First monthly decline in loans in 18 months

- Details

- Category: Economic Release

- Created: 31 October 2016

| Banking Sector Developments July 2016 |

||||

| Jul 16 |

Jun 16 |

May 16 |

Apr 16 |

|

| Deposit rate (%) * |

2.22 | 2.27 | 2.22 | 2.26 |

| Lending rate (%) * |

7.92 | 7.879 | 7.877 | 7.97 |

| Total Deposits (T$m) |

462.6 | 468.3 | 453.7 | 444.0 |

| Total Lending (T$m) ^ |

351.9 | 352.3 | 348.7 | 344.0 |

| New Commitments (T$m) | 11.2 | 10.5 | 11.3 | 10.6 |

| Broad Money (T$m) | 478.0 | 470.5 | 460.5 | 448.3 |

|

* Weighted Average calculated as a function of interest rate and volume of deposits and loans |

||||

First monthly decline in loans in 18 months

Lending

A decrease in business loans over the month outweighed an increase in household loans. As a result, lending in the banking sector slightly declined by $0.4 million (0.1%) to $351.9 million, following 18 consecutive months of credit growth. Over the year, both household and business loans increased, driving a $42.8 million (13.8%) rise in the overall credit growth. This exceeds the NRBT’s forecast of a 11% credit growth for 2016/17. Lending activities in the non-bank financial institutions also rose over the year by $14.3 million (13.0%) to $124.8 million. This was driven by an increase in household loans, offsetting a decline in business lending.

Business Lending

Banks’ lending to businesses decreased over the month by $3.5 million (2.2%) to $161.2 million, led by a $5.7 million (12.3%) fall in public enterprises loans. The full settlement of a major public enterprises loan largely contributed to the monthly decline. In addition, loans to other financial corporations also fell by $0.1 million (0.8%). Moreover, total bank lending to businesses rose over the year by $8.5 million (5.6%), driven by higher lending to the manufacturing, agriculture, construction, tourism and trade sectors. This was partially supported by low interest rates from the Government Development Loans managed by the Tonga Development Bank. However, including government on-lent loans, business lending only increased over the year by $7.8 million (3.8%) reflecting the loan repayments made over the year.

Household Lending

The increases in all categories drove a $3.1 million (1.7%) growth in banks’ lending to households over the month to another new record high of $189.5 million. The growth in housing loans contributes the most by $2.6 million (2.0%) followed by an increase in other personal loans and vehicle loans over the month of July by $0.5 million (0.9%) and $0.03 million (4.4%) respectively. Despite an increase in weighted average lending rates for all categories, higher lending reflected a strong consumer confidence and the increasing construction activities by household.

The rise in housing loans is in line with a $0.8 million (30.7%) increase in payments for the import of construction materials whilst higher vehicle loans coincides with a $0.2 million (11.3) rise in payments for the import of vehicles in July. Similarly, over the year, banks’ lending to households increased by $34.4 million (22.2%), with housing loans increasing the most by $30.3 million (29.7%). This was supported by a decline in housing lending rate over the year by 43.6 basis points. Meanwhile, lending from non-bank financial institutions to households also rose over the year by $15.0 million (26.7%), reflecting higher other personal loans. The introduction of home improvement loan at the Retirement Fund Board in July 2016 also contributed to the monthly and annual rise.

Other Lending

Other loans from banks decreased over the month and over the year by $0.01 million (0.8%) and $0.1 million (10.2%) respectively, due mainly to lending activities within the non-profit institutions sector.

Non-performing loans

Banks’ total non-performing loans fell over the month by $5.9 million (24.3%) to $18.3 million, representing 5.2% of total loans. Both household and business non-performing loans decreased over the month, with business non-performing loans declining the most, decreasing by $1.0 million (8.5%). This was driven mainly by the settlement of non-performing loan for a major public enterprises. Similarly, both household and business non-performing loans continued to drive the decline in total non-performing loans over the year by $9.7 million (34.7%), with non-performing business loans decreasing the most mainly on tourism, mining & quarrying and trade sectors.

Deposits

Total bank deposits decreased over the month by $5.7 million (2.9%) to $462.6 million. This was driven by decreases in time and demand deposits, offsetting an increase in saving deposits. The decline in time deposits resulted mainly from lower deposits of businesses. In year ended terms, total deposits rose by $60.0 million (14.9%) driven by rises in all categories with demand deposits rising the most.

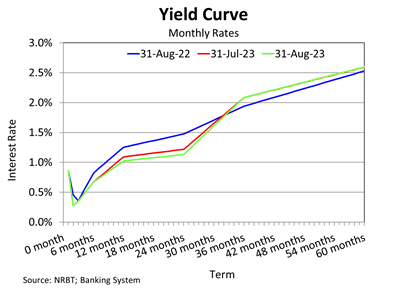

Interest Rate Spread

An increase in business lending rates over the month drove the 4.5 basis points rise in weighted average lending rate. In contrast, weighted average deposit rate fell by 5 basis points due to lower interest rates for demand and term deposits. As a result, the weighted average interest rate spread slightly widened to 5.71% in July 2016 from 5.61% in the previous month. In year ended terms, weighted average interest rate spread narrowed by 23.7 basis points, due mainly to a fall in the weighted average lending rates outweighing a decline in weighted average deposit rates.

Broad money

Broad money grew over the month by $7.5 million (1.6%) to another record high of $478.0 million. A $17.1 million (4.7%) growth in net foreign assets offset a $9.8 million (9.0%) decline in net domestic assets. The increase in foreign reserves contributed to the higher foreign assets whilst a decrease in other items (net) drove the lower domestic assets. Broad money also rose over the year by $64.5 million (15.6%) due to a significant rise in net foreign assets of $84.0 million (28.4%) which outweighed a $19.6 million (16.6%) fall in net domestic assets. The receipt of the budget support funds during the year to July 2016 explains the higher foreign reserves and corresponds to the increase in net foreign assets.

Liquidity

The liquidity (reserve money) in the banking system rose by $8.9 million (3.5%) in July to $265.5 million, due mainly to an increase in banks’ deposits to the NRBT vault. Total banking system loans to deposit ratio increased to 76.1% from 75.2% in June, which is below the 80% minimum loan to deposit ratio that was effective on 1st July 2016. This indicates that excess liquidity in the banking system still remains. Over the year, banking system liquidity rose by $28.1 million (11.8%) due mainly to a $18.9 million (11.8%) rise in banks’ deposits to the NRBT vault.

Outlook

The National Reserve Bank of Tonga in its February 2016 Monetary Policy Statement (MPS) estimated a credit growth of about 11% in 2016/17. This forecast will be revised again and will be published in the August 2016 MPS. The NRBT forecasts is in line with the IMF Article IV projected growth of 10.8% for 2016/17. The banks’ prospects for credit growth remains positive and the NRBT’s projection is supported by improving economic conditions, annual and one-off events taking place during the financial year.

The NRBT forecasts the annual growth in broad money to rise by 10%, coinciding with the IMF’s estimated growth of 9% projection for June 2017, supported by the anticipated increase in lending and foreign reserves.

The banks’ loan to deposit ratio of 80% - 90% is anticipated to be achieved progressively over 18 months. This measure is to encourage the utilization of the excess liquidity in the banking system to increase lending, in order to support economic growth. At the same time, the NRBT is exploring alternative monetary policy and macro prudential tools to strengthen the policy transmission mechanism, and at the same time ensure financial stability is maintained. The NRBT will closely monitor the country’s economic and fiscal developments and financial conditions to maintain internal and external monetary stability, and promote a sound and efficient financial system to support macroeconomic stability and economic growth.

Download the full report: Banking Sector Development - July 2016