Monthly Economic Review for October 2018

- Details

- Category: Economic Releases

- Created: 27 December 2018

Global economy remains favourable

The International Monetary Fund (IMF) reported in its October World Economic Outlook (WEO) that global growth has been steadily expanding. Global economy is now projected to grow by 3.7% for 2018 and 2019. In the United

States, growth remains strong due to the continuous increase in fiscal stimulus. However, the forecast for 2019 has been revised downwards as a result of the recently announced trade measures. The Reserve Bank of Australia reported in its statement for October Monetary Policy Decision that forecast for strong growth remains and is expected to average at above 3% in 2018. This has been supported by higher levels of infrastructure investment and a growth in resource exports. As for New Zealand, the latest economic growth data for June 2018 reflects positive growth due to household incomes driving consumption.

Domestic activities trends positively

Sectoral performances were broadly positive during the month of October 2018. Total agricultural export volumes increased significantly due to the high volume of squash, a total of 910.5 tonnes was exported during the month and agricultural export proceeds rose by $0.3 million. This was supported by a better harvest of root crops such as giant taro and cassava. Loans in the secondary sector increased indicating continued vibrant activities within the industry. Banks’ lending to individual housing rose by $2.3 million whilst lending to businesses for construction purposes increased by $1.1 million and manufacturing loan grew by $0.2 million. The 2.1 tonne increase in the export of handicrafts also supported the growth in this sector. Partial indicators suggest household disposable income levels increased supported by the $0.5 million increase in remittance receipts and the $1.6 million increase in new commitments for personal loans. Reflecting the demand for imported goods, container registrations rose by 120 registrations, mainly for business containers. Import payments for wholesale & retail goods also increased by $2.7 million as businesses stock up in preparation for the festive season and points to stronger activity in the trade sector throughout the month. The financial services continued to grow supported by strong credit growth. Travel receipts also increased by $1.7 million (16.0%), even though, international air arrivals fell over the month by 760 passengers coinciding with the decline in number of flight arrivals.

Job advertisements continued to slow over the month

Job vacancies1 declined over the month by 13 job vacancies but rose over the year by 148 vacancies. This was due to lower advertised job vacancies in the public sector which is a usual trend reflected in previous years.

New base period for the Consumer Price Index

The changes to the Consumer Price Index basket included a new base period to September 2018, extend the coverage of the price changes to include Vava’u, updated the basket of goods and its weights, and changes to the methodology.

The inflation rate rose over the month of October due to rises in both domestic and imported prices. Domestic food and catering service prices increased coupled with increases in imported footwear, roof iron & timber, and fuel prices.

The headline inflation also rose over the year by 6.2% compared to 5.5% in September 2018 but lower than the 6.4% in October 2017. Higher overall domestic prices were driven by increases in food, tobacco, alcoholic beverages, kava-Tonga, clothing and catering services. In addition, higher imported prices over the year were noted for alcoholic beverages & tobacco, petroleum, clothing & footwear, and liquid petroleum gas.

Exchange Rates continued to remain relatively stable

The Nominal Effective Exchange Rate (NEER) index slightly increased in October resulting from appreciation of the TOP against AUD, NZD, FJD, GBP, EUR & CNY. The Real Effective Exchange Rate (REER) index increased slightly reflecting the slight increase in inflation over the month. Over the year, the NEER rose slightly whilst the REER increased more coinciding also with Tonga’s higher headline inflation rate in comparison to its trading partners.

Foreign reserves increases in October

Foreign reserves rose over the month following a decline last month. The increase is due to the rise in official transfer receipts and lower government payments. As such, the official foreign reserves rose and continues to remain at

comfortable levels and is sufficient to cover 7.3 months of imports.

The turnaround in the financial account balance over the month was attributed to lower government payments following the commencement of the principal government loan repayment to the Export-Import (EXIM) Bank of China. The receipt of budgetary support and grant funds from development partners and higher travel receipts drove the surplus in the current account.

The deficit in the current account lowered the surplus in the overall OET balance over the year. The Capital account was the highest contributor to the overall surplus OET balance. This stemmed from higher official grants for investment projects or capital expenditures, mostly for government and public construction. Higher interbank transfers drove the surplus in the financial account after recording a deficit in the previous year. On the other hand, the widening in the merchandise trade contributed to the current account deficit. This was due to the higher payments for import of wholesale & retail goods.

Broad money declined

Over the month, the increase in government deposits, due to receipts of the budgetary support and grant funds contributed to the decline in net credit to government which resulted in lower domestic assets and broad money. The rise in foreign reserves drove foreign assets higher. Broad money however rose over the year as a result of a significant increase in the foreign reserves. The receipts of budgetary support, grants and cyclone relief funds from development partners and higher remittances during the year contributed to this annual growth.

Liquidity remains in excess

The banking system continued to remain sound over October 2018 as banks maintained a strong capital position, supported by adequate profits and low level of nonperforming loans. Higher deposits by the commercial banks to the Reserve Bank’s vault contributed to expand reserve money. The banks’ total loans to deposit ratio grew to 73.3% from 72.9% in the previous month, reflecting higher lending outweighing growth in deposits. This ratio continued to remain below the 80% minimum loan to deposit ratio which indicates that there is capacity for further lending by the banks.

Total lending reached new high level

Lending to businesses increased the most both monthly and annually. The monthly trend was mainly for public enterprises, wholesale & retail, construction and transport sectors while over the year, loans were mainly for public enterprise, wholesale & retail, tourism and agricultural sectors.

Both trends were partially supported by the low interest rates offered on the Government Development Loan scheme and coincided with strong domestic economic activities evident throughout the year. This was supported by a 590 increase over the year in container registrations and 15.7% rise in wholesale & retail import payments. The monthly and annual growth in household loans mainly housing loans supported both trends, indicating their continued capacity to access loans.

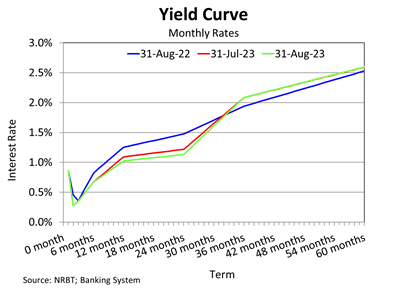

Weighted average interest rate spread widened further

The weighted average interest rate spread widened over the month and over the year due mainly to increase in the weighted average lending rate. Over the month, the increased weighted average lending rates was mainly for household other personal loans and business loans such as manufacturing, construction and fisheries. In year ended terms, the weighted average lending rates increased mainly on business loans for mining & quarrying, manufacturing sectors and professional & other service sectors. On the other hand, the weighted average deposit rates declined due to decrease in demand term and deposit rates.

Outlook

In light of the above, the Reserve Bank’s outlook for strong domestic economic activity remains in the medium term. The level of foreign reserves is expected to remain at comfortable levels, supported by expected receipts of budgetary support and grant funds from development partners, higher receipts of remittances and the deferment of the principal loan repayment to the EXIM Bank of China. This will be partially offset by the anticipated increase in imports. Inflation is expected to fall below the Reserve Bank’s inflation reference rate of 5% per annum at the beginning of 2019, subject to changes in the rebasing of inflation. The Reserve Bank will continue to closely monitor developments in the domestic and global economies to ensure financial and macroeconomic stability are maintained and to change its monetary policy setting where necessary to support its monetary policy objectives.

1 - Based on data collected by the Reserve Bank

Resources

| Monthly Economic Review - October 2018 Released on 27 December 2018 | |

| See more Monthly Economic Review releases. |