- Monthly Economic Review - February 2024 DOWNLOAD THE FULL REVIEW | PDF 996 KB

Inflation eased, yet high, on major trading partners

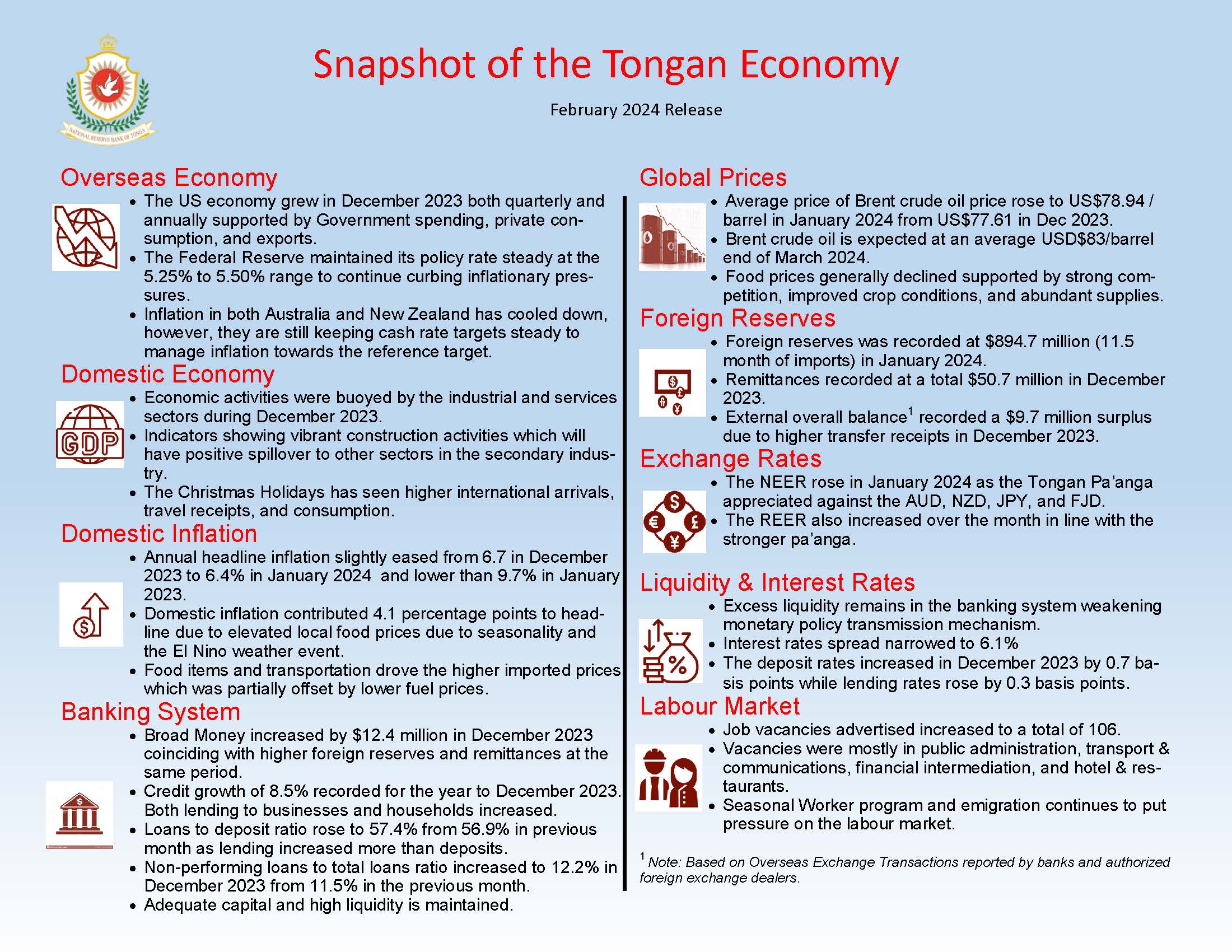

The US Bureau of Economic Analysis reported an annual growth rate of 3.3% in the fourth quarter of 2023 for the US economy. Consumer spending and exports were key drivers of this growth, reflecting positive outturns in the food and health care services, recreational goods and vehicles, and financial services in the exports sector. Increased real disposable income, government spending, and high savings from the pandemic provided ample financial support for households and also supported growth in the December 2023 quarter.

US inflation in December 2023 continued to cool down to 3.4% compared to 6.5% in December 2022 as the Federal Reserve maintains its policy rate steady at the 5.25% to 5.50% range to curb inflationary pressure in the economy.

In Australia, the unemployment rate remained the same in December 2023 at 3.9%, following a strong growth in employment in the previous two months. Annual inflation rate slowed to 4.1% in the December 2023 quarter from 5.4% in the previous quarter. The cash rate target remains at 4.35% to manage inflation towards the 2% – 3% target. In New Zealand, the annual headline inflation was 4.7% in December 2023, consistently falling for four consecutive quarters since December 2022 at 7.2%.

Christmas Holiday season boosted economic activities

Domestically, the primary sector faced strong demands during the celebratory events of the Christmas Holiday season.The strong pick up in demand only further aggravated already high prices given the lingered supply shortage within the primary sector. Total agricultural exports slowed from the peak export season in the previous month by 556.2 tonnes (-52.0%) due to a decline in the exports of squash, root crops (i.e. taro, cassava, & sweet potato), and watermelon. The fall in squash exports also reflect the early onset of the El Nino event and its adverse effects on the plantations. Coincidently, total agricultural export proceeds also declined by $1.0 million (-84.4%) in December 2023. However, the sector is looking forward to the implementation of the multimillion Tonga Circular Economy project. For fisheries, the marine exports rose over the month by 294 metric tonnes (+593.1%) driven mainly by higher tuna exports. At the same time, total marine export proceeds also recorded an increase of $0.2 million (+152.6%).

Indicators in the industrial sector showed vibrant activities for December 2023, particularly within the construction sector and its positive spillover effects to the other industries. Over the month, the total value of construction applications submitted to the Ministry of Infrastructure increased by $1.2 million (+8.7%), attributed largely to private projects. The individual housing loan also recorded an increase of $1.5 million (+0.8%), along with a new loan commitment of $0.5 millions for the construction sector. In December 2023, the construction import payments increased by $0.5 million (+29.1%). While the sector is also supported by the ongoing implementation of other development public projects, domestic labor and skills shortage, and elevated prices of both goods and services remain as challenges to the sector’s growth.

The service sector trended favourably during the Christmas Holiday season and its festivities. International travels were active as total passenger arrivals rose over the month by 200 passengers (+1,6%) and total passenger departures increased by 710 passengers (+5.4%) as people travelled to visit families and friends during the holiday season. Travel receipts also picked up by $2.4 million (21.3%), reflective of the increased spending by the travellers during their visit. Several festivals and activities were hosted by a few local enterprises and communities, further boosting the sectoral growth. Over the month, the wholesale and retail import payments rose by $4.8 millions (+16.6%).

More job vacancies advertised in the New year

Job advertisements continued to rise in the New Year by 13 job vacancies (+14.0%) as surveyed by the Reserve Bank, stemming from public administration, transport & communications, financial intermediation, and hotel & restaurants sectors. Over the year to January 2024, total job vacancies advertised publicly increased by 100 job vacancies (+11.7%). Majority of the total job vacancies over the year to January 2024 were from public administrations, hotel & restaurants, utilities, and health & social work sectors.

Headline inflation dipped to 6.4% in January 2024

Consumer Price Index slightly declined over the month by 0.1%, owed largely to a general decline in imported prices while domestic prices further inceased. Imported inflation recorded a monthly fall stemming from lower price of fuel, non-alcoholic beverages, and imported clothing. However, price for imported food items, goods for personal care, alcoholic beverages, maintenance products, and households items still increased over the month. At the same time, higher domestic prices in January 2024 was supported by the further increase in electricity tariff for the first quarter of 2024. Nonetheless, this increase was partially offset by the declined price of local food items, tertiary education fees, and local clothing.

Headline inflation slightly dipped in January 2024 to 6.4% from 6.7% in previous month. This is also lower than the 9.7% in January 2023. Imported inflation contributed around 2.3 percentage points to the headline inflation, primarily fuelled by elevated price of imported food items, international airfares, alcoholic beverages, goods for personal care, and household items. Nonetheless, price of fuel, non-alcoholic beverages, and LP gas were still lower compared to previous year. On the other hand, domestic prices contributed 4.1 percentage points to the headline inflation. The main domestic contributors to the headline inflation were local food items, catering services, electricity tariff, transport components, and kava. Meanwhile, tertiary education fees, local tobacco and clothing declined at annual rate partially offsetting the increase.

Core inflation on the other hand also slowed down to 5.5% in the New Year, compared to 5.9% in previous month and 8.3% in January 2023. The slowdown further reflects the decreased price over the year for local tobacco, clothing, and tertiary education. At the same time, non-core inflation was lowered to 7.1% mainly by the declined price of fuel and LP gas over the year.

Effective exchange rate increased in January

The Nominal Effective Exhange Rate (NEER) rose over the month by 0.8% in parallel with an increased in the Real Effective Exchange Rate (REER) by 0.2% in January. The positive movement was underpinned by the appreciation in the Tongan Pa’anga against all currencies except USD, GBP and CNY.

In year ended terms, the NEER remains higher by 2.7% compared to the previous year as the TOP generally appreciated against the trading partners’ currencies (AUD, NZD, FJD, CNY and JPY). This may assist in offsetting imported inflation as overseas payments would become cheaper in terms of local currency. Additionally, REER also increased over the year by 5.5% in line with the slight increase in Tonga’s inflation.

Foreign reserves fell in January

Foreign reserves stood at $894.7 million as it declined by $7.1 million in January. This represent 11.5 months of imports, which exceeds the IMF’s recommended threshold of 7.5 months. This is lower in 2024 by $16.4 million compared to reserves recorded twelve months prior. Higher payments for import drove the overall decline. The majority of the official foreign reserves are held in USD, NZD, and AUD.

Remittances surge during Christmas festivities

Total remittance receipts rose substantially over the month by $7.6 million (17.5%) to $50.7 million underpinned by an increased in all categories. This is a typical trend observed in December driven by the Christmas celebrations and festivities.

Over the year, total remittance receipts continued to remain stronger by $61.1 million (12.8%) largely attributed to private transfers and compensation of employees receipts. This reflects improvements of economies abroad supporting investment and employment opportunities.

Broad money rose

Broad money increased in December 2023, by $12.4 million (1.5%) over the month and $16.9 million (2.0%) annually. The net foreign assets increased over the month and over the year, in line with the rising foreign reserves and remittances. The net domestic assets increased over the month, underpinned by higher credit to private sector but declined annually, corresponding to lower capital accounts. The movements in net credit to central governments also supported both trends.

Reserve money increased

Liquidity in the financial system increased over the month of December 2023, by $11.9 million (2.0%). The Currency in circulation (CIC) increased and offset the decline in the Exchange Settlement Account (ESA) and Statutory Required Deposits (SRD).

However, over the year, liquidity in the financial system declined by 1.2 million (0.2%). This was solely driven by lower ESA mainly on higher withdrawal from the Reserve Bank’s vault and net sales of foreign currency to the commercial banks.

Business lending boosting credit growth

The banks’ total lending increased over the month and over the year to December 2023, by $7.2 million (1.4%) and $41.3 million (8.5%), respectively. Lending to both businesses and households increased, reflecting higher businesses and consumer confidence as well as recoveries to the economy.

Lending to businesses increased over the month, mainly for public enterprises and businesses within the professional & other services, tourism and distribution sectors. Annually, more loans were issued to the professional & other services businesses’ again, as well as businesses such as transport, tourism, manufacturing and distribution sectors.

Household loans increased over the month, mainly housing and other personal purposes. Similarly, over the year, all categories of households’ loans increased led by higher other personal loans, followed by rises in both housing and vehicles loans.

Total deposits in the banks increased by $4.5 million (0.5%) over the month, and over the year by $38.6 million (4.4%) to $913.5 million, driven by higher time and demand deposits. Time deposits from churches and private businesses increased over the month and over the year and the higher time deposits from the Retirement Funds also contributed to the annual rise. The loans to deposit ratio increased in December 2023 to 57.4% compared to 56.9% in November 2023 and 55.2% last year, reflecting lending rising more than deposits.

Interest rates declined

Weighted average interest rate spread narrowed over the month and over the year to December 2023, by 0.4 basis points and 19.0 basis points to 6.1%.

The deposit rates increased by 0.7 basis points over the month and outweighed the 0.3 basis points rise in lending rates. Both time and demand deposit rates rise over the month and offset the decline in saving deposit rates. Lending rates offered to the fisheries, agricultural and distribution sectors increased over the month, along with the household housing loan rates.

Over the year, the lending declined by 21.3 basis points and offset the decreased in deposit rates by 2.2 basis points. Lending rates offered to the agricultural, constructions, and transports sectors decreased over the year as well as all the loan rates offered to households, led by lower vehicle loans rates, and followed by the decline in other personal loan and housing rates. Similarly, the demand deposit rates fell and offset the rise in both saving and time deposit rates.

Outlook

In light of the latest developments above, the NRBT expects decline in headline inflation, staying below the 5% range. This expectation hinges on stable global oil prices, assuming no significant spikes. However, geopolitical uncertainties, such as the ongoing conflict between Israel and Hamas and tensions in the Middle East and Ukraine, pose risks of disrupting oil supplies, potentially pressuring petroleum prices upwards. Locally, any worsening in food supply could also escalate domestic inflation. The GDP growth for the current financial year is expected to be moderate, with domestic production remaining below potential. This scenario allows the Reserve Bank substantial leeway to support economic growth without triggering significant inflationary pressures. Tonga's foreign reserves are projected to remain robust, comfortably above the IMF's recommended seven and a half months of import coverage. The financial system is stable, characterized by ample liquidity. The NRBT will maintain vigilant monitoring of inflation trends while supporting the economy's recovery efforts.