued to support the overall domestic growth as reflected in the $3.8 million (2.3%) increase in housing loans over the month. The tertiary sector indicated strong growth during the month. This was reflected in an increase of 209 containers (24.5%) in the total number of container registrations. Both private and business containers rose by 159 and 50 registrations respectively, indicating a strong informal distribution sector, and the starting of a busy time for wholesale and retail given the annual church conferences and other events such as the children’s white Sunday and Mother’s Day. International air arrivals increased by 21.0%, and one cruise ship arrived during the month and may have contributed to the tourism sector growth.

The total number of job advertisements declined by 10 vacancies over May 2017 which was attributed mainly to lower government vacancies. The intention to fill vacant positions in the government before the end of the financial year had boosted the number of vacancies advertised in the previous month. However, over the year, total number of job advertisements rose by 2 vacancies, which indicated a rising demand for labour in Tonga and may assist in reducing the unemployment rate.

Headline inflation increased over the month by 0.2% as both domestic and imported inflation rose by 0.2% at the end of May. This was driven by a further increase in the price of kava-Tonga and imported meat. The average price of kava-Tonga further increased by 13.6% to $125/kg. Additionally, the prices of chicken pieces and mutton flaps rose by 4.5% and 2.0% respectively to an average of $3.71 and $13.76 per kilogram respectively.

The annual headline inflation rose by 10.0% over the year to May 2017. This was due to imported prices being at a very low level in May 2016, which declined by 5.0%. Imported prices therefore rose by 11.8% over the year to May 2017 contributing 6.5 percentage points to the annual headline inflation. All imported food categories rose except for imported fruits and vegetables, led by a 23.4% increase in prices of meat, fish & poultry which included a 34.7% rise in the price of mutton flap and 29.7% increase in the price of chicken pieces over the year. This was followed by the prices of other food components which rose by 11.7%, which included a 26.1% increase in the price of sugar. The higher prices of imported food continued to reflect the excise taxes and custom duties imposed on various imported food in July 2016. This tax effect is also reflected in the 32.5% increase in price of Winfield blue tobacco. Additionally, the increase in world oil prices drove the price of fuel higher by 19.2%, petrol and diesel prices rose by 21.1% and 18.7% respectively. Furthermore, the price of kerosene and liquid petroleum gas increased by 7.9%.

Similarly, the domestic annual inflation rate rose by 7.8% largely driven by the seasonality of local food, rise in electricity price, and the continued short supply of kava-Tonga. The price of local food rose by 7.1% contributing 1.5 percentage points to the overall headline inflation due to the prolonged dry weather in 2017 for growing vegetables compared to the same period in 2016. The increase in oil prices drove the electricity price higher by 22.7% contributing 1.0 percentage point to the headline inflation. Moreover, the price of kava-Tonga increased over the year by 69.4% with a 0.9 percentage point contribution to the annual headline inflation.

In May 2017, the New Zealand Dollar (NZD) and Euro (EUR) appreciated against the Tongan Pa’anga (TOP) while the United States Dollar (USD), Chinese Yuan (CNY), Japanese Yen (JPY), Australian Dollar (AUD), British Pound (GPB) and Fijian Dollar (FJD) depreciated against the TOP. As a result, both the Nominal Effective Exchange Rate (NEER) index and the Real Effective Exchange Rate (REER) index slightly decreased over the month. In annual terms, the NEER index continued to fall while the REER index rose. The rise in the REER index reflected Tonga’s higher headline inflation rate relative to its trading partners, which may impact the international competitiveness of the Tongan exports of goods and services.

Total Overseas Exchange Transaction (OET) receipts for the month of May 2017 rose by 32.6% to $71.2 million. This was attributed mainly to the rise in official transfers underpinned by budgetary support and more grants received by the Government for technical assistance and other current expenditures. Private transfer receipts also rose reflecting higher remittances received for the special celebrations and church conferences in May. This marked the second monthly peak point for remittances for the 12-month period to May 2017. In year ended terms, total OET receipts rose by 19.0% which was largely owing to the higher inflows of private remittances and official grant receipts. The celebrations and annual events during the year supported the annual growth in remittances. Majority of the annual remittance receipts were in USD and AUD which were supported by the depreciation of the TOP against AUD. This coincided with the positive economic growth in these countries.

Total OET payments for the month increased also by 20.7% to $55.0 million due mainly to higher import payments. Services and transfer payments also rose while primary income payments decreased. Higher payments for the import of wholesale & retail goods drove the increase in import payments which coincided with the rise in container registrations over the month. Total OET payments rose over the year by 9.8%, which was driven by higher payments for imports and services.

The overall OET balance for May 2017 was therefore a surplus of $20.6 million. This contributed to the rise in the official foreign reserves to $392.3 million in May 2017, equivalent to 7.2 months1 of imports cover, which is still above the Reserve Bank’s minimum range of 3-4 months.

Broad money (money supply) rose in May. This was driven solely by higher foreign reserves which contributed to the higher net foreign assets over the month. This had offset the decline in net domestic assets which was due mainly to an increase in government deposits. Annually, broad money increased which was attributed to a rise in net foreign assets, more specifically on foreign reserves.

Liquidity in the banking system (reserve money)2 increased over the month as well as over the year to $284.8 million due mainly to higher cash deposits made by the commercial banks to the Reserve Bank vault. Banks’ total loans to deposit ratio remained unchanged at 74.5% in May. This ratio continued to remain below the 80% loan to deposit ratio target which indicates excess liquidity in the banking system remains and that there is capacity for further lending by the banks.

Total banks’ lending grew over the month and over the year to a new record high of $397.7 million. Lending to both households and businesses drove the monthly and annual increase. More specifically, lending to households over the month resulted from higher housing loans whilst lending to businesses were driven by more loans for the manufacturing, services, and agricultural sectors. Over the year, housing, vehicle, and other personal loans all contributed to higher lending to households with housing loans continuing to be the most significant contributor to the overall growth. Growth in loans for wholesale & retail, manufacturing, and agriculture led to higher lending to

businesses. This supported the yearly rise in agricultural exports volume and other domestic economic activities. Furthermore, the lower interest rates from the Government Development Loans have also supported the higher lending to these sectors. Credit growth over the year to May of $49.0 million (14.1%) was relatively higher compared to an annual credit growth in April of $47.9 million (13.9%).

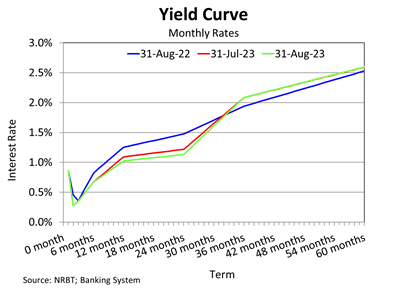

The weighted average interest rate spread narrowed slightly to 5.682% in May. This was due to a decline in the weighted average lending rate which outweighed a fall in the weighted average deposit rate. The weighted average lending rate decreased driven mainly by lower rates for household loans particularly vehicles and other personal loans and lower lending rates for business loans to public enterprises, trade, and tourism sectors. Meanwhile, the lower weighted average deposit rate was driven by a fall in the demand deposit rates. In year ended terms, the weighted average interest rate spread widened by 1.0 basis point. This was due mainly to a decrease in the weighted average deposit rate which partially offset a decrease in the weighted average lending rate. Lower savings and term deposit rates contributed to the decline in weighted average deposit rate with savings deposit rates declining the most. Lending rates for household loans (for housing and vehicle loans only) and business loans (for almost all sectors with public enterprises, trade, and manufacturing sectors showing significant movements) declined over the year to May. This supported both the higher monthly and annual credit growth.

Net credit to Government continued to fall over the month by $7.8 million and over the year by $48.9 million. This was driven by a rise in government deposits supported by the receipts of the budgetary support and government grant funds from development partners during the month.

The Reserve Bank’s outlook for strong domestic economic activity remains in the medium term. The level of foreign reserves is also expected to remain at comfortable levels supported by expected higher receipts of remittances and foreign aid and this will be partially offset by the projected rise in imports. Upward inflationary pressure remains in the near term due to the impact of the increase in custom duty and excise tax effective on 1st July 2016, however it is expected to fall below the Reserve Bank’s inflation reference rate of 5% per annum in 2017/18. In light of the above developments and that the banking system remained sound, the Reserve Bank Board maintained its current monetary policy measures. The Reserve Bank will remain vigilant and continue to closely monitor early signs of vulnerability, developments in the domestic and global economy, update its monetary policy setting to maintain internal and external monetary stability, and to promote a sound and efficient financial system in order to support macroeconomic stability and economic growth.

1 - Method of calculation changed in February 2017 to include both imports of goods & services (previous method used imports of goods only)

2 - Sum of currency in circulation, exchange settlement account balances, and required reserve deposits.

Resources

| Monthly Economic Review - May 2017 Released on 2 August 2017 | |

| See more Monthly Economic Review releases. |