- Monthly Economic Update - August 2025 DOWNLOAD THE FULL UPDATE | PDF • 572 KB

Global growth outlook remains firm amid persistent uncertainty

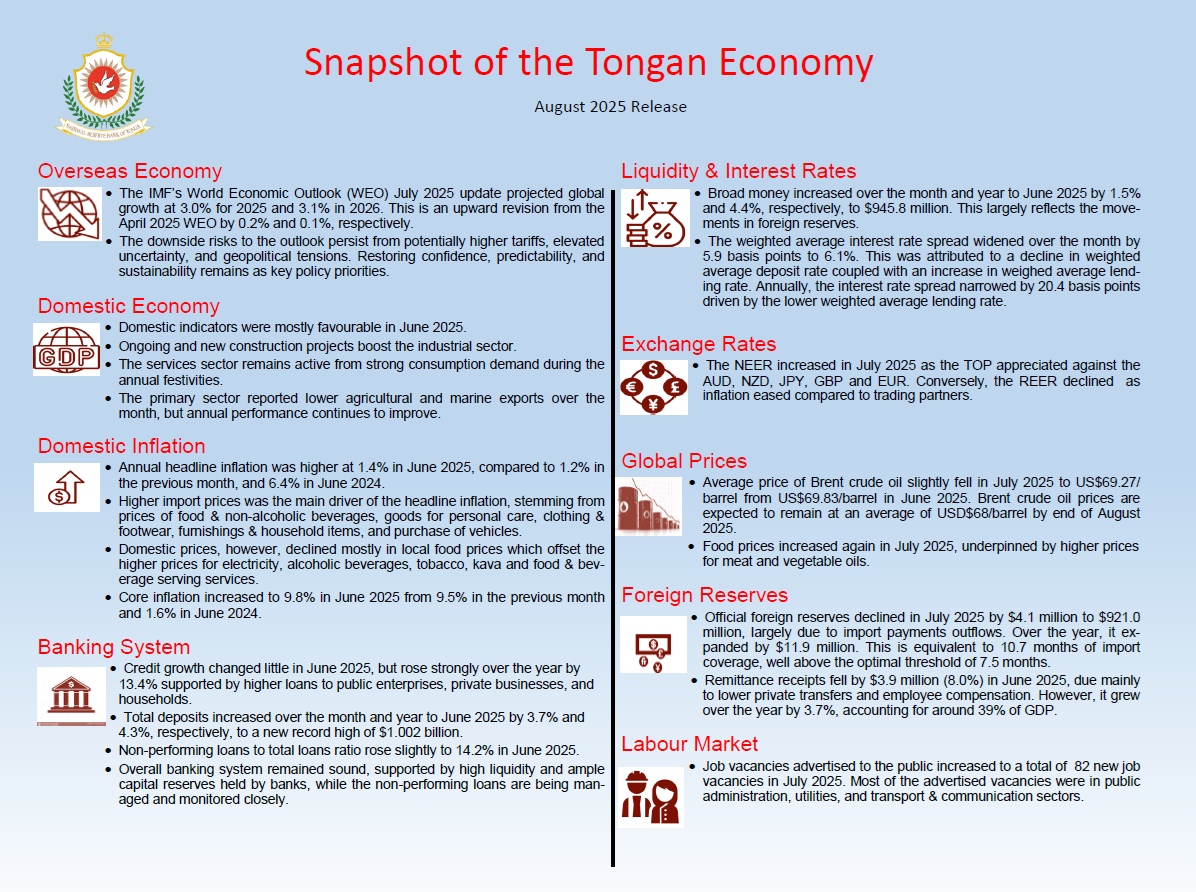

The IMF’s World Economic Outlook (WEO) July 2025 update projected global growth at 3.0% for 2025 and 3.1% in 2026, an upward revision of 0.2% and 0.1% respectively, from the April 2025 WEO. The revision in growth stemmed from improvement in international trade, lower effective tariff rates, improvement in financial conditions, and fiscal expansion in some major economies. This reflects the pause in the US tariffs and the de-escalation of trade tensions with China. However, downside risks to the outlook persist from potentially higher tariffs, elevated uncertainty, and geopolitical tensions. Restoring confidence, predictability, and sustainability remain as key policy priorities.

Growth in advanced economies is projected to slow from 1.8% in 2024 to 1.5% in 2025 and 1.6% in 2026. The US economy is forecasted to expand at a rate of 1.9% in 2025 (down from 2.9% in 2024), on the back of lower tariff rates and looser financial conditions. Meanwhile, growth in the Euro Area is estimated to accelerate to 1.0% in 2025 and to 1.2% in 2026, from a modest contribution from exports and a rebound in private consumption. Growth for Emerging & Developing Economies (Tonga included) is projected to be 4.1% in 2025 and 4.0% in 2026. Global inflationary pressures continue to ease, with World Consumer Prices declining by 4.2% in 2025 and 3.6% in 2026 (from 5.6% in 2024), on the back of cooling demand and falling energy prices.

The Asia Development Bank in their Outlook for July 2025 however, downgraded their growth outlook for the region to 4.7% for 2025 and 4.6% for 2026 (from 4.9% and 4.7% respectively in the April 2025 outlook), due to the increased tariffs and global trade uncertainty. The impact of the tariffs on Pacific Island economies’ exports will be minimal, however Tonga may be worse off from the movements in exchange rate and the new US tax imposed on remittances. About more than 40% of remittance receipts in Tonga are from the US.

Key events support domestic performance in June 2025

Primary sector activities were slower in June 2025. Total agricultural exports fell by 161.9 tonnes (17.6%), due to lower export volumes of root crops, watermelon, and coconut. In contrast, total agricultural export receipts rose by $0.5 million (132.8%), reflecting lag in receipt. On an annual basis, total agriculture exports increased by 675.5 tonnes (9.8%), reflecting the sector’s recovery from adverse weather conditions and development initiatives. Similarly, total marine exports fell by 65.8 metric tonnes (70.3%) in June 2025, along with aquarium exports by 2,850 pieces (39.1%). However, total marine export receipts increased by $0.2 million (149.6%). On the outlook, upcoming government development projects such as the bio-gas production, pack house, butchery, and the acquisition of fishing vessels, are anticipated to boost sectoral growth.

Development projects outlined in the Government Budget Statement for the fiscal year 2026 are expected to support growth in the industrial sector. Major initiatives include the construction of the Fanga’uta Lagoon Bridge, the Tonga Resilience Climate Project II, the Fua’amotu Airport upgrade, the new Parliament House, and the National Museum, among others. The spillover effects of these projects will benefit other industries such as mining & quarrying, manufacturing, and the utilities sector. In June 2025, the total value of construction permit applications rose significantly by $71.7 million (536.1%), reflecting the inclusion of high value infrastructure projects. Meanwhile, private applications for construction permits also increased by $19.5 million (160.5%), indicating continued private sector development.

Domestic events such as the annual church conferences, spurred vibrant outcomes in the tertiary sector. Total container registrations increased by 543 containers (71.9%), driven by increases in both business and private containers. The rise in business containers reflects increased trading activities during the festive season, coinciding with increased wholesale & retail import payments of $0.5 million (1.5%). Meanwhile, the increase in private containers suggests higher in-kind remittances.

Job vacancies rose in the beginning of new fiscal year

The NRBT’s job advertisement survey recorded 82 job vacancies in July 2025, an increase from 39 job vacancies in the previous month. Most of the advertised vacancies were in public administration, utilities, and transport & communication sectors. This increase coincides with the implementation of new projects and the new positions approved in the new Government Budget.

Over the year to July 2025, the total number of job vacancies advertised declined by 112 (12.8%). Majority of the advertised vacancies were in public administration, transport & communication, financial intermediation, and business services sectors.

Annual headline inflation edged up to 1.4% during festive month

Consumer Price Index increased by 2.6% in June 2025, predominantly due to higher domestic prices by 5.0%, reflecting high demand during the peak festive season. Import prices remained relatively stable over the month. Higher domestic prices stemmed from local food prices, alcoholic beverages, tobacco, and kava. All root crops, and most vegetables, fruits, and meat prices increased during the month.

Headline inflation rose by 1.4% in the year to June 2025, but still lower than the 6.4% in June 2024. Imported inflation outpaced domestic prices over the year, due to higher prices of food & non-alcoholic beverages, goods for personal care, clothing & footwear, furnishings & household items, and purchase of vehicles. These increases were partially offset by lower prices for fuel, and gas & other fuels. Contrarily, domestic prices continued to decline annually, driven mostly by lower local food prices. Nonetheless, prices of electricity, alcoholic beverages, tobacco, and kava, food & beverage serving services were still higher compared to the previous year.

Core inflation increased further to 9.8% in June 2025 from 9.5% in the previous month, driven by price increases across core goods and services. The diversion of the core inflation trend from the headline reflects price stickiness in core items, keeping cost of living relatively high. On the other hand, non-core inflation recorded a year on year decline of 4.9%, as a result of the declining local food and energy prices.

Nominal Effective exchange rate increased in July 2025

The Nominal Effective Exchange Rate (NEER) increased by 0.5% over the month as the Tongan Pa’anga appreciated against the weighted basket of its trading partners’ currencies. On the other hand, the Real Effective Exchange Rate (REER) slightly declined during the month by 0.1%, in line with the easing of inflation in Tonga.

Over the year, the NEER declined by 0.7%, while the REER strengthened by 0.4% suggesting that Tonga’s prices are relatively higher compared to its trading partner countries, which could result in a loss in trade competitiveness.

Foreign reserves declined in July 2025

Foreign reserves was at $921.0 million in July 2025, declining by $4.1 million (0.4%) over the month, largely due to outflows of import payments. This is equivalent to 10.7 months of import coverage, well above the optimal threshold of 7.5 months. Over the year, foreign reserves increased by $11.9 million. The majority of official foreign reserves are held in USD, NZD, and AUD.

Remittances declined in June 2025

Following the hike during the family month (May), remittance receipts fell by $3.9 million (8.0%) in June 2025, mainly due to declines in private transfers and employee compensation. Annually, total remittances still grew by $19.4 million (3.7%), equivalent to around 39% of GDP.

Money supply and Reserve money expanded in June 2025

Broad money increased over the month and over the year to June 2025, by $13.9 million (1.5%) and $39.8 million (4.4%) respectively, to a new high level of $945.8 million. This was mostly driven by the rising foreign reserves. The net foreign assets grew over the month reflecting higher foreign reserves and other foreign assets, but declined annually owing to higher liabilities. The net domestic assets, on the other hand, decreased over the month underpinned by lower net credit to the central government, but rose annually as lending to the private sector increased, along with the net credit to non-financial corporations and the central government.

Liquidity in the banking system increased over the month, but declined annually in June 2025, by $30.0 million (5.0%) and $0.8 million (0.1%), respectively. The monthly rise was attributed to higher Exchange Settlement Accounts (ESA) and Currency in Circulation (CIC) offsetting the lower Statutory Required Deposits (SRD). Annually, the ESA declined and outweighed the rises in both the SRD and CIC.

Total bank deposits climbed to a new high record of $1.002 billion in June 2025. This resulted from an increase of $35.6 million (3.7%) over the month, and $41.2 million (4.3%) annually. All deposit types increased, mostly from the central government, public enterprises, retirement funds, microfinance, and non-profit organizations. The rise in total deposits contribute to the excess liquidity in the banking system.

Monthly credit growth stalled in June 2025

The banks’ total lending slightly decreased over the month of June 2025 by $0.1 million (0.02%), however, continued to increase annually by $71.7 million (13.4%) to $605.2 million. Over the year, more loans were issued to public enterprises and private businesses such as professional & other services, distribution, and tourism sectors. Household loans also increased, led by higher housing loans followed by other personal and vehicle loans.

The non-performing loans to total loans ratio slightly rose to 14.2% in June 2025 from 14.0% in May 2025, and remained higher compared to 11.2% a year ago. This reflects financial challenges faced by the private sector, including those in the transport, construction and manufacturing sectors.

Interest rates spread widened in June 2025

The weighted average interest rate spread widened over the month of June 2025 by 5.9 basis points to 6.1%. This was attributed to the 3.3 basis points decline in the weighted average deposit rate, coupled with the 2.5 basis points increase in the weighted average lending rate. Over the year the weighted average interest rate spread narrowed by 20.4 basis points as the 24.1 basis points drop in the weighted average lending rate outweighed the 3.7 basis points decline in the weighted average deposit rate.

Outlook

Economic recovery is underway for the Tongan economy supported by fiscal expansionary measures and easing inflationary pressures. Nonetheless, the weakening global economy and elevated uncertainties on trade policies and geopolitical tensions remain as significant risks to both the growth and inflation outlook. Nonetheless, headline inflation is projected to remain below the 5% reference rate, while core inflation remains persistently high at over 9 percent and expected to take longer to converge back to the headline. Foreign reserves fluctuated to its peak over the last 12 months in August 2025. The financial system remains sound, while systemic risks are closely monitored to manage compliance with prudential requirements.

Given the state of the economy and the outlook, the NRBT in its August 2025 Monetary Policy Statement has shifted from its accommodative to a neutral policy stance in response to persistently high core inflation at over 9 percent. The policy change reflects NRBT’s commitment to modernising its operational frameworks to strengthen monetary policy transmission and preserve the exchange rate peg. Measures are being implemented to gradually develop Tonga’s underdeveloped money market, which lacks a yield curve and any interbank activity for over 15 years and have therefore constrained transmission through interest rates and the NRBT’s influence.