Depreciation of the Tongan Pa'anga

- Details

- Category: Press Releases

- Created: 26 September 2014

The value of the Tongan pa’anga, and the Reserve Bank exchange rate policy supports the conflicting objectives of maintaining:

- adequate foreign reserves of at least 3-4 months of imports; and

- a low, stable inflation rate below the 6-8 per cent reference range.

The Reserve Bank monitors pa’anga exchange rate movements, to ensure the country’s balance of payments position and price stability align with these objectives. Carefully balancing the advantages for both recipients and remitters of foreign exchange aims to support macroeconomic stability.

Consistent with policies of other Pacific island countries, the pa’anga exchange rate is pegged to a basket of currencies comprising of its major trading partners. Movements in the pa’anga would depend on the movements in the currencies in the basket and their weights within the basket.

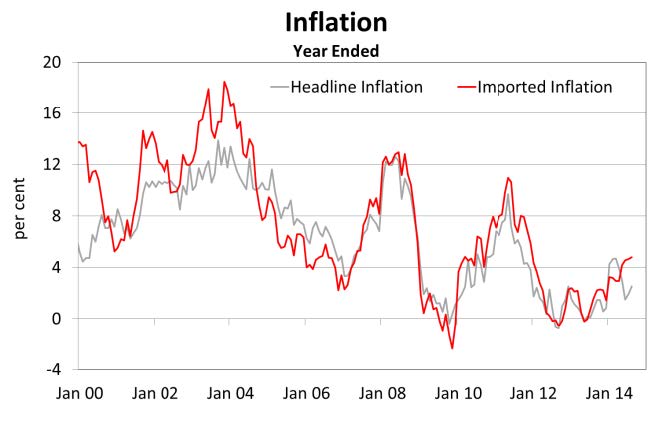

While depreciation in the pa’anga disadvantages remitters of foreign exchange, it benefits recipients, such as tourism, export businesses, and individuals who receive remittances. An increase in the costs of imported goods and services, in theory, contributes to a rise in the imported component of inflation. The pa’anga has depreciated against the US dollar, Australian dollar and New Zealand dollar by 2.6 per cent, 40.9 per cent and 49.9 per cent respectively over the 14 years from 2000. The nominal effective exchange rate index fell 11.9 per cent over the past 12 years, also implying a depreciation of the pa’anga against its major trading partners. Despite the depreciation of the pa’anga against major trading partners, the headline inflation rate has fallen from its volatile highs over the same period, including a peak of 13.9 per cent in 2003, to 2.5 per cent in August 2014. While this reflects various external factors such as the global financial crisis, low inflation justifies the continuation of the NRBT’s exchange rate policy.

While depreciation in the pa’anga disadvantages remitters of foreign exchange, it benefits recipients, such as tourism, export businesses, and individuals who receive remittances. An increase in the costs of imported goods and services, in theory, contributes to a rise in the imported component of inflation. The pa’anga has depreciated against the US dollar, Australian dollar and New Zealand dollar by 2.6 per cent, 40.9 per cent and 49.9 per cent respectively over the 14 years from 2000. The nominal effective exchange rate index fell 11.9 per cent over the past 12 years, also implying a depreciation of the pa’anga against its major trading partners. Despite the depreciation of the pa’anga against major trading partners, the headline inflation rate has fallen from its volatile highs over the same period, including a peak of 13.9 per cent in 2003, to 2.5 per cent in August 2014. While this reflects various external factors such as the global financial crisis, low inflation justifies the continuation of the NRBT’s exchange rate policy.

In early 2001, the Australian dollar fell below US$0.50 then rose to almost US$1.10 in 2011. In September 2014, the Australian dollar stood at US$0.89. The New Zealand dollar rose from a low of US$0.39 in 2000 to US$0.80 in September 2014. The strong appreciation in the Australian dollar and the New Zealand dollar during the 14-year period (18 September 2000 to 18 September 2014) of 63 per cent and 93 per cent respectively have exacerbated the depreciation in the pa’anga against these currencies. The depreciation has been managed such that it maintains price stability, while encouraging Tongan export industries and remittances, to the benefit of the broader economy.

At the end of August 2014, the foreign reserves level was at T$283.9 million, equivalent to 9.0 months of imports - a record high. At the same time, inflation rose by 2.5 per cent over the year to August, well below the Reserve Bank’s reference range of 6-8 per cent. The Reserve Bank is of the view that the pa’anga is at an appropriate value to achieve the objectives of maintaining an adequate foreign reserves level and low, stable inflation over the near-term.

For further details, please contact:

National Reserve Bank of Tonga

Telephone: (676) 24057 | Fax: (676) 24201

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Website: www.reservebank.to

For media: Press Release in English