Monthly Economic Review for August 2015

- Details

- Category: Press Releases

- Created: 23 October 2015

Global developments among Tonga’s key trading partners continued to support domestic economic activity. Unemployment rate in the United States improved from 5.3% to 5.1% while in New Zealand, the unemployment rate remained unchanged at 5.9% and in Australia it rose slightly to 6.2% from 6.1%. World oil prices continued to fall over the month by 6.2% to US$50 per barrel. The Tongan Pa’anga appreciated slightly against the New Zealand and the Australian dollar but depreciated against the U.S. Dollar.

Domestically, economic activity continued to slow down over August. In the trade sector, the number of container registrations decreased by 9.3%. This coincides with lower payments for imports (excluding oil) in August. Additionally, vehicle registrations fell by 18.3% as a result of fewer registrations for all vehicle types except buses. Air arrivals decreased by 18.7%. From the Utilities sector, electricity consumption and production fell by 10.5% and 3.2% respectively, further supporting the slowdown in economic activities over the month. In contrast, the agricultural sector experienced growth over the month with agricultural exports volume increasing by 51.5%. This was due mainly to the recovery in the fruit products. However, agricultural exports receipts decreased indicating a possible delay in receiving proceeds. Marines catch rose over August which corresponds to a 48% rise in marines export receipts.

Prices fell over August by 1.8% as a result of lower domestic and imported prices, largely through decreases in food prices. Domestic prices fell by 2.6% caused by a fall in the prices of fruits and vegetables. This is supported by findings from the NRBT Liaison Program where growers indicated that agricultural yields have improved due to better weather conditions thereby resulting in lower domestic food prices. Import prices also fell by 1.2% largely due to a decline in the prices of Meat, fish & poulrty.

The annual headline inflation rate decreased by 1.0%. Domestic prices rose by 6.6% over the year, however this was offset by a 6.0% decline in imported prices. In particular, imported food prices decreased by 10.2% and the lower global oil prices resulted in lower domestic energy prices. Contrastingly, domestic prices increased over the year due to higher food prices for items such as Fruit & vegetables, and Meats, fish & poultry. This could be due to the El Niño weather conditions over the year affecting agricultural output.

The Nominal Effective Exchange Rate (NEER) fell over the month by around 0.3% driven by the Tongan pa’anga depreciating against the US dollar. The fall in prices over August combined with the depreciation in the NEER accounted for the 2.1% decline in the Real Effective Exchange Rate (REER). The lower REER indicates an improvement in Tonga’s price competitiveness against that of its major trading partners.

Total Overseas Exchange Transactions (OET) payments rose by 14% to $44million over August. Import payments rose by 17%, driven by payments for oil imports. Total OET receipts also rose by 12% to $55.1million due mainly to a $4.5million rise in Official transfers. Total remittances also increased by 4% to $22.7 million over August, contributing to the rise in receipts. Total export receipts were around the same levels as in July and is expected to rise in the next few months with proceeds from squash. Travel receipts were about 10% lower than last month at $8.4 million. This coincides with international air arrivals falling in August after recording the highest record of air arrivals for this year in July. The net balance of OET over the month of August, which is equivalent to the net change in the foreign reserves, was therefore a surplus of $8.3 million, slightly lower than the surplus in July. The foreign reserves rose by $8.3 million over the month of August to $310.9 million, sufficient to cover 8.6 months of imports, well above the NRBT’s minimum range.

Broad money rose over August by 2.6% to $424.2 million. This was due mainly to a 3.4% increase in net domestic assets, as a result of an increase in lending, and a 2.3% rise in net foreign assets, largely due to the higher foreign reserves. This also coincides with increases in currency in circulation, demand deposits and savings and term deposits. In year ended terms, broad money rose by 15.5%. This reflects a rise in net domestic assets and net foreign assets by 32.3% and 9.9% respectively. Total deposits and currency in circulation also increased in line with the rise in broad money. Banking system liquidity also rose over the month by 4.0% to $167.2 million and over the year by 12.4%. This is in line with the increase in foreign reserves.

Net credit to government rose by 6% in August. This was driven by a 5% fall in government deposits.

Bank lending rose over the month by 0.3% due mainly to increased lending to households. Including loans extended by non-banks, total lending also increased by 1%. Additionally, more than 50 new loans were approved from the Government’s managed funds loan scheme during the month, totalled to $0.3 million. In year ended terms, bank lending increased by 11.5% driven by increased lending to businesses and households. Including loans extended by non-banks, total lending only rose by 8.5%, reflecting lower on-lent loans by the government.

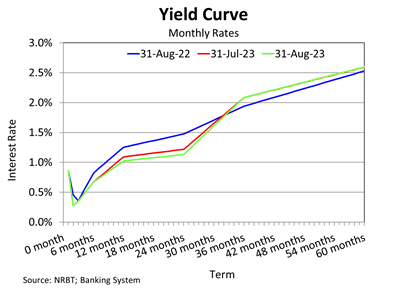

Weighted average interest rate spread widened over August from 5.95% to 6.02%. This was due to a 6.7 basis points increase in the weighted average lending rate to 8.29%, and a 0.8 basis points drop in the weighted average deposit rate.

Weighted interest rate spread widened over the month from 5.88% to 5.95% in July 2015. This was due to a 0.3 basis points increase in weighted average lending rate to 8.23%, and a 6.4 basis points drop in weighted average deposit rate.

Given the recent developments in the major trading partners’ economies coupled with the continued lower world oil prices, the NRBT’s outlook for Tonga’s economy remains positive despite the slow down at the beginning of 2015/16. Early signs of improvement are evident from the agricultural sector. We also expect robust credit growth as business confidence and conditions improve. The banking system continued to remain relatively stable and profitable, with reported credit growth and strong liquidity and capital positions. Low inflationary and liquidity pressures together with ample foreign reserves support no change to the current monetary policy settings in the near‐term.

The NRBT will continue to promote prudent lending, closely monitor credit growth and be mindful of the impact of a continued deflation. The NRBT will closely monitor the country’s economic developments and financial conditions to maintain internal and external monetary stability, and promote a sound and efficient financial system to support macroeconomic stability and economic growth.

Download the full report for more information.