- Monthly Economic Update - July 2025 DOWNLOAD THE FULL UPDATE | PDF • 572 KB

Weak growth in advanced economies

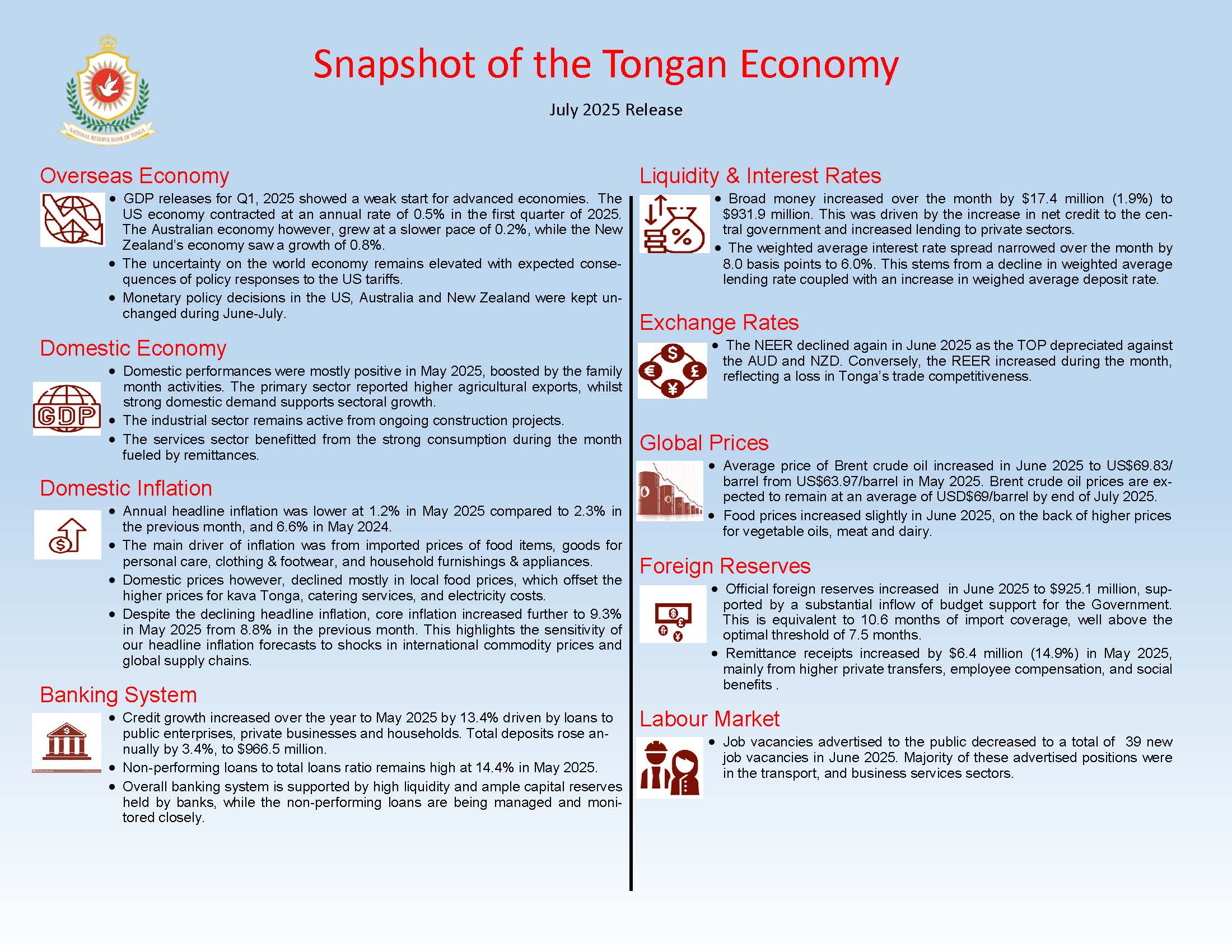

In the first quarter of 2025, the US economy contracted at an annual rate of 0.5 percent, on the back of higher imports and lower government spending. The US annual inflation rate rose to 2.7% in June 2025, the highest since February 2025 as the U.S. President’s tarrifs begin to impact prices. President Trump recently announced plans in July 2025 to slap tariffs as high as 50% on dozens of countries, including 25% tariffs on top U.S. trade partners such as Japan and South Korea. Trade tensions contribute to the escalated uncertainties on the global growth outlook. Australia also recorded a slower growth of 0.2% in the first quarter of 2025, while the New Zealand economy expanded by 0.8%.

On this backdrop, monetary policy in advanced economies remained cautious in June-July. The Federal Reserve maintained the target funds rate at 4-1/4 to 4-1/2% (18 June 2025). Similarly, Reserve Bank of Australia left the cash rate unchanged at 3.85% (8 July 2025), and Reserve Bank of NZ also held the Official Cash Rate at 3.25% (9 July 2025).

Improved domestic performance during the family month

The primary sector outcomes were mostly favorable in May 2025, reflecting improved harvests and favourable weather conditions. Total agricultural export volumes increased by 136.2 tonnes (17.4%), driven by higher volumes of root crops such as yam and taro, watermelon, and coconut. Over the year, agricultural export volumes also rose by 675.5 tonnes (9.8%). Contrarily, total agricultural export proceeds declined by $0.2 million (37.0%) while marine export proceeds remained relatively stable. At the same time, strong domestic demand and consumption during the family month supported sectoral growth.

The industrial sector was supported by active construction projects in May 2025. A substantial increase in construction import payments of $2.1 million (50.1%) during the month coincides with ongoing government infrastructure projects. Loans to the construction sector continued to grow by $0.3 million (1.4%), along with higher loans for individual housing of $2.5 million (1.2%). Lending to the manufacturing sector also rose by $0.6 million (3.2%).

Indicators of the tertiary sector also trended upward. Import payments for wholesale & retail import payments increased by $3.7 million (12.2%) in May 2025, reflecting strong trading activities. Although travel receipts slightly declined by $0.6 million (3.6%), it was offset by the continued rise in remittances fuelling household spending and consumption. At the same time, total vehicle registrations also increased by 15 registrations (7.7%) during the month.

Sharp drop in advertised vacancies in June 2025

According to the Reserve Bank’s survey on job advertisements, 39 new job vacancies were advertised in June 2025, dropping from 92 in the previous month. The decline was notable for the public administration vacancies as the fiscal year comes to a close. Majority of the advertised positions were in the transport and business services sectors. Over the year to June 2025, total job vacancies advertised fell by 79 (8.5%).

Annual Headline inflation declined further to 1.2% in May 2025

In May 2025, the Consumer Price Index rose by 0.8%, driven by increases in both imported and domestic prices. Over the month, imported inflation was mainly from price increases in imported food items, clothing & footwear, garden products, and goods for personal care. Domestic prices also rose for local food items and kava Tonga.

Headline inflation dropped further to 1.2% in May 2025. This is lower than the 2.3% recorded in April 2025, and 6.6% in May 2024. Over the year, imported prices rose by 4.4%, stemming from imported food items, goods for personal care, clothing & footwear, and household furnishings & appliances. On the other hand, domestic prices declined by 1.4% over the year, supported largely by declines in local food prices such as root crops, vegetables (i.e. lu, head cabbage, capsicum and tomatoes), and fruits (i.e. pawpaw, breadfruit, and watermelon). These declines more than offset the increases in prices of kava Tonga, catering services, and electricity tariffs.

Nonetheless, core inflation (excluding energy and food) continued to rise in May 2025 to 9.3%. The higher prices of imported goods for personal care, furnishings & household items, clothing & footwear, and purchase of vehicles contributed to the higher core inflation. At the same time, the rising domestic prices for alcoholic beverages, tobacco & kava, food & beverage services, and passenger transport services further contributed to core inflation. Contrarily, non-core inflation (energy & food only) declined by 5.2% supported by the lower prices of local food items, fuel, and gas & other fuels. In that respect, the NRBT’s inflation forecasts still remains volatile to shocks in the international commodity prices and global supply chains.

Real Effective exchange rate increased in June 2025

The Tongan pa’anga continued to depreciate against the AUD and NZD during the month, the Nominal Effective Exchange Rate (NEER) declined by 0.2% over the month and by 1.2% over the year. Despite the easing of inflation in Tonga, the Real Effective Exchange Rate (REER) still increased over the month by 0.4%, reflecting the higher prices of goods and services in Tonga relative to its trading partner countries. Conversely, the REER weakened over the year by 1.6%, in parallel to the declining NEER.

Foreign Reserves rose from Budget Support inflows

The substantial inflow of budgetary support in June resulted in an increase in foreign reserves by $53.5 million compared to the previous month, and over the year by $0.7 million. This maintained the foreign reserves at a comfortable level of $925.1 million, equivalent to 10.6 months of import coverage, well above the optimal threshold of 7.5 months. The majority of official foreign reserves are held in USD, NZD, and AUD.

Remittances surged during the family month

Remittance receipts continued to follow the usual trend for the month of May, rising markedly by $6.4 million (14.9%). This was mainly from higher private transfers, employee compensation, and social benefits. This growth was also supported by church offerings and conferences held during the month. Remittance receipts were dominated by AUD, increasing by $2.6 million (15.8%), followed by an increase of $2.2 million in NZD, and $1.8 million in USD. This coincides with the appreciation of the Australian and New Zealand dollars against the Tongan pa'anga in May. Annually, total remittances continued to increase by $18.0 million (3.4%) to $541.7 million.

Money supply and Reserve money expanded in May

Broad money increased further over the month and year to May 2025 by $17.4 million (1.9%) and $42.8 million (4.8%) respectively, to a total of $931.9 million. The net domestic assets increased over the month and over the year, underpinned by higher net credit to the central government and increased lending to private sectors. The net foreign assets also increased over the month but declined annually, in line with the movements in foreign reserves.

Liquidity in the banking system grew over the month; however, declined annually in May 2025, by $0.4 million (0.1%) and $4.4 million (0.7%), respectively. The monthly rise was solely driven by higher Currency in Circulation (CIC). Annually, the lower Exchange Settlement Accounts (ESA) more than offset the rises in both the Statutory Required Deposits (SRD) and CIC.

Positive credit growth continues in May 2025

The banks’ total lending increased over the month of May 2025 by $3.3 million (0.6%), and over the year by $71.5 million (13.4%) to $602.0 million. Over the month, lending to businesses within the professional & other services, manufacturing and fisheries sectors increased, as well as household housing and vehicle loans. Annually, more loans were issued to public enterprises and private businesses such as professional & other services, distribution and tourism sectors. Household loans also increased from all categories.

The non-performing loans to total loans ratio slightly rose to 14.9% in May 2025, from 14.6% in April 2025 and remained higher compared to 11.6% a year ago, reflecting weak asset quality remains. Problem loans are comprised mainly of business loans.

Total bank deposits decreased by $3.8 million (0.4%) over the month, but increased annually by $31.7 million (3.4%) to $966.5 million. Demand deposits decreased over the month and offset the rising saving and time deposits. The lower deposits over the month were mostly from the central government and non-profit organisations. Annually, both demand and time deposits increased, mainly from private sectors, government, microfinance businesses, retirement funds and public enterprises. The total loan to deposit ratio increased to 61.5% in May 2025, from 60.9% in the previous month, and 56.0% last year.

Interest rates spread narrowed in May 2025

The weighted average interest rate spread narrowed over themonth and over the year to May 2025 by 8.0 basis points and 23.3 basis points respectively, to 6.0%. The monthly decline is due to the weighted average lending rate decreasing by 4.4 basis points, coupled with the 3.6 basis points increased in the weighted average deposits rate.

Annually, the weighted average lending rate decreased by 27.0 basis points which offset the 3.7 basis points fall in weighted average deposit rate.

Outlook

Improved domestic performances support the recovery of the Tongan economy. The NRBT has revised its GDP forecasts, pointing to stronger growth in the medium term supported by fiscal expansionary measures, the accommodative monetary policies and the recovery of the primary sector. Nonetheless, the weakening global economy and elevated uncertainties on trade policies and geopolitical tensions may have spillover effects on domestic growth and inflation.

Some fluctuation in inflation is expected over the upcoming high season months, but with not much deviation above the 5% reference rate. However, wars and conflicts in the Middle East are driving oil prices up which will impact inflation in the near future. The recent persistently high core inflation also requires closer monitoring so as to avoid a rebound in headline inflation.

Foreign reserves is projected to remain comfortably above the optimal level of 7.5 months of imports cover in the medium term. However, foreign reserves is expected to decline gradually as import payments and scheduled debt repayments eventuate.

Credit growth is expected to remain strong in the near term as some banks are now expanding their lending products to SMEs and other business sectors, and in anticipation of the reactivation of the Government GDL loans. Ongoing close monitoring of non-performing loans and workout strategies continues.

The NRBT will continue to strengthen its policy tools to enhance the effectiveness of its monetary policy decisions in the domestic financial market, while remaining vigilant of risks to the financial system.