Reserve Bank of Tonga Serving the Kingdom

- Details

- Category: Press Release

- Created: 15 September 2023

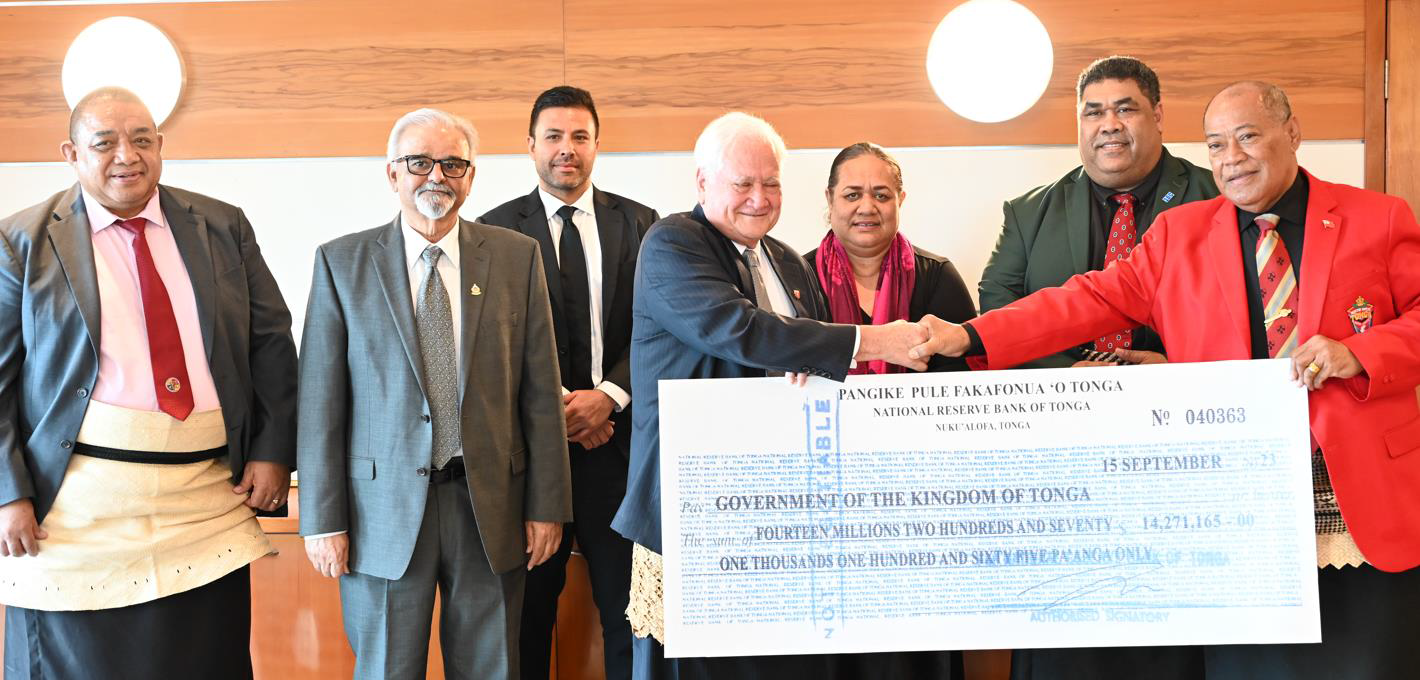

The National Reserve Bank of Tonga today made a significant contribution to His Majesty’s Government in presenting a cheque for $14.2 million to the Acting Prime Minister Honorable Samiu Vaipulu and Minister for Finance, Honorable Tiofilusi Tiueti. During its 2023 Annual General Meeting held on Friday 15 September. Chairman of the Reserve Bank Board Lord Sevele presented the cheque and proudly shared:

| Also read in Tongan: Tokoni ‘a e Pangikē Pule Ki he Fonua |

"This year’s audited financial statement of the Bank confirmed a historical net profit of $20.4 million, a substantial improvement from the previous year's profit of $0.5 million, and the best-ever in the history of the Bank. The $14.2 million therefrom represents the annual distribution of 70% of the net profit to His Majesty’s Government for the financial year ended 30th June 2023. Our stellar performance in 2023 reflects increased interest rates earned on our foreign reserves and changes to our investment strategy – increasing our investment levels, choosing longer term maturity, and more-focused evolving currency composition, closely monitored during the year.”

Reserve Bank Chairman, Lord Sevele presenting the profit distribution to Acting Prime Minister Hon. Samiu Vaipulu in the presence of Minister for Finance Hon. Tiofilusi Tieeti and Board Directors, Friday 15 September 2023, NRBT Board Room.

Reserve Bank Chairman, Lord Sevele presenting the profit distribution to Acting Prime Minister Hon. Samiu Vaipulu in the presence of Minister for Finance Hon. Tiofilusi Tieeti and Board Directors, Friday 15 September 2023, NRBT Board Room.

During the year, the Bank had a comprehensive focus on promoting price stability, financial stability, and bolstering foreign reserves to shape the nation's economic future. The Bank's responsibilities ensuring the stability of the financial system, safeguarding our pegged exchange rate for macroeconomic stability, and managing local and foreign currency supplies have been reasonably successful despite world-wide difficulties of rising prices, supply bottlenecks.

One objective area in which the Bank’s efforts have not produced all the desired results is that of taming inflation, a situation that it shares in common with most of the central banks in Australasia. There is increasing evidence that the interest channel of the monetary policy is too blunt an instrument for the Tongan economy. The coherence of the Government fiscal policies will need to be improved where they have direct contributions to families cost of living. As shared in the region, controlling inflation and the rising costs of living are tasks the Reserve Bank cannot achieve on its own, but needs Government wide action to assist control the costs of living. This joint responsibility is one of the objectives that the Board will focus on from now on.

Looking to the short to medium term, 2023 marks the dawn of a Five Year Board Strategy that begins with a Review of the Bank’s Act to allow revisit its effectiveness in promoting stronger economic growth to mitigate the weak prospect identified by the 2023 IMF Article IV concluding statement. The Bank believe that the potential for greater and faster economic growth is there - ready for Tonga to exploit: but it needs pragmatic vision, planning and coordinated actions. Lord Sevele extended his appreciation for the Bank's independence and its close partnership with the Ministry of Finance, government institutions, the four banks in Tonga, the two retirement funds, the International Monetary Fund (IMF), and the international and bilateral Development Partners.

In closing, Lord Sevele gratefully acknowledged the effective and efficient leadership of the Governor, Tatafu Moeaki, his executive management team and all the hard working staff of the Bank, and also thanked his fellow Directors for their expert advice and constant support.

Enquiries

National Reserve Bank of Tonga

Fasi mo e Afi

NUKU'ALOFA

Telephone: (676) 24057

Fax: (676) 24201

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.