Statement by Sione Ngongo Kioa, Governor: Monetary Policy Decision - January 2021

- Details

- Category: Press Release

- Created: 29 January 2021

The National Reserve Bank of Tonga’s Board of Directors at its first board meeting for the year, on the 27th of January 2021, approved to maintain its current monetary policy measures outlined below. This is to encourage utilization of the excess liquidity in the banking system, through further lending to growth sectors and to support the economy from the impacts of COVID-19.

- Maintain the monetary policy rate at 0% (zero interest rate policy).

- Maintain the minimum loans/deposit ratio of 80%.

- Maintain the Statutory Reserve Deposit ratio at 10%.

- Maintain the inflation reference rate at 5%.

- Monitor the commercial banks' liquidity and adjust the SRD ratio if needed.

- Monitoring the commercial banks’ capital reserves and adjust further when required.

- Ease the exchange control requirements when required.

- Continue to issue Government Bonds.

- Maintain clear channels of effective communications with the financial institutions for adequate preparedness.

- Continue to be transparent and raise awareness of its monetary policy decisions through press releases to the public.

- Closely monitor the impacts of the pandemic in the financial system for early detection of any signs of vulnerability.

- Continue to ensure both commercial banks and non-bank financial institutions adheres to all Government declarations regarding COVID-19 in the workplace while delivering essential financial services to the public.

The Governor of the Reserve Bank, Sione Ngongo Kioa, shared that the domestic economy for November 2020 experienced slight growth despite continued conditions of closed borders and COVID-19 restrictions. The primary sector reported a decline in total agricultural exports, mainly, taro, yam, and watermelons. However, squash exports rose during the month yet was much lower than November 2019. The secondary sector indicated growth yet gain due to the completion of new classrooms from the TC Gita and TC Harold reconstruction projects. Lending to businesses within the sector rose further adding to growth. The tertiary sector showed some activity as repatriation flights continued. Container registrations increased depicting some growth in the trade sector.

Inflation slightly increased in November 2020 by 0.3% driven solely by domestic prices particularly for electricity, fuel, and food. However, in the year to November 2020, deflation continued and declined by 0.8%. The annual headline deflation was due solely to domestic prices partially offsetting higher imported prices. Lower domestic prices resulted in a decline in prices for electricity, gas, other fuels, and kava Tonga.

Official foreign reserves increased during the month and rose significantly during the year to November 2020 by $8.7 million and $100.7 million respectively to $590.2 million, equivalent to 9.9 months of imports. The monthly increase is attributed to an increase in budget support receipts, project grant funds and remittance receipts.

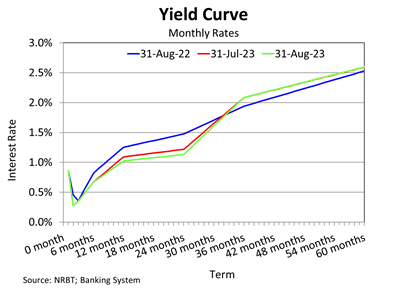

The total banking system continues to maintain its soundness supported by strong capital and adequate profits. The banks’ total loans to deposit ratio declined to 70.4% in November 2020 from 73.8% last month and remains below the 80% minimum. The consistent fall of this ratio continues despite excess liquidity existing in the system coupled with higher money supply. Although banks’ total lending increased in November 2020, the level of deposits also continued to climb higher. The weighted average interest rate spread increased over the month by 4.2 basis points whilst it declined by 40.4 basis points in the year to November 2020 to 5.660% resulting from a decline in lending rates.

In consideration of the above, the Reserve Bank continues to review its GDP forecasts and projects a moderate downturn in future economic growth. Foreign reserves is still expected to be well above the 3 months minimum threshold of import cover, while inflation is also expected to remain below the 5% reference rate. The banking system is still sound supported by high liquidity. Meanwhile, the Reserve Bank continues to be vigilant in closely monitoring its economic and financial indicators and stands ready to adjust its monetary policy settings if needed to maintain internal and external stability and support macroeconomic growth.

Enquiries

Economics Department

National Reserve Bank of Tonga

Fasi mo e Afi

NUKU'ALOFA

Telephone: (676) 24057

Fax: (676) 24201

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Resources

| Press Release in English |

| Press Release in Tongan |

| See more Press Releases in 2021. |