Monthly Economic Review for January 2018

- Details

- Category: Economic Releases

- Created: 16 March 2018

According to the IMF’s January 2018 World Economic Outlook Update, global economic activity continued to remain steady. Global output was estimated to have grown by 3.7% in 2017 which is slightly higher than previous projections. The US economy experienced an annual growth rate of nearly 3.0% in the second half of 2017 supported by job gains, rising household wealth, and favourable consumer sentiment. Additionally, GDP growth for Australia picked up by the end of September 2017 reporting an annual growth rate of 2.8% particularly due to a strong labour market. New Zealand’s GDP growth eased over second half of 2017 recording an official annual rate of 2.7% for the year ended September 2017. This was a result of weaker consumption growth and slowing residential investments. Overall, Tonga’s major trading partners continue to hold a positive outlook.

Monthly economic indicators mirrored usual trend in January of every year showing slower growth in economic activities. According to the Reserve Bank liaison program, the supply of root crops in the domestic market were abundant whilst the supply of local fruits and vegetables declined due to seasonality. The total agricultural export volume continued to fall over the month of January by 97.7 tonnes, due to a decrease in the export of coconuts and squash although the volume of exported root crops increased. Performance of the secondary sector slowed over the month as individual housing and business manufacturing loans declined. Business construction loans, on the contrary, slightly rose by 7.7%. The tertiary sector slightly improved over the month, supported by the rise in total lending particularly higher lending to the trade and tourism sectors which rose by 21.4% and 27.1% respectively. Although total air arrival passengers declined by 29.9%, travel receipts slightly rose to $10.2 million from $10.0 million last month.

As a partial indicator of employment, the total number of job advertisements fell in January 2018 by 8 vacancies and over the year by 88 vacancies.

The headline inflation for the month is yet to be released by the Statistics Department. However, the Reserve Bank expects the annual headline inflation rate to increase further in January 2018 to 5.7% from the 5.5% recorded in December 2017. This anticipated higher inflation rate is due to higher expectations in the prices of food, transportation, alcohol, electricity and kava-Tonga.

In January 2018, the Tongan Pa’anga depreciated against all major currencies except USD, leading to a fall in both the Nominal Effective Exchange Rate (NEER) index and the Real Effective Exchange Rate (REER) index. Both AUD and NZD appreciated on broad based USD weakness, and AUD was also supported by favorable economic activity. Over the year, the NEER Index declined while the REER index rose. This reflected Tonga’s higher headline inflation rate relative to its trading partners, which may impact the international competitiveness of the Tongan exports of goods and services.

Based on the Overseas Exchange Transaction (OET) data, the current account balance recorded a deficit of $8.0 million which was higher than the $7.2 million deficit in December 2017. This is primarily due to a fall in private transfer receipts particularly remittances and non-profit transfer receipts. This outweighed the lower services and import payments particularly for professional, management consulting & other business services and wholesale & retail trade imports. Both the capital account and financial account balance recorded surpluses over the month of January 2018, though lower than that of the previous month due to lower receipts. Over the year, the current account balance recorded a deficit of $22.3 million compared to a surplus of $23.5 million in January 2017. The turnaround reflected a 14.8% increase in imports mainly for wholesale and retail trade, and primary income and services payments also rose by 48.5% and 5.8% respectively. Capital account and financial account balances recorded higher surpluses over the year due to an increase in budget support receipts together with private capital receipts. The overall OET balance for January 2018 recorded a surplus of $1.6 million. This contributed to the rise in the official foreign reserves to $424.1 million, equivalent to 7.7 months1 of import cover, which is above the Reserve Bank’s minimum range of 3-4 months.

Despite the higher foreign reserves contributing to higher net foreign assets over the month, a 10.4% decrease in net domestic assets triggered a decline in broad money (money supply). The fall in net domestic assets was due to an increase in government deposits. Moreover, in the year ended January 2018, broad money had increased led mainly by a significant rise in net foreign assets (mainly foreign reserves) as well as a slight increase in net domestic assets (domestic credit).

The banking system continued to remain stable and profitable and maintained strong capital position in the beginning of 2018. Liquidity in the banking system (reserve money) slightly fell over January to $295.5 million. This was largely driven by a $6.0 million decline in currency in circulation as the commercial banks deposit $5.7 million cash back to the Reserve Bank vault following the busy Christmas festive month. The banks’ total loan to deposit ratio slightly decreased to 74.8% in January from 75.1% last month. This reflected a $3.1 million (0.5%) increase in total deposits outweighing a lower growth in total lending of $0.08 million. This ratio continued to remain below the 80% loan to deposit ratio target which indicates excess liquidity in the banking system remains and that there is capacity for further lending by banks.

Total banks’ lending increased over January to $429.4 million, driven solely by more business loans particularly lending to wholesale & retail, hotels & restaurants and agricultural sectors. This offset a decrease in household lending over the month. Over the year, banks’ competition and the continued low interest rates have contributed to a strong demand for housing loans. Housing loan balances increased by 15.2% in January 2018, which indicated encouraging signs for the housing and construction industry. Furthermore, banks’ lending to businesses rose particularly to businesses involved in wholesale & retail, hotels & restaurants, transport and services sectors. This continued to coincide with strong domestic economic activities evident throughout the year. Low interest rates from the Government Development Loans partially supported the higher lending in the agricultural sector.

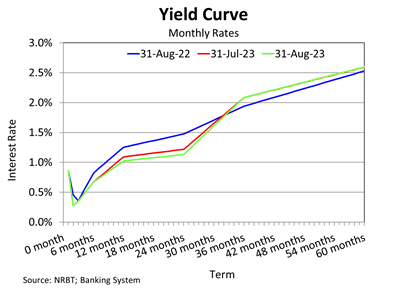

The weighted average interest rate spread narrowed in January to 5.748%. This resulted from a rise in the weighted average deposit rate (rise in all categories) outweighing the increase in the weighted average lending rate (increase in rates particularly for the manufacturing, utilities and tourism sectors). Over the year, the weighted average interest rate spread however widened due to the increase in lending rates (increase in both business and households lending rates) outweighing the rise in deposit rates (rise in demand and saving deposit rates).

Net credit to Government continued to decline over the month by $5.9 million and by $45.3 million over the year, which stemmed from the rise in government deposits. This reflected the receipts of grants and project funds, and supported by the high revenue collection that were deposited during the month and year.

While the outlook is promising in the years ahead as projected by the Reserve Bank in its August 2017 Monetary Policy Statement, this growth outlook is affected by the Tropical Cyclone Gita. The level of foreign reserves is also expected to remain at comfortable levels supported by expected higher receipts of remittances and foreign aid. This will be partially offset by the projected rise in imports. Upward inflationary pressure remains in the near term and is expected to remain above the Reserve Bank’s inflation reference rate of 5% per annum in 2018. In light of the above developments and that the banking system remained sound, the Reserve Bank Board maintained its current accommodative monetary policy measures. The Reserve Bank will remain vigilant and continue to closely monitor developments in the domestic and global economy for early signs of vulnerability or overheating of the economy. Furthermore, the Reserve Bank will continue to update its monetary policy setting to maintain internal and external monetary stability and to promote a sound and efficient financial system, in order to support macroeconomic stability and economic growth.

1 - Method of calculation changed in February 2017 to include both imports of goods & services (previous method used imports of goods only).

Resources

| Monthly Economic Review - January 2018 Released on 16 March 2018 | |

| See more Monthly Economic Review releases. |