- Monthly Economic Update - June 2025 DOWNLOAD THE FULL UPDATE | PDF • 571 KB

Downgrade in global growth outlook from the escalating trade war

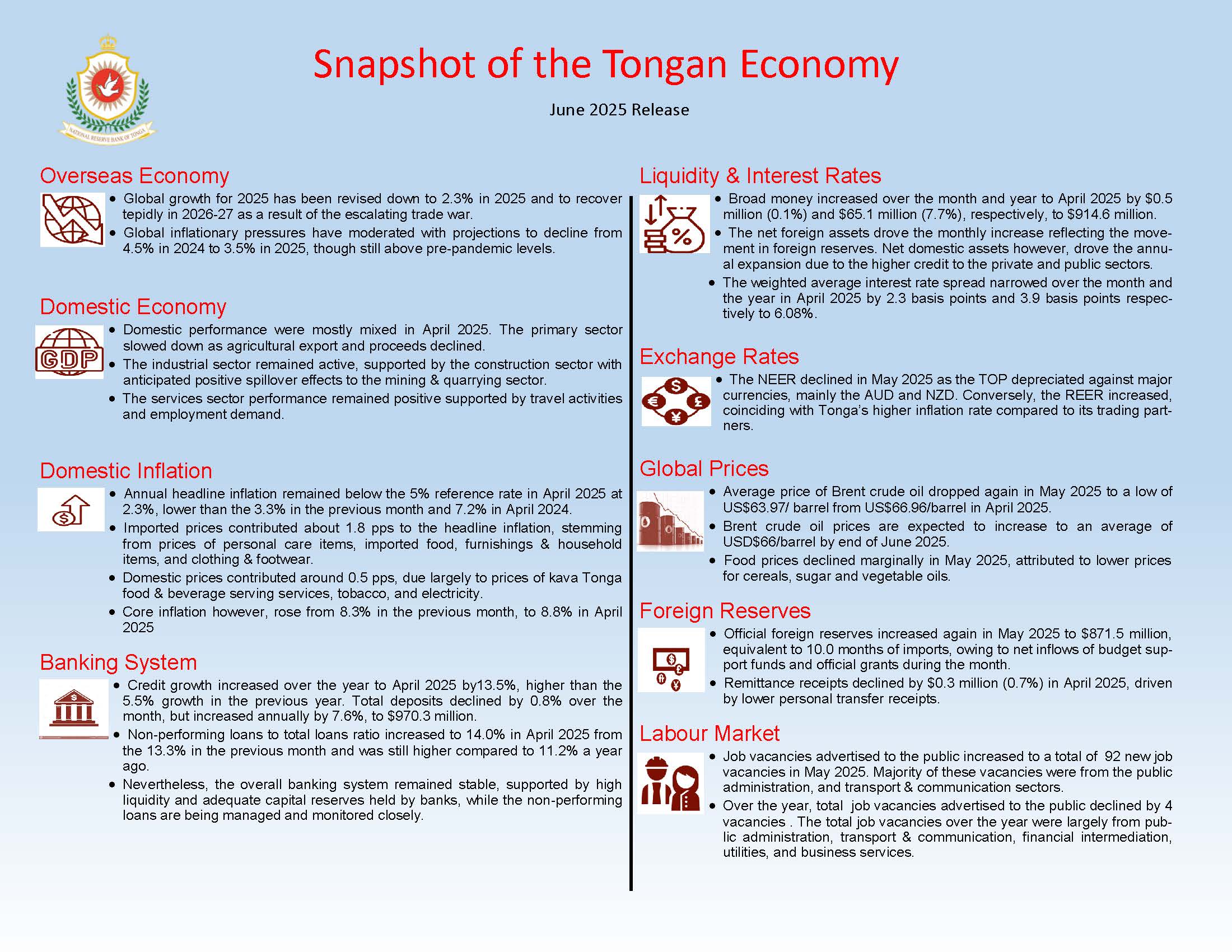

The World Bank Group in its June 2025 World Economic Prospects report downgraded its global growth outlook for 2025 from 3.3% (January 2025) to 2.3%. This marks the slowest growth rate since 2008, largely attributed to the substantial rise in trade barriers and policy uncertainties. The global economy is projected to recover tepidly in 2026, leaving global output materially below January projections.The recent escalation of the war in Iran contributes to a gloomier outlook for the global economy.

Inflationary pressures have moderated with projections to decline from 4.5% in 2024 to 3.5% in 2025, though still above pre-pandemic levels. Advanced economies are anticipated to control inflation more effectively than emerging economies, but persistent services and wage inflation, alongside potential supply shocks, could pose challenges. The recent conflict in Iran, could potentially affect energy prices disrupting the disinflationary trend, with spillover effects on investor confidence and consumer spending.

Economic growth in the East Asia & Pacific region (including Tonga, excluding China) is projected to slow to 4.5% in 2025, down from 5% in 2024. The slower growth is on the back of the escalating global trade tensions and increased policy uncertainty, as the weaker global growth outlook and reduced confidence impact investment, exports, and consumption in the region.

Domestic activities show mixed outcomes for April 2025

Indicators in the primary sector portrayed a slowdown in April 2025. Total agricultural export declined by 172.1 tonnes (18.0%), due to lower export volumes of root crops such as yam, sweet potato, and taro, as well as coconut, and sandalwood. Coincidently, total agricultural export receipts fell by $0.2 million (27.2%). At the same time, total marine export receipts declined by $0.1 million (39.3%). Nonetheless, the overall outlook for the primary sector remains positive, supported by planned Government projects for the upcoming financial year including the Tonga Ciruclar Economy System and several new initiatives such as packhouses, butchery facility, and increased focus in Public-Private Partnership and funding. In addition, the Government is planning to acquire new fishing vessels which are expected to further boost domestic fisheries production.

Credit extended to the industrial sector showed mixed outcomes in April 2025. Lending to the construction sector rose by $0.3 million (1.4%), along with an increase of $0.02 million (4.4%) recorded for the utilities sector. On the other hand, lending to the manufacturing and mining & quarrying sectors declined by $0.1 million (0.3%) and $0.04 million (22.0%), respectively. Meanwhile, ongoing infrastructure projects such as the Tapanekale project, Nuku’alofa Port Upgrade, Port rehabilitation works in Ha’apai and ‘Eua, and the ongoing road maintenance will continue to support growth in the sector.

The tertiary sector demonstated continued positive trends in April 2025. Total travel receipts substantially rose over the month by $5.3 million (49.1%) which reflected both upbeat business and personal travels. At the same time, total import payments excluding oil increased by $3.1 million (7.2%), while wholesale & retail import payments rose by $1.0 million (3.5%). Additionally, total vehicle import payments increased by $1.9 million (45.6%).

More job opportunities in May 2025

The Reserve Bank’s survey on job advertisements recorded 92 new job vacancies in May 2025, higher than the 83 job vacancies in the previous month. This reflects higher employment demand from the public administration, and transport & communication sectors. The year-end number of job vacancies fell by 4 (0.4%). The total job vacancies over the year were largely from public administration, transport & communication, financial intermediation, utilities, and business services.

Headline inflation declined to 2.3% in April 2025

The Consumer Price Index recorded a slight upturn of 0.3% in April 2025, driven by increases in both imported and domestic prices. Imported prices rose by 0.3% largely due to higher costs for operation of personal transport equipment, household items, imported food & non-alcoholic beverages, and goods for personal care. At the same time, domestic prices also increased by 0.3%, stemming from higher costs of electricity, domestic passenger transport services, and tobacco. In contrast, local food prices declined over the month reflecting better harvests thereby offsetting some of the increases.

Headline inflation further slowed down to 2.3% in April 2025 from 3.3% in the previous month and 7.2% in April 2024. Approximately, imported inflation contributed around 1.8 percentage points (pps) to the headline inflation. This contribution stemmed largely from goods for personal care, imported food items, furnishings & household items, and clothing & footwear. On the other hand, domestic prices contributed around 0.5 pps to the headline inflation. The main domestic contributors were kava Tonga, food & beverage serving services, tobacco, and electricity prices. Meanwhile, prices for local food and early childhood & primary education declined over the year.

Core inflation (excluding energy and food) increased further to 8.8% in April 2025. The upward pressure was due to prices of domestic items such as alcoholic beverages, tobacco & kava, food & beverage serving services, passenger transport services and tertiary education fees. At the same time, prices of imported items such as goods for personal care, furnishings & household items, clothing & footwear, and purchase of vehicles, also contributed to the rising core inflation. Conversely, non-core inflation (energy & food only) declined further to -2.7% from -0.7% in the previous month, mainly due to declining local food and energy prices.

Real Effective exchange rate increased in May 2025

The Nominal Effective Exchange Rate (NEER) declined by 0.1% during May 2025, and 0.6% over the year. This was driven by the strengthening of the AUD and NZD against the Tongan pa’anga.

Contrastingly, the Real Effective Exchange Rate (REER) strengthened by 1.7% during the month and by 3.8% over the year. This coincides with Tonga’s relatively higher inflation rate compared to its trading partners, suggesting a decline in Tonga’s competitiveness in global trade.

Foreign reserves rose again in May 2025

Foreign reserves increased by $4.0 million in May 2025 to $871.5 million, underpinned by inflows of budget support funds, official grants and remittances. This is equivalent to 10.0 months of imports cover, which is well above the optimal threshold of 7.5 months. Although foreign reserves remains comfortable, it has declined by $21.5 million over the year, attributed to outflows for imports, debt repayments and offshore investments. The majority of official foreign reserves are held in USD, NZD, and AUD.

Remittances declined from lower private transfers in April 2025

Despite a growth in employee compensation, private capital transfers, and social benefits during the month, private transfer receipts fell by $0.5 million (1.3%) in April 2025, contributing to an overall decline in remittances of $0.3 million (0.7%) from the previous month. This trend coincided with an increase in travel receipts, as remittance funds may have been used for travel-related expenses.

Additionally, remittance receipts from the United States declined in April 2025, which may be due to the rise in US inflation and the depreciation of the US dollar against the Tongan pa’anga during the month. This was followed by a decrease in receipts from Australia, outweighing the increase in receipts from New Zealand.

However, total remittance receipts still rose over the year by $6.9 million (1.3%) to $536.7 million, driven by continued financial support from the Tongan diaspora.

Money supply expanded in April 2025

Broad money increased over the month and over the year to April 2025 by $0.5 million (0.1%) and $65.1 million (7.7%) respectively, to a total of $914.6 million. The net foreign assets increased over the month, in line with higher foreign reserves, but declined annually, reflecting higher import payments and loan repayments. On the other hand, the net domestic assets decreased over the month, underpinned by lower net credit to the central government and private sectors. Over the year, net domestic assets increased due to higher credit to the private sector and the central government.

Reserve money increased

Liquidity in the banking system increased over the month and over the year to April 2025, by $1.2 million (0.2%) and $16.5 million (2.8%), respectively. Both rises attributed to higher Statutory Required Deposits (SRD) and Currency in Circulation (CIC), offsetting the lower Exchange Settlement Accounts (ESA). The increased SRD and CIC were in line with the growth in deposits and the higher demand for currency.

Lending Growth

The banks’ total lending increased over the month of April 2025, by $0.8 million (0.1%) and over the year by $71.8 million (13.5%), to $602.0 million, underpinned by higher business and household loans.

Over the month, lending to businesses within the distribution, transport and construction sectors increased, as well as household other personal loans and vehicle loans.

Annually, more loans were issued to public enterprises and private businesses such as professional & other services, distribution and tourism sectors. Household loans also increased for all categories.

The non-performing loans to total loans ratio increased to 14.0% in April 2025, from 13.3% in March 2025 and 11.2% a year ago. Close supervision of existing vulnerabilities in the banking system remains crucial to ensure financial stability.

Total bank deposits decreased by $8.1 million (0.8%) over the month, but increased annually by $68.9 million (7.6%) to $970.3 million. Both demand and saving deposits decreased over the month and offset the increased time deposits. The lower deposits were mostly from private businesses, central and public enterprises. Annually, both demand and time deposits increased, mainly from private sectors, government, microfinance businesses, retirement funds and public enterprises. Total loan to deposit ratio increased to 60.9% in April 2025, from 60.3% in the previous month, and 57.6% last year.

Interest rates spread narrowed in April 2025

The weighted average interest rate spread narrowed over the month and over the year to April 2025 by 2.3 basis points and 3.9 basis points respectively, to 6.08%.

The monthly decline is owed to the weighted average deposit rate increasing by 2.1 basis points, while the weighted average lending rate fell by 0.3 basis points. Deposit rates increased over the month underpinned by the decline in total deposits. Lending rates however, decreased over the month, mainly for public enterprises and businesses within the utilities, distribution and manufacturing sectors.

Annually, the weighted average lending rate decreased by 14.8 basis points and offset the 10.8 basis points fall in the weighted average deposit rate. Lending rates offered to non-profit organizations, public enterprises and businesses such as mining/quarrying, utilities and fisheries sectors declined annually. Similarly, both time and demand deposits fell and had offset the higher saving deposit rates.

Additionally, household loan rates declined over the month and over the year, led by lower housing, other personal loan rates and vehicle loans rates. This is supported by competitive loan campaigns offered by commercial banks during the year.

Outlook

The Tongan economy is showing progress in its recovery, supported by the fiscal expansion and the accommodative monetary policies. The Government’s planned initiatives for the upcoming financial year paints an optimistic outlook for domestic activities, underpinned by increased support for private sector development and greater access to finance.

Inflation is projected to fluctuate over the upcoming high season months before stabilizing below the NRBT’s reference rate. However, the persistently high core inflation requires a sustained decline in energy prices to pass through to business cost structures. Heightened uncertainties from trade war retaliations and geopolitical tensions in the Middle-East poses upside risks to the outlook.

Foreign reserves is expected to remain comfortably above the optimal level of 7.5 months of imports cover in the near term. However, the projected increase in import outflows and scheduled debt repayments and potential offshore investments will put pressure on the foreign reserves levels.

Credit growth is also anticipated to expand further in the near term supporting the economic recovery. Meanwhile, ongoing oversight and management of vulnerabilities and risks will help maintain financial stability as non-performing loans remain relatively high.

The NRBT will continue to strengthen its policy tools to enhance the effectiveness of its monetary policy decisions in the domestic financial market.