- Monthly Economic Update - December 2025 DOWNLOAD THE FULL UPDATE | PDF • 417 KB

Global growth shows no sign of picking up

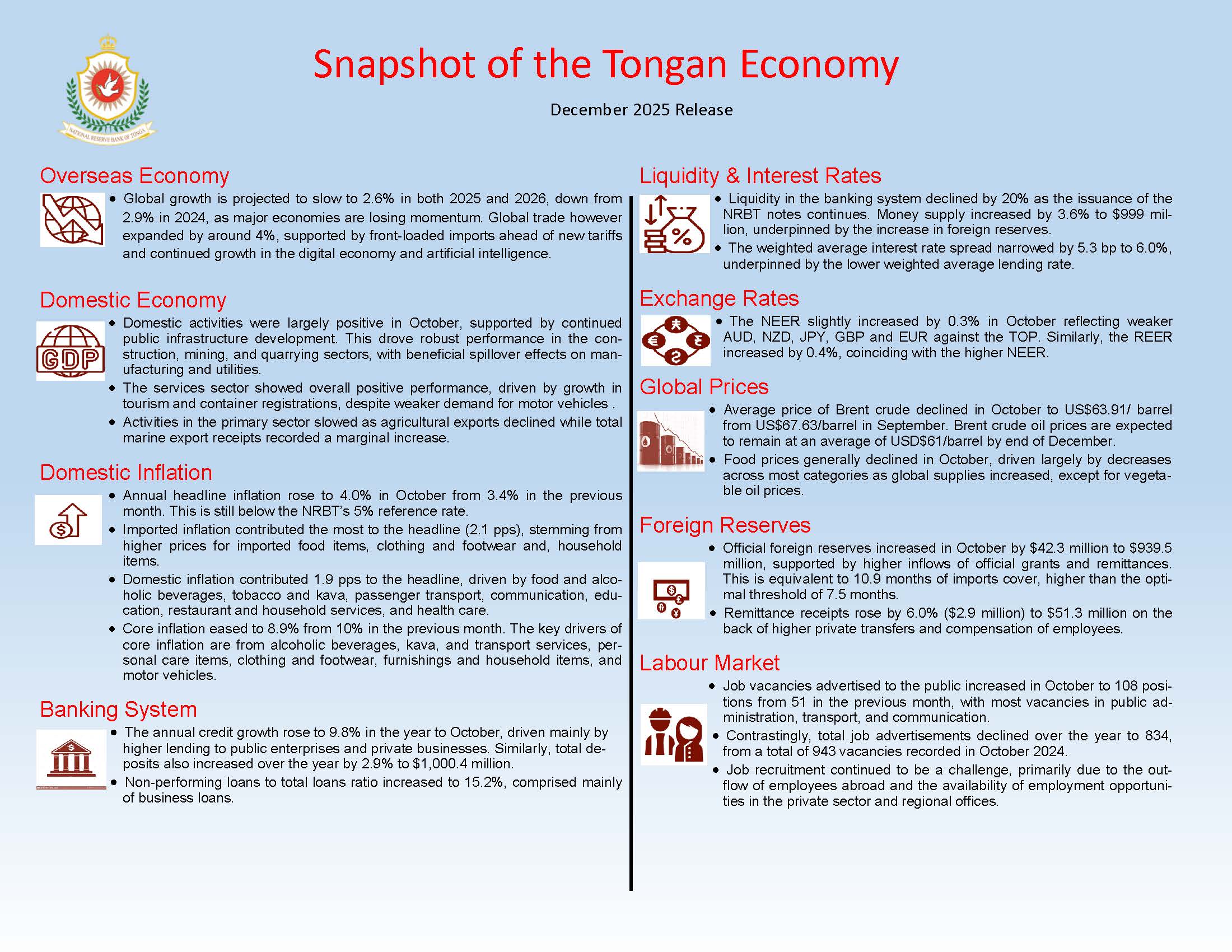

The UN Trade and Development’s December 2025 update projects a slowdown in global growth to 2.6% in 2025 and 2026, compared with 2.9% in 2024,as major economies are losing momentum. This forecast is lower than the International Monetary Fund’s October 2025 projections, which estimate global economic growth at 3.2% in 2025 and 3.1% in 2026. Growth in the United States is expected to moderate to 1.8% in 2025 and further to 1.5% in 2026. China’s growth is projected to ease from 5.0% in 2025 to 4.6% in 2026, remaining well below the pre-pandemic average of 6.7%. In contrast, developing economies are forecasted to expand by 4.3%, outpacing advanced economies. Global trade however expanded by about 4%, supported by front-loaded imports ahead of new tariffs and continued growth in the digital economy and artificial intelligence.

Domestic indicatiors generally positive

Activities in the primary sector slowed with agricultural exports declining by 22.8% (717.8 tonnes) in October. This was mainly due to lower shipments of cassava, squash, and yam. Correspondingly, agricultural export proceeds decreased by 15.4% ($0.15 million) in October 2025, but remained higher than in October 2024. Meanwhile, total marine export receipts increased marginally over the month.

Public infrastructure development continued to support robust performance in the industry sector. Construction has begun on the new Parliament Building, and contracts for the Fanga’uta Lagoon Bridge and approach roads have been signed, boosting demand for construction, mining, and quarrying services and generating positive spillover effects for the energy and manufacturing sectors. Additionally, funding of over USD 260,000 was approved under the Japanese Grass-Roots Human Security Project for the construction of an evacuation hall on ‘Eueiki Island and upgrades to kitchen facilities at Tupou College; however, implementation and spending have yet to commence.

The tertiary sector showed mixed performance in October. Vehicle registrations declined by 3.0%, reflecting softer demand for cars and motorcycles, with year-ended registrations also lower due to reduced motorcycle and government vehicle registrations. In contrast, container registrations increased over the month but fell over the year by 1763.0 containers (13.5%), as both business and private containers declined. The annual decline in container registrations corresponds with a 1.2% decrease in payments for wholesale and retail imports.

Increase in new job vacancies advertised

Labour market indicator for October shows a notable increase in job vacancies to 108 in October from 51 recorded in the previous month. These vacancies were mostly from public administration, transport and communication. In year-ended terms, total job advertisements declined from 943 in October 2024 to 834 in October 2025, with the largest reductions observed in the services sector, particularly in public administration, hotels & restaurants, financial intermediation, and utilities.

Headline inflation hit 4.0% in October

The Consumer Price Index (CPI) was unchanged in October compared with the previous month. Imported prices declined by 0.1% while domestic prices remained steady, indicating subdued monthly price movements with low volatility across both components.

Annually, headline inflation rose to 4.0% from 3.4% in September. Imported inflation contributed around 2.1 percentage points (pps), mainly due to higher prices for imported food items, clothing and footwear and household items. Domestic inflation added around 1.9 pps, driven by food and alcoholic beverages, tobacco and kava, passenger transport, communication, education, restaurant and household services, and health care. These increases were partially offset by continued declines in local food and electricity prices.

Annual core inflation (excluding food and energy) eased to 8.9% from 10.0% in September, reflecting moderation in underlying inflationary pressures. Domestic core prices contributed around 6.0 pps, led by alcoholic beverages, kava, and transport services, while imported core prices added 2.8 pps, reflecting higher costs for personal care items, clothing and footwear, furnishings and household items, and motor vehicles.

Effective exchange rates increased

The Nominal Effective exchange rate (NEER) rose by 0.3% over the month, reflecting weaker AUD, NZD, JPY, GBP and EUR against the TOP. Over the year, the NEER also recorded a 0.1% increase, driven by a general appreciation of the TOP against the NZD. The Real Effective Exchange Rate (REER) also increased, up 0.4% during the month and 1.9% over the year, indicating a decline in Tonga’s trade competitiveness.

Foreign reserves rose in October

Foreign reserves increased in October 2025 by $42.3 million, supported by higher inflows of official grants and remittances. Over the year, reserves increased by $41.3 million to $939.5 million. This is equivalent to 10.9 months of import coverage, above the optimal threshold of 7.5 months. The majority of official foreign reserves are held in USD, NZD, and AUD.

Remittance receipts picked up

Remittance receipts rose by 6.0% ($2.9 million) in October to $51.3 million from higher private transfers and compensation of employees. Over the year, receipts increased by 6.4% ($33.6 million) to $557.8 million, reflecting stronger support from temporary workers abroad. Majority of remittance receipts are private transfers from family and friends abroad (88.2%), followed by compensation of temporary workers abroad (10.6%). AUD dominated receipts at 42.9%, followed by USD at 34.3% and NZD at 19.7%. The NRBT estimates that remittances represent 40% of GDP, underscoring its importance to the Tongan economy and household welfare.

Liquidity increased

Banks’ Exchange Settlement Accounts (ESA) declined by 20.0% ($61.1 million) over the month and by 29.2% ($103.8 million) year-on-year, mainly due to purchases of NRBT notes. However, these declines were more than offset by increases in the Currency in Circulation and Statutory Reserve Deposits on both a monthly and annual basis. Consequently, reserve money increased over the month and year by 2.8% ($17.9 million) and 2.3% ($14.3 million) respectively.

Broad money rose by 3.6% ($34.9 million) over the month and by 10.2% (92.7 million) over the year, reaching $999.0 million. Monthly growth was largely driven by higher net foreign assets, while the annual rise reflected increased net domestic assets. The higher net foreign assets aligned with the increasing foreign reserve whilst the growing net domestic assets reflect the rising securities and credit to the private sector. At the same time, total bank deposits rose again by 0.1% ($0.7 million) to $1,000 million, mostly from higher savings and time deposits.

Total bank’s lending declined

The bank’s total credit remained high despite a slight monthly decline of 0.6% ($3.4 million). On an annual basis, total loans rose by 9.8% ($54.1 million) to $608.1 million. Lending to public enterprises and private businesses in the distribution, fisheries, and transport sectors decreased over the month. In contrast, annual growth was driven by higher lending to public enterprises and private businesses in professional and other services, tourism, and manufacturing. Household loans increased over the month, driven mainly by higher housing loans, while all loan categories contributed to the annual growth, led by housing loans, followed by other personal and vehicle loans. The annual rise in both business and household lending reflected stronger business confidence and ongoing economic recovery.

The non-performing loans (NPL) to total loans ratio increased from 14.3% recorded last month to 15.2%. Non-performing loans are mostly comprised of business loans.

Interest rate spread narrowed

The weighted average interest rate spread narrowed over the month by 5.3 basis points (bp) to 6.0%. The weighted average lending rate declined by 4.4 bp and outweighed the 1.0 bp increase in the weighted average deposit rates. Annually, the interest rate spread narrowed by 21.4 bp, driven mostly by the 28.5 bp decrease in the weighted average lending rate.

Outlook

Overall, indicators in the domestic sector largely support a firm economic recovery, in line with NRBT projections. Fiscal and monetary policies continue to promote private sector development and improve access to finance, fostering a stronger recovery. The commencement of scheduled public infrastructure projects and the rollout of additional credit schemes are expected to stimulate economic activity in the near term. However, the recent change in the Government may have an impact on operations and major projects in the pipeline.

Inflation is expected to fluctuate over the coming months, but should deviate around the 5% reference rate. However, downside risks from uncertainties in global trade policies persist, alongside more frequent disruptions in domestic energy supply.

Foreign reserves is expected to remain above the optimal level of 7.5 months. The increasing import demand and foreign debt obligations may weigh down on reserves.

The financial system remains sound from high liquidity, adequate capital buffers, and sustained profitability. However, the elevated level of NPLs highlights the need for prudent lending practices and enhanced oversight.

In light of these developments and outlook, the NRBT maintains its neutral monetary policy stance. Issuing NRBT notes will continue to manage excess banking system liquidity and support effective transmission to market interest rates. Efforts to strengthen liquidity management, reactivate the interbank market, modernize the payment systems, and deepen financial markets are ongoing.