Monetary Policy Statement for February 2015

- Details

- Category: Press Releases

- Created: 01 May 2015

The National Reserve Bank of Tonga (NRBT) today released its Monetary Policy Statement for February 2015. This Statement reviews Tonga’s economic growth and the NRBT’s conduct of monetary policy in the six months to February 2015. It also provides the NRBT’s outlook for the next six months.

With the low inflation levels and high level of foreign reserves, the NRBT’s monetary policy remained accommodative in the past six months to February 2015.

The NRBT estimates Real Gross Domestic Product growth of 2.2% in 2014/15, a downward revision from the August 2014 estimate of 2.9% growth due mainly to adverse weather conditions and delays to large construction projects scheduled for the year. The growth estimate is supported by positive spillover effects from the declining global oil prices and low inflation.

With the expected pick-up in the world economy, the NRBT anticipates stronger economic growth for 2015/16 of 3.2% driven by a rebound in the primary production, stronger financial intermediation and expected improvements in the tourism and construction sectors.

Consumer prices recorded the first deflation rate since May 2013 of -1.1% over the 12 months to February 2015. Significant decline in world oil prices contributed to lower domestic prices for the Household Operation component, particularly electricity prices. Headline inflation will continue to remain negative until the end of this calendar year.

Gross official foreign reserves reached a new record high of $293.6 million at the end of December 2014, before declining to $281.3 million at the end of February 2015. This is in line with a surplus of $0.2 million in the balance of overseas exchange transactions (OET) over the year to February 2015, which is much lower than the surplus in August 2014. The outlook for the foreign reserves is to remain high over the remainder of the 2015 and 2016 financial year.

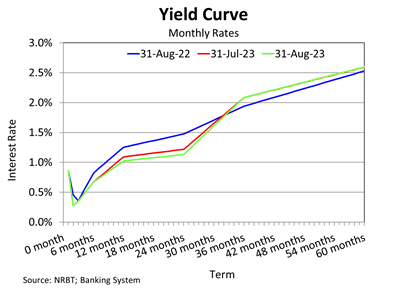

Broad money increased reflecting higher net domestic assets, and is expected to increase due mainly to projected credit growth of more than 10% and a likely increase in net credit to government. Banking system liquidity remains high supporting narrow interest rate spreads.

The banking system remains sound. Despite the continued concern with the overall quality of the banks’ loans, the banking system continued to be profitable, maintaining strong liquidity and capital positions.

The fiscal position has improved according to the IMF 2015 Article IV report, supported by large grant inflows. The NRBT will assess the impact of the Government’s 2015/16 fiscal budget on the monetary policy targets.

Against this background of low inflation; low interest rates; stable exchange rates; high banking system liquidity and improvement in credit growth; adequate level of foreign reserves; and continued recovery in the domestic economy, the National Reserve Bank of Tonga Board of Directors approved to maintain the current accommodative Monetary Policy stance.

For further details, please contact:

National Reserve Bank of Tonga

Telephone: (676) 24057 | Fax: (676) 24201

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Website: www.reservebank.to