- Monthly Economic Update - January 2026 DOWNLOAD THE FULL UPDATE | PDF • 417 KB

Outlook

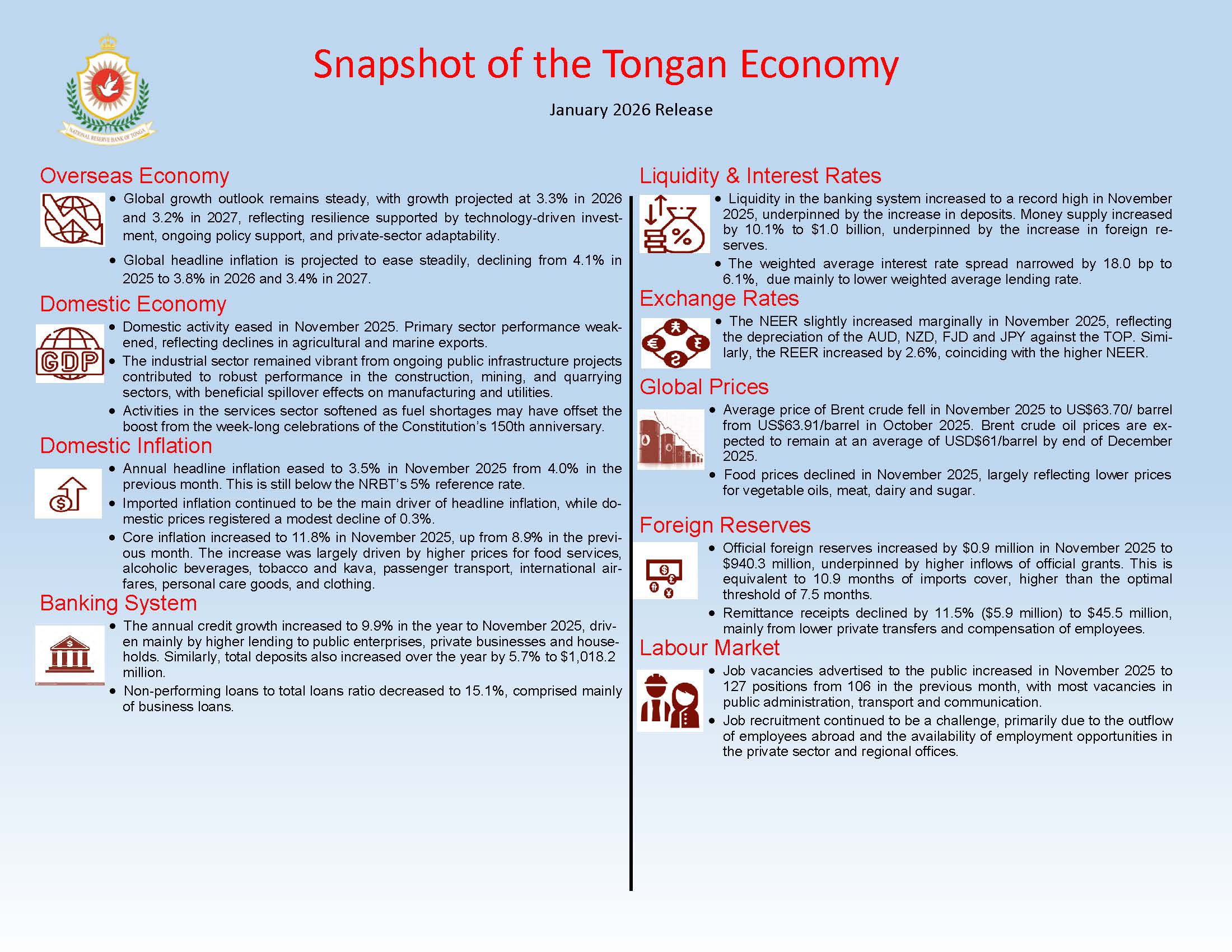

Despite a slow outturn for the month of November 2025, the annual trends of economic indicators still support the NRBT’s projections of a firm economic recovery in thecurrent fiscal year. The new Government continues to prioritise economic growth, thereby expected to maintain fiscal expansionary measures.

Inflation is at 3.5 percent (to November 2025) however, risks to the outlook are tilted to the upside. Temporary inflation pressures are expected in the first half of 2026, which could lift headline inflation above the 5% reference rate.

Higher import demand is also expected to place pressure on foreign reserves, but current forecast to remain above the optimal threshold of 7.5 months in the near term.

The financial system remains sound, supported by high liquidity, adequate capital, and sustained profitability. However, elevated non-performing loans highlight the need for continued prudence in lending and enhanced supervision.

Global growth remains steady amid divergent forces

The IMF’s January 2026 World Economic Outlook (WEO) projects global growth of 3.3% in 2026 and 3.2% in 2027, marking a modest upward revision from the October 2025 WEO. This reflects the global economy’s resilience, supported by technology-driven investment, ongoing fiscal and monetary support, and strong private-sector adaptability. Global headline inflation is projected to decline from an estimated 4.1% in 2025 to 3.8% in 2026, and further to 3.4% in 2027. Nonetheless, key downside risks remain including the escalation of geopolitical tensions and reevaluation of technology expectations.

Moderate domestic activities

In November 2025, primary sector activities slowed. Agricultural exports fell by 19.9% (142.8 tonnes) to 575.1 tonnes, reducing proceeds by 25.8% ($0.6 million), mainly due to lower shipments of cassava, kava, squash, and yam. Marine exports dropped by 96.9% (86.5 metric tons) month-on- month to 2.7 metric tons, driven by tuna, shark meat, and snapper, while aquarium exports fell 25.7% (3753 pieces) to 10,862 pieces.

Positive sentiments for the industry sector performance were fueled by the progress in major public infrastructure projects. Construction commenced on the new Parliament Building and the awarded contract for the USD$140 million Fanga’uta Lagoon Bridge including landing and approach roads. These projects are driving construction activity through increased demand for building works, mining, and quarrying services thereby lifting the sector’s contribution to growth and generating spillover effects to energy and manufacturing.

The tertiary sector activities generally eased in November 2025. Despite a week-long celebration of the 150th year of the Constitution earlier in the month, fuel shortages may have muted the services industry. Container registrations fell by 7.1% (76 registrations) month-on-month to 999 units, while vehicle registrations declined by 19.7% (63 registrations) to 257 units. Travel receipts also declined by 29.0% ($5.6 million). However, wholesale and retail import payments remained stable, and non-oil import payments increased, suggesting higher-value goods, and price increases.

Headline inflation slightly eased to 3.5 percent

The Consumer Price Index (CPI) rose by 2.5% in November 2025, driven mainly by a 4.7% increase in imported prices. the highest monthly rise on record, reflecting a surge in international airfares and prices of imported food, personal care goods, and fuel. Domestic prices increased modestly by 0.7%, primarily due to local food and tobacco prices.

On an annual basis, headline inflation moderated to 3.5% from 4.0% in October 2025. Imported inflation remained the main contributor, corresponding to the higher international airfare prices, imported food items, goods for personal care, and clothing and footwear. Meanwhile, domestic prices recorded a slight annual decline of 0.3%, led by lower local food costs, partially offsetting the increase in import prices.

Underlying inflation pressures are intensifying rising to 11.8% from 8.9%, reflecting broad-based price increase everyday services and goods, including food services, transport, airfares, personal care, and clothing. The 10% trimmed-mean measure also increased to 9.1% confirming underlying pressure. While lower food and prices have pushed non-core inflation into negative territory (-3.3 percent), this has masked the strength of core inflation, narrowing the gap with headline and increasing the risk of sustained price pressure for households.

Job advertisements increase

There were more job vacancies in November 2025, 127 advertisements compared with 106 in October 2025. The increase reflects continued strengthening in hiring activities toward the end of the year, especially for public administration. In year-ended terms, total job advertisements declined from 993 in November 2024 to 866 in November 2025, indicating that hiring activity earlier in the year remained subdued, despite recent monthly improvements.

Effective exchange rates increased over the month

The Nominal Effective Exchange Rate (NEER) increased by 0.1% in November 2025, reflecting the depreciation of the AUD, NZD, FJD and JPY against the TOP. Over the year, the NEER recorded a 0.1% decline, driven by the weakening of the TOP against the USD, AUD, EUR and GBP. The Real Effective Exchange Rate increased by 2.6% during the month and rose 1.1% over the year, indicating a decline in Tonga’s trade competitiveness.

Foreign reserves above thresholds

In November 2025, foreign reserves slightly increased by 0.1% ($0.9 million) to $940.3 million, supported by higher inflows of official grants. This is equivalent to 10.9 months of import coverage, above the optimal threshold of 7.5 months. Over the year, foreign reserve increased by $48.2 million.

Remittance receipts slowed

Remittance receipts fell by 11.5% ($5.9 million) in November 2025 to $45.5 million, mainly from lower private transfers and compensation of employees. The majority of remittances were private transfers from family and friends abroad (88%), followed by compensation of temporary workers abroad (10%). AUD dominated receipts at nearly 40%, followed by USD at 35% and NZD at 21%. The NRBT estimates that remittances represent around 37% of GDP, underscoring their importance to Tonga’s economy and household welfare.

Money Supply expanded

Reserve Money rose by 1.6% ($10.0 million) over the month and by 3.3% ($21.0 million) over the year, to $656.6 million. The monthly increase was driven solely by higher balances in Banks’ Exchange Settlement Accounts (ESA), which offset declines in Currency in Circulation (CIC), Statutory Reserve Deposits (SRD) and other deposits. On an annual basis, however, CIC, SRD, and other deposits all recorded gains which offset the lower ESA.

Broad money grew by 0.4% ($3.5 million) over the month

and by 10.1% ($91.7 million) over the year, setting a new all-time high of $1.0 billion. The monthly and annual expansions were mostly supported by higher net foreign assets. This reflects the accumulation of foreign reserves and other external holdings.

Total bank’s lending rose

Banks’ total credit rose in November 2025 to a new record level of $611.8 million, driven by solid lending growth to both businesses and households over the month and over the year. Monthly lending increased by 0.6% ($3.7 million), reflecting a $1.9 million (0.6%) rise in household loans and a $1.8 million (0.6%) increase in business loans. Within household lending, other personal loans recorded the largest monthly growth, followed by housing and vehicles loans. On the business side, lending growth was concentrated in public enterprises and private businesses, particularly within the construction, distribution, and agricultural sectors.

Annually, total loans rose by 9.9% ($55.3 million), reflecting buoyant business confidence and sustained economic recovery. Growth in business lending was led by public enterprises and private businesses, especially in professional and other services, construction, and entertainment and catering sectors. Household lending also increased over the year, driven primarily by higher housing loans, followed by gains in other personal loans and vehicle loans.

The ratio of non-performing loans (NPL) to total loans improved from 15.8% recorded last month to 15.1%. Most NPLs are business loans.

Interest rate spread widened

The weighted average interest rate spread inched higher over the month by 6.5 basis points to 6.1%, reflecting a decline in the weighted average deposit rate by 4.2 basis points coupled with a 2.4 basis points increase in weighted average lending rate.

Over the year, the interest rate spread contracted by 18.0 basis points, largely due to a 20.2 basis points decrease in weighted average lending rates which outweighed the 2.3 basis points decline in weighted average deposit rates.