- Monthly Economic Update - July 2024 DOWNLOAD THE FULL REVIEW | PDF 897 KB

Global economy to stabilize in 2024

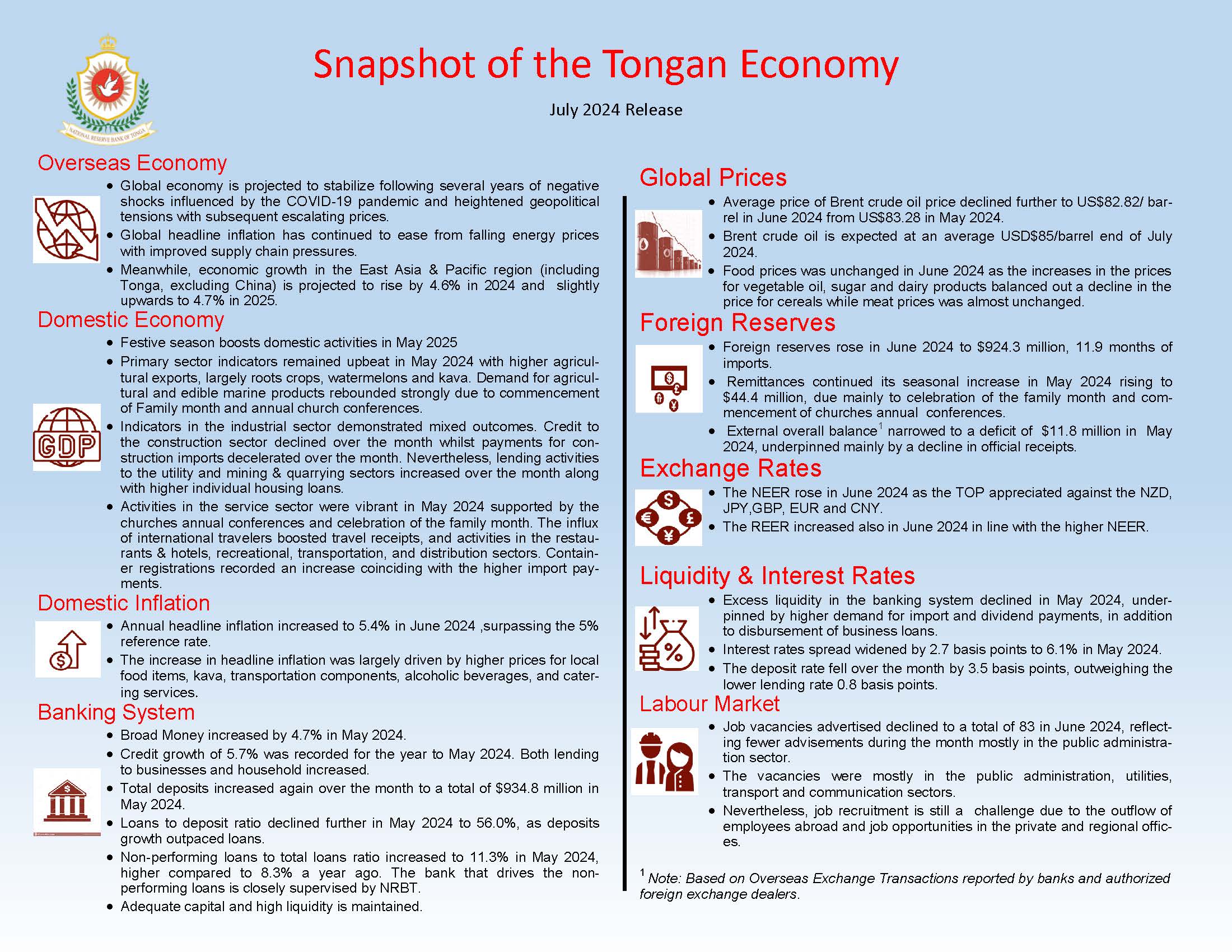

In its June 2024 World Economic Prospects report, the World Bank Group anticipates that the global economy will stabilise following several challenging years of high price volatility due to disruptions caused by the COVID-19 pandemic as well as significant geopolitical conflicts, including the ongoing Russia-Ukraine and Israel-Hamas wars. Global growth is projected to be moderate at 2.6% in 2024, and 2.7% in 2025. This recovery is underpinned by stronger growth in the US, improving domestic demand in emerging markets and developing economies (EMDEs), and a rebound in global trade.

Severe inflationary pressures experienced throughout 2022 and 2023 have been steadily easing. This has largely been due to the effectiveness of restrictive monetary policies introduced by developed economies such as the U.S., European Union, United Kingdom, and Australia to curb consumer demand following the reopening of countries’ borders post-pandemic. Additionally, supply-side and trade route disruptions caused by ongoing global conflicts have been steadily resolving, particularly concerning energy and oil. Global headline inflation is expected to average 3.5% in 2024, then continue to decline to 2.9% in 2025. Thus, central banks across major economies are expected to gradually ease monetary conditions to support growth.

Economic growth in the East Asia Pacific Region (excluding China) is projected to be 4.6% and 4.7% in 2024 and 2025 respectively. This growth is driven predominantly by higher exports, particularly within industrial activities, due to an upturn in global goods trade as well as an expected resurgence in tourism activities as monetary conditions ease and consumer confidence improves across developed economies such as Australia and New Zealand.

Festive season boosts domestic activities

In line with historical annual harvest results, agricultural exports rose by 36.6% (147 tonnes) in May, driven mainly by higher production of root crops, watermelon, and kava. The fisheries sector was unfortunately hampered by unfavorable weather conditions, which impeded fishermen's ability to operate and, in turn, decreased overall exports for the month. Although exports of aquarium products increased by 1,503 pieces, total marine exports fell due to lower tuna exports over the month. Domestically, the family month celebration and church conferences boosted demand for agricultural and seafood products, which contributed to local inflationary pressure as mismatch between local demand and supply of food continue.

Industrial sector credit growth in May was mixed. Lending to the construction sector declined by $6.9 million (32.1%) reflecting large repayments during the month with only one minor new loan commitment of $0.1 million. Construction import payments was also lower by $0.2 million (5.6%) in May. Nevertheless, household credit growth was steady with housing loans increasing by $0.7 million (0.3%). Finance to both the utilities and mining & quarrying sectors also increased, with an increase of $0.2 million (48.1%) and $0.03 million (28.3%), respectively.

The services sector thrived in May 2024. The Church of Tonga inaugurated its new school, Anastasis College, along with several churches’ annual conferences, and the family month events. Tongan diaspora from abroad visited the Kingdom to attend these occasions, leading to increased spending by both households and businesses. Migration activities were more active, with total passenger arrivals increasing by 1,157 (14.7%), and passenger departures increasing by 1,133 15.0%). Travel receipts grew by $3.4 million (32.4%). Coincidently, performances in the restaurants & hotels, recreational, transportation, and distribution sectors were boosted. Consequently, container registrations increased by 243 (23.9%) over the month, driven by growth in both business and private listings. Import payments (excluding oil) rose by $9.9 million (25.6%), with payments for wholesale and retail imports increasing by $7.5 million (28.2%). The rise in private container registrations reflects larger in-kind remittances received during the family month as well as preparation for church conferences and celebrations.

More employment opportunities in June 2024

The Reserve Bank’s survey on job advertisements showed that there were 83 job vacancies advertised in June 2024, which has declined by 10 vacancies (10.8%) from the previous month. Total job vacancies advertised during the month stemmed mostly from the public administration, utilities, and transport & communication sectors. At annual rate, total job vacancies advertised to the public fell by 18 vacancies (1.9%). Majority of the employment opportunities over the year were from the public administration, transport & communication, utilities, and hotel & restaurant sectors.

Headline inflation exceeded the 5% threshold in June 2024

The Consumer Price Index recorded another uptick of 2.2% in June 2024, owed to both higher domestic and imported prices. Domestic prices increased over the month, fueled primarily by local prices for food items such as root crops, vegetables, and seafood (i.e. octopus and lobster). Overall, prices of local food and non-alcoholic beverages further rose by 8.9% (compared to a 10.7% increase in May 2024), reflecting the strong demand prompted by the activities during the festive season. Additionally, spending on restaurants & hotels and local transportation services surged due to higher number of travelers, which further exerted pressure on prices. At the same time, imported inflation was driven largely by higher prices of imported food items, personal care goods, household items, construction materials, alcoholic beverages, non-alcoholic beverages, and LP gas. Meanwhile, price of fuel declined over the month offsetting some of the increases. Nonetheless, the global price of oil continues to remain volatile due to ongoing geopolitical conflicts.

Annual headline inflation increased to 5.4% in June 2024, surpassing the 5% reference rate. This increase was higher than the previous month (4.9%) but lower than the June 2023 rate (7.4%). The higher annual headline inflation for June 2024 is indicative of demand outpacing domestic supply capacity. Persistent labour market shortages continued to drive the cost of production in the agriculture and fishery sectors, as producers compensated higher input costs by increasing the price of their goods. Furthermore, unfavourable weather conditions also adversely affected vegetable crop yields and impeded the ability of fishing vessels to operate resulting in lower production across both sectors. Consequently, to meet local demand requirements suppliers had to rely on imported agricultural substitutes to accommodate the increased demand throughout the festive season. However, the elevated demand experienced over June tends to be transitory as the festive season comes to an end.

In June 2024, imported inflation contributed around 0.8 percentage points (pps) to the headline inflation, owing mainly to prices of fuel, goods for personal care, alcoholic beverages, household items, imported food items, and LP gas. Conversely, prices of non-alcoholic beverages, construction materials, and clothing were lower compared to June 2023. On the other hand, domestic prices contributed 4.6 pps to the headline inflation driven largely by food items, kava, transportation components, alcoholic beverages, and catering services. Contrarily, prices for electricity, tertiary education, tobacco, and labour cost declined annually.

Core inflation further declined to 1.7% in June 2024 from 3.8% in May 2024. This is the lowest rate since 1.6% in November 2021. Meanwhile, non-core inflation further rose to 8.0% from 5.7% in the previous month. This is the highest non-core inflation rate since 10.5% in March 2023. The high rate is further indicative of the resurgence in the price of local food items during the month and the higher price of fuel and LP gas compared to the same period in previous year.

Effective exchange rates

The Nominal Effective Exchange Rate (NEER) rose by 0.4% in June 2024, underpinned by the appreciation of the Tongan pa’anga against all major currencies except the USD, AUD and FJD. Similarly, the Real Effective Exchange Rate (REER) also increased in June 2024, reflecting the rise in NEER.

On a year-end basis, the NEER is higher by 1.1% compared to the previous year, as the TOP appreciated against the AUD and NZD, easing the cost of imported goods. In parallel, REER increased by 1.5% consistent with Tonga’s relatively higher inflation rate.

Foreign reserves increased from Government official grants

Foreign reserves rose by $31.3 million over the month of June, mainly due to inflow of Government budgetary support and project funds from development partners. This is sufficient to cover 11.9 months of imports, exceeding IMF’s recommended 7.5 months. Twelve months prior, reserves were higher by $2.9 million. The majority of the official foreign reserves are held in USD, NZD, and AUD.

Remittances receipts trend up during family month of May

Remittance receipts continued its upward trend in May, driven by the celebrations held throughout the month. All remittance categories increased, recording a $4.3 million (10.7%) growth in May 2024.

Moreover, remittance received in Australian dollar increased the most by 20.7% and followed by receipts in New Zealand and US dollars. This was supported by the decline in Australia’s unemployment rate and the small rise in payroll jobs in mid-May. Over the year, total remittance receipts rose by $5.0 million (1.0%) as the global economy continues its gradual recovery.

Broad money increased

Broad money expanded both monthly and annually in May 2024, rising by $39.7 million (4.7%) and $66.9 million (8.1%) respectively, to a total $889.2 million. Both net domestic assets and net foreign assets grew over the month, corresponding with higher net credit to the central government and increased foreign liabilities. Annually, net foreign assets continued to grow in line with rising foreign reserves, while net domestic assets fell due to higher net credit to the central government, mainly through increased government deposits.

Reserve money rose

Liquidity in the financial system increased over the month and year in May 2024, by $21.2 million (3.6%) and $47.9 million (8.6%) respectively, to $605.4 million. Growth in Currency in Circulation (CIC) was the highest (4.9%), followed by a 4.2% increase in Exchange Settlement Accounts (ESA). Both these increases reflect the higher demand of money during the celebrations, which are funded from remittances. Statutory Required Deposits (SRD) also increased reflecting higher deposits.

Credit growth increased

The banks’ total lending rose in May 2024 both on a monthly and yearly basis, by $3.6 million (0.7%) and $28.6 million (5.7%) respectively, to $533.8 million. This monthly rise was attributed mainly to increases in business loans in the manufacturing, professional & other services, transport sectors, as well as household loans.

Annually, lending to businesses such as tourism, distribution and professional & other services sectors increased along with all categories of household loans, reflecting a continued improvement in businesses and consumer confidence and economic recovery.

Total bank deposits increased by $33.4 million (3.7%) over the month, and $75.4 million (8.8%) over the year, totalling $934.8 million. These increases were due to higher demand and savings deposits monthly, and more demand and time deposits annually. Higher deposits were predominantly from the Retirement Funds, the private non-bank sector, and the private sector. Total loan to deposit ratio decreased to 56.0% in May 2024 from 57.6% in the previous month, as deposit growth outpaced lending.

Lending rates widened

In May the weighted average interest rate spread widened by 11.4 basis points from the previous month and 10.5 basis points year-to-date, reaching 6.2%. The monthly rise was supported by a 7.9 basis points increase in lending rates combined with a 3.5 basis points decrease in deposit rates. Annually, the deposits rates fell by 9.2 basis points while lending rates rose by 1.3 basis points.

Lending rates for the agriculture, transport, construction, and professional & other services industry sectors rose over the month by 4.2%. Additionally, the annual lending rate for businesses in agriculture, fisheries, and tourism also increased, possibly reflecting a rise in the banks’ risk profile or perception of these sectors. However, despite a monthly increase, lending rates for household loans decreased on an annual basis, potentially indicating an improvement in the household risk profile or higher competition between banks for this sector.

Conversely, the decrease in weighted average deposit rates, both monthly and annually, was primarily due to the significant increase in deposit volumes. Lower time and demand deposit rates also contributed to the annual decline.

Outlook

The NRBT has projected a moderate growth of 2.6% for Tonga’s economy for the FY 2025. Major infrastructure projects, an anticipated influx of visitors for events such as the Pacific Islands Forum meeting, and the annual local festivities are expected to help contribute to this growth. Headline inflation has slightly risen above the 5% reference rate in June 2024 as strong demand for domestic food prices drove up prices. However, it should also be noted that this high inflation is expected to be transitory as the festive season ends. However, if the domestic supply imbalance persist, the headline inflation may remain above the 5% reference rate for an extended period. A greater collaboration between Monetary and Fiscal Policy will need to be implemented to address lingering local supply and demand concerns. The risk to the outlook is also tilted to the downside with the ongoing wars in the Middle East region and the potential disruptions on global trading activities. Foreign reserves, are still at comfortable levels and projected to remain above the IMF’s prescribed level of 7.5 months of imports cover in the near to medium term. The financial system maintains stability with high liquidity and banks holding sufficient capital reserves. However, one financial institution is under close supervision, highlighting the need for vigilant oversight to uphold this stability. The Reserve Bank is currently reviewing its monetary policy tools in light of the current macro-economic conditions to continue and ensure price stability as well as financial stability.