Monthly Economic Review for April 2018

- Details

- Category: Economic Releases

- Created: 18 June 2018

The International Monetary Fund (IMF) reported in its April 2018 World Economic Outlook (WEO) that the global economy strengthened due to strong performances in advanced, emerging and developing countries in the past three quarters. Global economy is now projected to grow by 3.9% this year compared to a forecast of 3.7% in the IMF’s October 2017 WEO. Tonga’s major trading partners including the U.S. continues to move closer to full employment whereas the tax cut package by government supports high household consumption. The Reserve Bank of Australia (RBA) reported that economic growth picked up in the most recent March 2018 quarter due to a recovery in coal exports while liquefied gas exports increased further. The Reserve Bank of New Zealand (RBNZ) stated last month that GDP is projected to be weaker than expected resulting from weather effects on agricultural production.

Over the month, economic activities within the primary and secondary industries proved to be largely favourable. This was reflected in the total agricultural export volume which increased by 135.7 tonnes driven by more exports of root crops such as yam and taro due to seasonality. Additionally, loans to the construction sector increased as well as individual housing loans reflecting the consistently high demand for housing and buildings. Meanwhile, activities within the tertiary industry varied with container registrations declining by 91 containers over the month as a result of respective decreases in private and business containers by 31 and 60 containers. This remains above the monthly average of containers recorded in April of the past years, indicating that the trade sector is still busy. International air arrivals rose further in April by 307 passengers (5.0%), which coincided with an increase in travel receipts.

As a partial indicator of employment, the total number of job advertisements bounced back by 32 vacancies over the month mainly for Public Administration as financial year end approaches. In the 12 months to April, there were a total of 313 job advertisements of which 76% were again for Public Administration. In filling these vacant positions it will help to decrease Tonga’s unemployment rate1.

The official headline inflation rate for April 2018 is yet to be released by the Statistics Department. However, impacts of TC Gita in February weighed on domestic inflation (particularly food items) in March 2018 bringing the annual headline inflation rate to 9.8%. The Reserve Bank projects headline inflation for April 2018 to be above the 5% reference rate due to higher expectations in the prices of food, transportation, tobacco, alcohol, and Kava-Tonga continuing to put pressure on inflation. Domestic food supply is projected to recover before end of the year after the impact of the cyclone hence inflation is anticipated to fall below the 5% reference rate per annum by the end of 2018.

In April 2018, the Nominal Effective Exchange Rate (NEER) index slightly increased. This is mainly due to the weakening of the NZD and the AUD against the TOP on broad based USD strength and weak domestic inflation in New Zealand and Australia. Therefore in general, imports should (on average) be cheaper as the TOP appreciates against the basket of currencies of its major trading partners.

On the other hand, the Real Effective Exchange Rate (REER) index fell over the month and increased over the year which reflected Tonga’s higher headline inflation rate relative to its trading partners, which may impact the international competitiveness of the Tongan exports of goods and services.

Over the month, the overall Overseas Exchange Transaction (OET) balance continued to record a deficit of $1.8 million in April which was reflected in a slight fall in the official foreign reserves by 0.4% to $445.9 million. This is equivalent to 7.9 months2 of import cover, which is above the Reserve Bank’s minimum range of 3-4 months.

The deficit in the overall OET balance was due to a deficit in the financial account. This more than offset a surplus in the balances of the current and capital accounts. The deficit in the financial account was attributed to higher interbank payments during the month. The turnaround in the current account balance was due to lower import payments particularly wholesale & retail payments which declined by $12.5 million. Similarly, the services payments decreased by $6.8 million due to a decline in sea freight and professional services payments. In addition, the increase in receipts of insurance claims, compensation of employees, largely from returning seasonal workers abroad, and receipts for business travels contributed to the current account surplus. The capital account recorded a surplus due mainly to higher official and private grant receipts during the month.

In year ended terms, the surplus in the overall OET balance significantly increased due to surpluses in all accounts. The surplus in the capital account increased the most due mainly to higher official and private grant receipts for investment projects or capital expenditures during the year. The widening of the deficit in the merchandise trade and income accounts due to higher retail import payments of $53.9 million and more dividend payments of $5.9 million resulted in the lower surplus in the current account. Higher interbank receipts contributed to the surplus in the financial account.

Broad money declined over April by 2.1% due to a fall in both the net domestic assets and net foreign assets. Government deposits increased over the month which triggered the fall in net domestic credit while the net foreign assets fell as a result of a decline in the foreign reserves. Over the year, broad money increased by 7.3% due to a significant rise in the foreign reserves pushing net foreign assets upwards. This movement had offset the yearly decrease in net domestic assets.

Liquidity in the banking system (reserve money) decreased over April to $292.2 million due mainly to the settlement of maturing government bonds at the end of April. In year ended terms, liquidity increased driven by the rise in the required reserves and currency in circulation. The banks’ total loan to deposit ratio (including Government Development Loan (GDL) scheme) increased to 77.8% from 76.3% last month, reflecting the increase in total loans whilst total deposits declined. Similarly, the total loans to deposit ratio (excluding GDL) increased to 76.2% from 74.7% last month. This continued to remain below the 80% minimum loan to deposit ratio which indicates excess liquidity in the banking system remains and that there is capacity for further lending by banks.

Total banks’ lending (including GDL) increased over the month due to more loans to households (specificallyhousing loans) offsetting a decline in business loans. Over the year, total banks’ lending (including GDL) rose significantly as a result of more lending to both businesses and households. Business loans rose particularly for the public enterprises, and the wholesale & retail, and services sectors. Household loans also grew as demand for housing loans increased. Total lending (excluding GDL) also increased by $0.9 million to $435.5 million. Over the year, total banks’ lending (excluding GDL) also increased by $53.4 million. These movements continued to coincide with the strong domestic economic activities evident throughout the year. Low interest rates from the GDL scheme partially supported the credit growth.

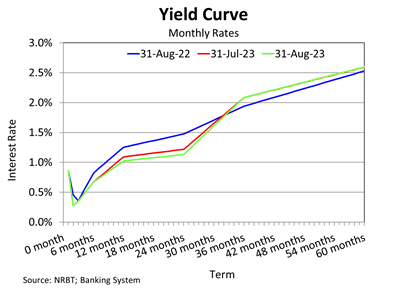

The weighted average interest rate spread widened further over the month and over the year to 5.848%. The monthly rise was due to an increase in the weighted average lending rate and a decline in weighted average deposit rate. Lending rates for housing and other personal loans increased as well as business lending rates for the agricultural, manufacturing and the tourism sectors. The weighted average deposit rate, however, declined due to a fall in all deposit rate categories. Over the year, the weighted average interest rate spread widened due to the increase in the weighted average lending rate (increase in both business and households lending rates) and the decline in the weighted average deposit rates.

Net credit to Government declined over the month and over the year mainly due to a rise in government deposits. The annual growth in deposits was driven by receipts of cyclone relief funds, grants and project funds, budgetary support as well as improved government revenue collection during the year.

Tonga’s economic growth prospects remains positive in the medium term. The level of foreign reserves is expected to remain at comfortable levels and inflation is anticipated to fall below the Reserve Bank’s inflation reference rate of 5% per annum by the end of 2018. The banking system continued to remain strong. Against this background, the Reserve Bank’s current accommodative monetary policy measures are maintained. Nevertheless, the Reserve Bank will continue to remain vigilant, closely monitor developments in the domestic and global economies and the implications on the monetary policy objectives.

1 - Tonga’s Statistics Department published 3 different unemployment rates in its 2016 Census of Population & Housing.

a. 1.1% - Not working, available & looking for work

b. 16.4% - Not working, available & willing to work

c. 34.8% - Including subsistence workers

2 - Method of calculation changed in February 2017 to include imports of both goods & services (previous method used imports of goods only)

Resources

| Monthly Economic Review - April 2018 Released on 18 June 2018 | |

| See more Monthly Economic Review releases. |