- Monthly Economic Update - March 2024 DOWNLOAD THE FULL UPDATE | PDF 1,008 KB

Global trade to rebound in 2024

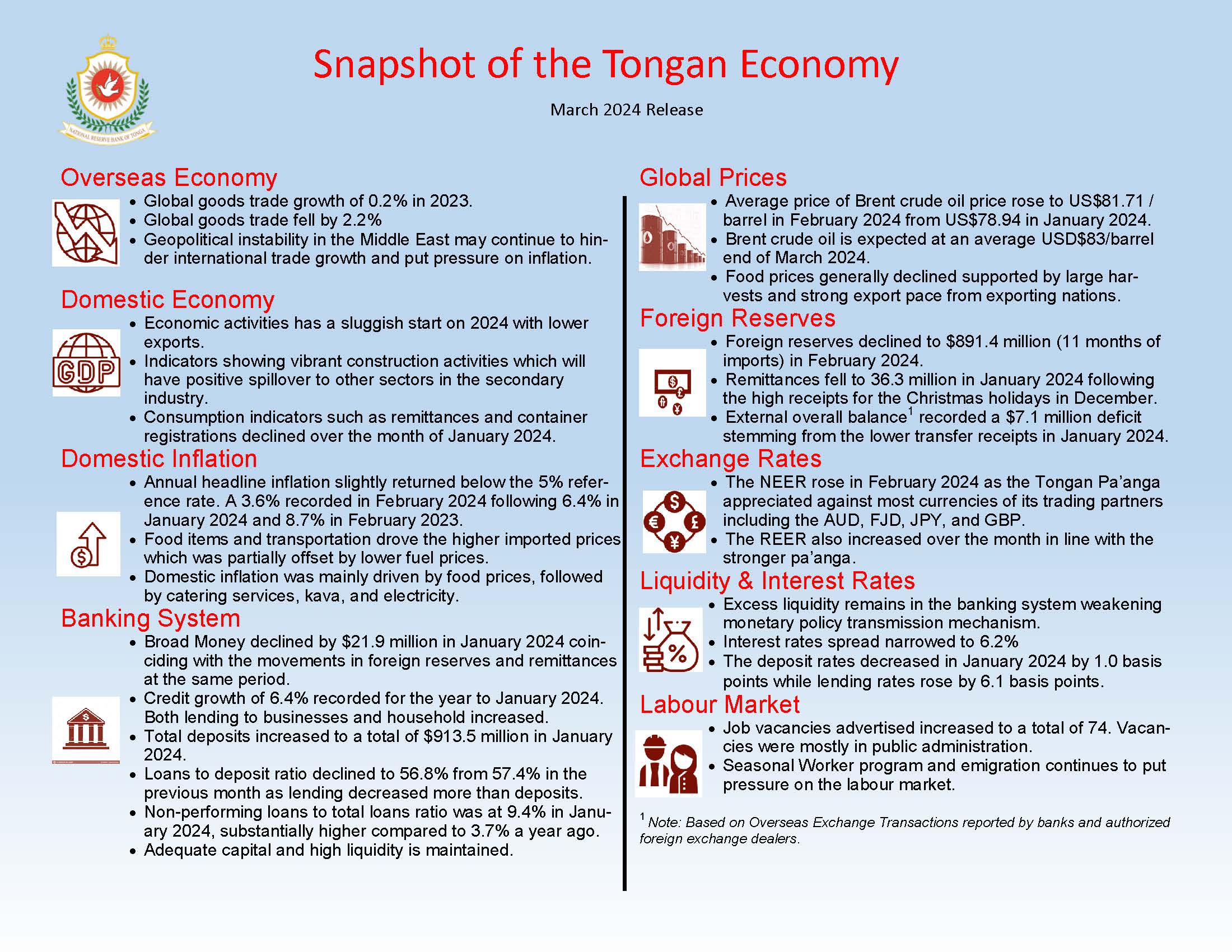

In its February 2024 Global Monthly report, the World Bank Group stated that global trade was relatively low at an estimated growth of 0.2% in 2023. Specifically, global goods trade fell by 2.2% in 2023. This is reflective of the slowdown in the global growth of industrial production specifically in advanced economies along with the slowdown in emerging markets and developing economies. This is a consequent of the fading pandemic era disruptions and supply chain pressures. Notably, this marks the first annual decline outside of a global recession in the past 20 years. Conversely, services trade recorded an improvement in 2023 specifically in the first half buoyed by robust demand for travel and international tourism activities. Overall, global trade is projected to pick up by 2.3% in 2024 and further expansion by 3.1% in 2025, supported by global growth output and normalization in trade patterns.

Geopolitical uncertainty and fragmentation specifically with the ongoing Israel-Hamas conflict, along with the potential for increased tensions in the Middle East, could disrupt global shipping routes hindering international trade growth and consequently put pressure on inflation. Restrictive trade policies imposed aimed at localizing production and reshoring of manufacturing activities specifically in the US and certain European Union economies could impede the flow of resources and materials across countries potentially slowing down projected trade growth.

Domestic activities slowed down in January 2024

A slowdown was reflected from the primary sector in January 2024, primarily due to the decline in exports volume. Total agricultural exports dropped by 50.3% (-258.3 tonnes) during the month, due to decreased exports of root crops, squash, coconut, and kava. This decline is attributed to the ending of the squash season, and the adverse impacts of the El Nino event on agricultural yields. Similarly, total marine exports substantially fell over the month by 65.2% (-224.2 metric tonnes) due to a huge decline in tuna and low export of shark meat. This may be reflective of several foreign vessels that have yet to resume operations following the holiday season. At the same time, total aquarium exports declined by 1,406 pieces (-28.4%). Coincidently, marine export proceeds recorded a decline of 51.5% (-$0.2 million).

The industrial sector showed a mixed performance for January 2024. Credit to construction sector fell by $0.8 million (-3.6%), along with a slight decline in the individual housing loans over the month. In addition, total electricity consumption also slowed by 0.3 million kWh (-3.7%). Contrarily, imports payment for construction material increased by $0.8 million (+34.5%) coinciding with a higher lending of 8.5% (+$0.01 million) to the mining & quarrying sector. Nonetheless, lending to the manufacturing and utilities sector both increased by 2.7% million (+$0.5 million) and 13.2% (+$0.1 million) respectively.

Indicators in the service sector reflect a slowdown over the month, indicating the end of the Christmas holiday activities. In January 2024, total passenger arrivals fell by 2,915 passengers (-22.4%), with lower passenger departures of 1,948 passengers (-14.0%). Meanwhile, total container registrations decreased by 495 containers (-40.1%), due to a decline in both business and private containers. Coincidently, imports payment excluding oil also declined by $2.0 million (-4.4%), indicative of the decrease in the wholesale & retail imports payment of $5.4 million (-16.2%).

Fewer job vacancies advertised in February 2024

According to the Reserve Bank’s survey on job advertisement, total job vacancies advertised over the month slowed down by 30.2% to 74 advertisements. However, the total job vacancies stemmed largely from the public administration. Over the year to February 2024, total job vacancies advertised publicly increased by 50 vacancies (+5.5%). Majority of the job vacancies advertised over the year were in public administration, transport & communications, utilities, and health & social work sectors.

Headline inflation fell below the 5% threshold in February 2024

Consumer Price Index declined over the month by 1.7%, partly reflecting a slowdown in demand and consumption following the holiday festivities. In February 2024, domestic prices generally declined due to lower prices of local food items such as root crops, seafood, vegetables, and suckling pig, as well as household items. Meanwhile, imported prices slightly increased over the month, primarily driven by higher prices for imported food items, clothing & footwear, and personal care goods. The high imported prices still reflect the lingering effects of COVID-19 induced costs from global suppliers and high freight charges.

Headline inflation returned below the 5% reference rate in February 2024 to 3.6%, lower than the 6.4% in the previous month and 8.7% in February 2023. The ease in inflation was largely supported by favorable movements in global energy prices compared to the pandemic period. Meanwhile, local food prices eased as demand and spending slowed down following the holiday activities. Nonetheless, imported prices contributed around 1.9 percentage points (pps) to headline inflation with main contribution stemming from international airfares, imported food items, alcoholic beverages, household items, and goods for personal care. Meanwhile, lower prices of fuel, LP gas, and construction materials over the year continued to reduce inflation. On the other hand, domestic prices rose over the year with a 1.7 pps contribution to headline inflation. Key domestic contributors included local food items, catering services, kava, electricity, and operation of personal transport equipment. Contrarily, the price of tertiary education fees, local tobacco, and clothing & footwear declined at annual rate and partially offset the inflationary pressure.

Core inflation continued to slow down over the month but remained above the 5% reference rate at 5.1% in February 2024. This is a decline from 5.5% in previous month and 8.0% in February 2023. The slowdown over the year was supported mainly by the decline in prices of imported construction materials, tertiary education fees, and local clothing. Meanwhile, non-core inflation recorded a rate of 2.5% significantly lower than the 7.1% in January 2024, due mainly to fall in the prices of fuel and LP gas over the year.

Effective exchange rates increased in February

The Nominal Effective Exchange Rate (NEER) rose over the month by 0.1%, underpinned by the appreciation of the Tongan Pa’anga (TOP) against the AUD, FJD, JPY, GBP, EUR and CNY. Similarly, the Real Effective Exchange Rate (REER) also increased by 1.2% in February, corresponding with the NEER’s increase.

In year ended terms, the NEER remains higher by 2.8% compared to the previous year as the TOP generally appreciated against the currencies of its trading partners (AUD, NZD, FJD, CNY and JPY). This may assist in partially offsetting some of the impacts of the higher imported inflation. Additionally, REER also increased by 4.4% over the year, in line with Tonga’s relatively higher inflation rate.

Foreign reserves declined again in February

Foreign reserves fell further in February by $3.2 million driven by outflow for import payments. This is equivalent to over 11 months of imports, which is higher than the 7.5 months prescribed by the IMF. Over the year, reserves recorded twelve months prior was higher by $19.7 million than in 2024. The majority of the official foreign reserves are held in USD, NZD, and AUD.

Remittances declined following the peak in December

Total remittance receipts declined by $14.6 million (28.7%) to $36.3 million over the month, following the high receipts in the December holiday season. The monthly decline largely stemmed from lower private transfers and compensation of employees. The weakened of the AUD and NZD against the TOP at the end of January 2024 may have also contributed to the decline in remittances during the month.

However, total remittances remained robust over the year, increasing by $51.0 million (10.5%) as the global economy continue its gradual recovery.

Broad money decline

Broad money decreased over the month in January 2024, by $21.9 million (2.5%) but rose annually by $2.2 million (0.3%) to a total $846.2 million. The net domestic assets declined over the month, as a result of lower credit to central government and capital accounts. However, over the year, the net domestic assets increased due to higher credit to private sectors and net credit to central government. The net foreign assets decreased also over the month and over the year, corresponding to lower foreign reserves and remittances.

Reserve money rose

Liquidity in the financial system increased over the month and over the year to January 2021, by $1.0 million (0.2%) and $3.1 million (0.5%) respectively. The monthly rise attributed to higher Exchange Settlement Account (ESA) and Statutory Required Deposits (SRD) offsetting the lower Currency in circulation (CIC).

Annually, both the Statutory Required Deposits (SRD) and Currency in circulation (CIC) increased and offsets the lower Exchange Settlement Account (ESA).

Credit growth slows down

The banks’ total lending declined over the month of January 2024, by $6.0 million (1.1%), however, rose annually by $31.7 million (6.4%). During the month, lending to businesses fell mainly to public enterprises and businesses within the distribution, construction and transport sectors. Household loans also declined, led by lower other personal loans, followed by lower housing and vehicle loans.

Annually, both businesses and household loans increased reflecting higher confidence amongst businesses and consumers, as well as economic recoveries. Lending to businesses such as transport, tourism and professional & business services increased, as along with all categories of household loans, again led by higher other personal loans, followed by rises in both housing and vehicle loans.

Total deposits in the banks increased by $4.5 million (0.5%) over the month and by $38.6 million (4.4%) over the year, reaching $913.5 million, driven by higher time and demand deposits. Time deposits from churches and private businesses increased both monthly and annually, and the higher time deposits from the Retirement Funds also contributed to the annual rise. The loans to deposit ratio decreased in January 2024 to 56.8% compared to 57.4% in December 2023 reflecting a greater decline in lending than in deposits. However, over the year, loan to deposit ratio rose from 55.3%, reflecting deposits increased more than lending.

Interest rates widened

The weighted average interest rate spread widened over the month but narrowed on a year-over-year basis as of January 2024, by 9.7 basis points and 8.6 basis points, respectively, reaching 6.2%.

Lending rates increase by 8.7 basis points over the month whilst deposit rates declined by 1.0 basis points. Lending rates offered to the agricultural, fisheries, and construction sectors rose, along with the household other personal loan rates. On the other hand, both the saving and demand deposit rates declined over the month and offset the rise in time deposit rates.

Over the year, both lending and the deposit rates declined by 11.0 basis points and 2.4 basis points, respectively. Lending rates offered to the transport, manufacturing and construction sectors decreased as well as household lending rates offered for vehicle and housing loans. Similarly, the demand deposit rates fell and offsets the rise in both saving and time deposit rates.

Outlook

In light of recent economic developments, the primary focus of the NRBT remains on inflation, GDP growth, and maintaining financial stability. We anticipate inflation to maintain a downward trend, staying below 5% throughout 2024, with the expectation of decreasing global oil prices. Nonetheless, the ongoing international conflict and tensions pose risks of disrupting oil supplies, potentially pressuring petroleum prices upwards. Additionally, the recent El Niño event has affected local food supply, likely exerting further upward pressure on prices.

Regarding GDP growth, we expect it to be moderate this financial year, as domestic production continues to lag behind potential. This situation provides the Reserve Bank with significant room to stimulate economic growth without triggering excessive inflationary pressures. Our foreign reserves are projected to stay well above the IMF’s recommended level of 7.5 months of import coverage in the near to medium term, indicating a robust buffer against external shocks.

The financial system remains stable with high liquidity levels, and banks are well-capitalized, prepared to absorb potential shocks.