Remittances remain high despite slight decrease

- Details

- Category: Economic Releases

- Created: 22 July 2015

| Remittance Receipts April 2015 |

||||

| * TOP $m | Apr 15 | Mar 15 | Feb 15 | Jan 15 |

| Remittance Receipts | 16.3 | 16.6 | 14.0 | 14.5 |

| Private Transfers | 13.6 | 14.9 | 12.9 | 13.7 |

| Employee Compensation | 2.3 | 1.4 | 1.1 | 0.8 |

| Private Capital Transfers | 0.01 | 0.2 | 0.0 | 0.0 |

| Social Benefits | 0.01 | 0.03 | 0.02 | 0.0 |

| * Month-ended | ||||

Remittances remain high despite slight decrease

|

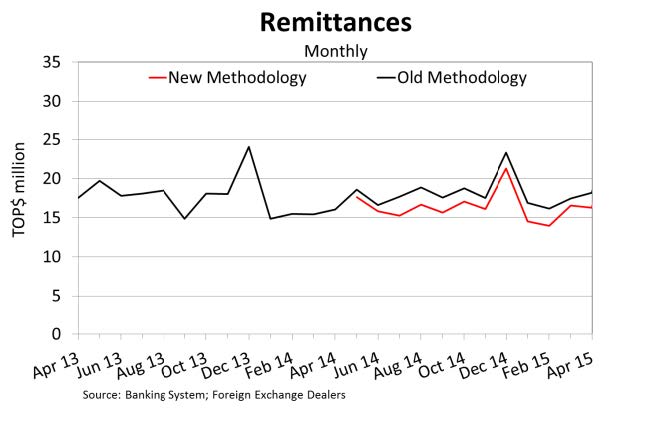

A change in methodology The calculation for Total Remittance Receipts has changed following Tonga’s transition into Balance of Payments and International Investment Position Manual 6 (BPM6), endorsed by the International Monetary Fund (IMF). This new coding system for overseas exchange transactions defines Remittances as the “household income from foreign economies arising mainly from the temporary or permanent movement of people to those economies”. Under BPM6 Total Remittances is calculated as the sum of Personal transfers; Employee Compensation; Private Capital Transfers; and Social Benefits. Previously, Remittances were calculated as the sum of Personal transfers and Non-profit Organisation transfers. The removal of these Non-profit Organisation transfers from the calculation, despite the addition of three other receipt types, has resulted in a lower Total Remittance Receipts figure under the new methodology (Refer Figure 1). |

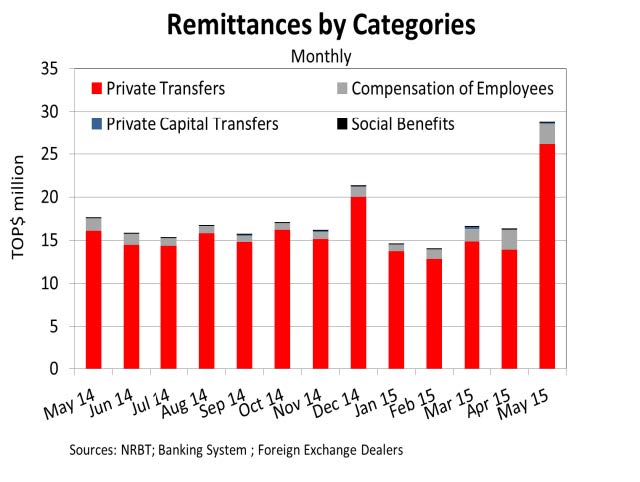

The total remittances receipt for the month of April was $16.3 million, representing 44.5% of the Total Overseas Exchange Transaction (OET) Receipts. Despite the slight decrease from the previous month, remittance receipts have been growing steadily since the start of the calendar year. This is most likely due to the upcoming coronation and other church conferences.

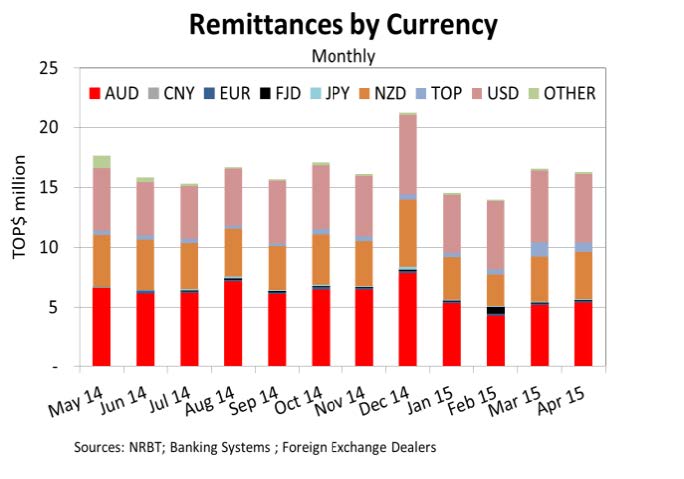

As per usual, the majority of remittances were received from Tonga’s main trading partners; the US (35%), Australia (33%) and New Zealand (24%). Over April, the $USD appreciated against the $TOP benefitting recipients in Tonga. On the other hand, the $AUD and $NZD depreciated against the $TOP. This has however had little impact on the level of remittances from both these countries. It appears the local need for money given the upcoming events outweigh the impact of the exchange rate fluctuations.

Furthermore, it appears residents are more likely to remit money through Foreign Exchange Dealers (FEDs) with 85% of Total Remittances in April received through the FEDs.

Private Transfers

Total private transfers, being gifts and transfers into Tongan bank accounts, decreased slightly over April by 6.6% to $13.9million. This represents 85.6% of Total Remittances received. The majority of the transfers were denominated in $AUD, $NZD and $USD.

Employee Compensation

Employee compensation is the sum of wages and salaries received and remitted back from the Recognised Seasonal Employer (RSE) program and other Tongan residents working short term overseas. This figure increased over April to $2.3million, making up 14.3% of Total Remittance receipts. The increase over the month is due to an increase in remittances from RSE workers. This coincides with increases in $AUD and $NZD for employee compensation as RSE programs are based in Australia and New Zealand.

Private Capital Transfers

Private grants for investments and capital projects received by individuals amounted to $11,046. This represents only 0.07% of Total Remittance receipts; a significant decrease from the previous month. Private Capital Transfers fluctuates considerably from month to month as these payments are rare and not the common method for money to be remitted to Tonga. In April, 90% of the Private Capital Transfers were denominated in $TOP however sent from the US for construction purposes.

Social Benefits

Pensions and other social benefits received by Tongan residents from overseas decreased to $14,444 over April. These payments were denominated in $TOP and $USD, and represent only 0.09% of Total Remittance Receipts.

Outlook

Remittance receipts are anticipated to rise in the coming months leading up to the King’s Coronation, church conferences and other school reunions. The NRBT will continue to closely monitor these receipts given they are one of the biggest inflows for Tonga’s economy. Although the proposed foreign exchange levy will impact the level of remittances, NRBT will work closely with both the Banks and FEDs to minimise the effects and obtain the most beneficial outcome for Tonga.

|

|

| Figure 1 | Figure 2 |

|

|

| Figure 3 | |

Table 1:

| Remittances Receipts TOP$ millions |

||||||

| Month Ended | Year-ended | Shares of | ||||

| Apr-15 | Mar-15 | Feb-15 | Jan-15 | Apr-15 | ||

| Total | 16.26 | 16.56 | 13.98 | 14.54 | 196.81 | 100.0 |

| Private Transfer | 13.92 | 14.90 | 12.85 | 13.72 | 182.29 | 92.6 |

| Compensation of Employees | 2.32 | 1.43 | 1.12 | 0.82 | 13.89 | 7.1 |

| Private capital transfers | 0.01 | 0.20 | 0.00 | 0.00 | 0.45 | 0.2 |

| Social benefits | 0.01 | 0.03 | 0.02 | 0.00 | 0.18 | 0.1 |

| Sources: NRBT, Banking System, Foreign Exchange Dealers | ||||||

| Remittances by Currency TOP$ millions |

||||||

| Month Ended | Year-ended | Shares of | ||||

| Apr-15 | Mar-15 | Feb-15 | Jan-15 | Apr-15 | ||

| Total | 16.26 | 16.56 | 13.98 | 14.54 | 196.81 | 100.0 |

| Australian Dollar (AUD) |

5.41 | 5.20 | 4.31 | 5.38 | 73.54 | 37.4 |

| US Dollar (USD) |

5.68 | 5.96 | 5.65 | 4.85 | 63.27 | 32.1 |

| New Zealand Dollar (NZD) |

3.96 | 3.76 | 2.60 | 3.52 | 47.35 | 24.1 |

| Tongan Pa'anga (TOP) |

0.76 | 1.21 | 0.46 | 0.36 | 5.54 | 2.8 |

| Euro (EUR) | 0.12 | 0.13 | 0.15 | 0.10 | 1.60 | 0.8 |

| Japanese Yen (JPY) | 0.08 | 0.06 | 0.07 | 0.07 | 0.98 | 0.5 |

| Fijian Dollar (FJD) | 0.08 | 0.06 | 0.07 | 0.07 | 0.98 | 0.5 |

| British Pound (GBP) | 0.04 | 0.06 | 0.03 | 0.07 | 0.91 | 0.5 |

| Chinese Yuan (CNY) | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.0 |

| Other | 0.13 | 0.12 | 0.64 | 0.13 | 2.64 | 1.3 |

| Sources: NRBT, Banking System, Foreign Exchange Dealers | ||||||

Download the Remittances Report for April for more information.