- Monthly Economic Update - May 2025 DOWNLOAD THE FULL UPDATE | PDF • 942 KB

Major policy shifts unfolds while global growth deteriorates

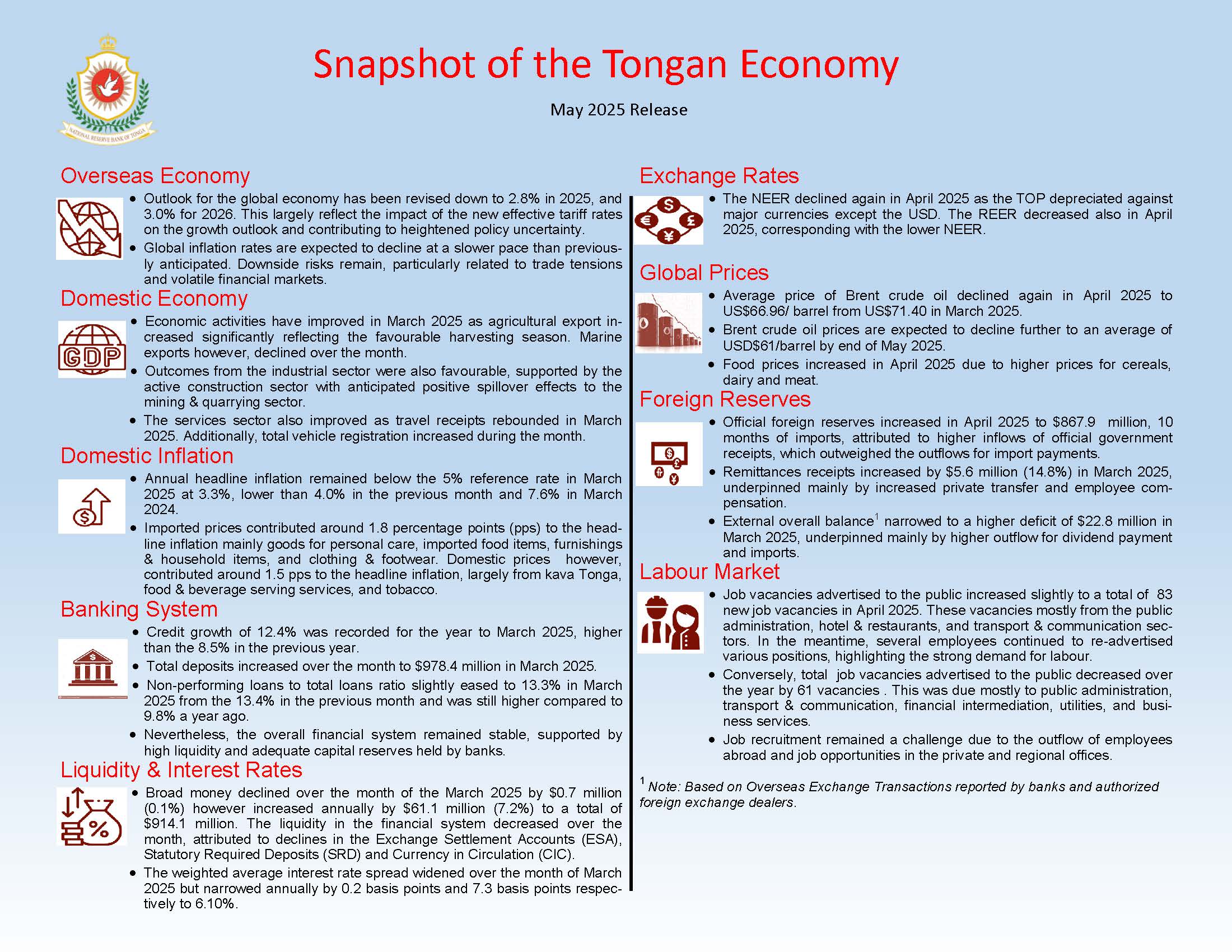

The IMF's April 2025 World Economic Outlook projects a slowdown in global growth, with forecasts revised down from 3.3% both in 2025 and 2026 in January 2025 to 2.8% and 3.0%. This largely reflect the new effective tariff rates which hinder growth outlooks and intensify uncertainties. The new US tarrifs and retaliatory measures by trading partners may also disrupt financial markets and deteriorating sentiment may result in tighter financial conditions.

Growth in advanced economies is projected to be 1.4% in 2025, a downward revision from the 1.9% forecast reported in January 2025. This stemmed from escalating trade tensions and heightened policy uncertainty. The US is expected to grow at 1.8% after it was initially forecasted at 2.7% in January 2025, influenced by the announcement of President Trump’s tarrifs. Meanwhile, emerging market and developing economies are projected to experience slower growth of 3.7% for 2025 compared to the 4.2% growth rateforecast in January 2025.

While inflation rates are expected to decline, they are projected to do so at a slower pace than previously anticipated. Downside risks persist, particularly related to trade wars and volatile financial markets. The recent escalation of geopolitical tensions in the Middle-East could further disrupt the anticipated declining trend in global inflation.

Domestic activities trended favorably in March 2025

Activities in the primary sector were mostly positive during March 2025. Total agricultural exports significantly increased by 625.4 tonnes (188.5%), owing to high export volumes of root crops, coconut, kava, and watermelon. The strong exports reflect the harvesting season for the crops particularly with a strong yield for yam (lose variety). This successful root crop harvest was also supported by the improvement in weather conditions during the year. As a result, total agricultural export receipts rose by $0.6 million (319.0%). On the other hand, total marine exports fell by 76.1 metric tonnes (79.9%) due to lower tuna and shark meat export. However, total aquarium exports increased by 1,695 pieces (48.0%), coinciding with the increased marine export receipts of $0.1 million (99.9%).

Favourable movements were observed within the industrial sector, reflecting vibrant momentum. Construction import payments recorded a substantial increase over the month of $2.2 million (82.9%), which may indicate strong demand from both the public and private sectors for ongoing construction-related activities. At the same time, new loan commitments by the construction sector rose significantly by $0.3 million (243.9%) compared to the previous month. This positive momentum in the construction sector is also anticipated to generate positive spill over effects on the mining & quarrying sector. Growth in the industrial sector may be further bolstered by recent government initiatives, including the unanimous passing of the 2025 Supplementary Appropriation Bill. This TOP$31 million budget allocates significant funds to key infrastructure and housing projects, such as $300,000 for the final stage of the Pangai foreshore construction, $10 million for road infrastructure, and funds to complete housing for individuals displaced by the 2022 Hunga Tonga-Hunga Ha’apai eruption.

Key indicators in the services sector largely improved in March 2025. From the travel industry, total travel receipts rebounded, increasing by $0.8 million (8.1%) compared to the previous month. Meanwhile, import payments excluding oil rose by $5.4 million (14.6%), along with higher wholesale & retail import payments of $5.4 million (23.0%). In addition, total vehicle registrations slightly edged up by 9 vehicles (4.5%) mostly light vehicles, taxis & rentals, and cars.

More job opportunities in April 2025

The Reserve Bank’s survey on job advertisements recorded 83 new job vacancies in April 2025, slightly higher than the 79 job vacancies in the previous month. Furthermore, several positions were re-advertised during the month, highlighting the strong demand for labour. Majority of these advertised vacancies were from public administration, hotel & restaurants, and transport & communication sectors. The year-end number of job vacancies decreased by 61 (6.3%). The total job vacancies over the year were largely from public administration, transport & communication, financial intermediation, utilities, and business services.

Headline inflation fell further to 3.3% in March 2025

The Consumer Price Index continued to decrease in March 2025 by 0.4%, primarily due to an overall decline in domestic prices. Lower domestic prices over the month was attributed largely to a 3.8% decline in local food prices, which may indicate improved local supply during the harvest season. This was partially offset by an increase in food & beverage serving services during the month. At the same time, imported prices edged up slightly, compounded by the prices of fuel, LP gas & other fuels, imported food items, and furniture.

Headline inflation remained below the 5% reference rate in March 2025 at 3.3%, lower than 4.0% in the previous month and 7.6% in March 2024. Imported inflation contributed around 1.8 percentage points (pps) to the headline inflation. The main imported contributors were goods for personal care, imported food items, furnishings & household items, and clothing & footwear. On the other hand, domestic prices contributed around 1.5 pps to the headline inflation, driven largely by kava Tonga, food & beverage serving services, and tobacco. Nonetheless, cost of electricity and early childhood & primary education declined over the year offsetting some of the increases.

Core inflation (excluding energy and food) rose to 8.3% in March 2025 from 8.0% in February 2025. Prices of domestic items such as alcoholic beverages, tobacco & kava, food & beverage serving services, and tertiary education fees contributed largely to the core inflation. This was further supported by imported items such as goods for personal care, furnishings & household items, clothing & footwear, and purchase of vehicles. On the other hand, non-core inflation declined further to 0.7% from 0.8% in the previous month, due mainly to lower energy prices.

Effective exchange rates declined further in April

The Nominal Effective Exchange Rate (NEER) declined by 1.1% during the month, reflecting a weakening of the Tongan paʻanga in relation to the weighted average of currencies of its major trading partners except the USD. Correspondingly, the Real Effective Exchange Rate (REER) also declined by 1.4% in April 2025.

In the year ended terms, the NEER weakened by 0.8% as the Tongan paʻanga generally depreciated against all major currencies except the AUD and NZD. Contrastingly, the REER strengthened by 1.2%, indicating a decline in Tonga’s global trade competitiveness.

Foreign reserves increased in April

Foreign reserves remained above the optimal threshold of 7.5 months, increasing by $25.3 million in April 2025 to a total of $867.9 million, equivalent to 10.0 months of imports cover. The increase during the month was mainly attributed to higher inflows of budget support from development partners, which outweighed the outflows for import payments. However, foreign reserves were $36.9 million lower compared to the same period last year. The majority of official foreign reserves are held in USD, NZD, and AUD.

Remittances rebound in March

Following a slowdown in February, remittances increased by $5.6 million (14.8%) in March 2025. The rise was primarily driven by an increase in private transfers, followed by employee compensation, with all categories contributing to the overall growth. The increase also coincided with local events such as school anniversary and other family events.

The increase was further supported by easing inflation in the United States and stable unemployment in Australia during the month, along with the depreciation of the Tongan paʻanga against both the Australian and New Zealand dollars. As a result, remittance inflows from major source countries increased, receipts from Australia increased the most, followed by receipts from the United States and New Zealand.

Over the year to March 2025, total remittance receipts increased by $4.3 million (0.8%), indicating sustained financial support from the Tongan diaspora for families and local community events.

Money supply decreased

Broad money declined over the month of March 2025 by $0.7 million (0.1%), however increased annually by $61.1 million (7.2%) to a total of $914.1 million. The net foreign assets decreased both over the month and over the year, mainly on lower foreign reserves. On the other hand, the net domestic assets increased over the month and over the year, underpinned by higher net credit to the central government over the month, and increased credit to private sectors and net credit to non-financial corporations over the year.

Reserve money decreased

Liquidity in the financial system decreased by $14.8 million (2.4%) in March 2025. This was led by lower Exchange Settlement Accounts (ESA) followed by Statutory Required Deposits (SRD) and Currency in Circulation (CIC). The lower ESA corresponded to the net purchase of foreign currency by the commercial banks. However, liquidity increased by $20.5 million (3.5%) annually to a total of $599.4 million as at end of March 2025. All categories of liquidity increased, reflecting growth in deposits and higher demand for currency over the year.

Total lending reached $600 million

The banks’ total lending increased over the month by $7.9 million (1.3%) and over the year by $66.5 million (12.4%), to a new high level of $601.4 million in March 2025. Both rises were attributed mainly to higher business loans. Household loans on the other hand declined over the month but increased annually. Lending to private businesses within the distribution, agricultural and manufacturing sectors increased over the month. Similarly, over the year, more loans were issued to public enterprises and private businesses in distribution, manufacturing and the forestry sectors. On the other hand, housing loans fell over the month driven by lower household loans during the month. Annually, all categories of household loans increased, led by housing loans followed by other personal and vehicles loans.

The non-performing loans to total loans ratio eased slightly to 13.3% in March 2025, from 13.4% in February 2025, but it is still higher compared to 9.8% a year ago. As non-performing loans are still above trigger levels, close supervision of existing vulnerabilities in the banking system remains crucial to ensure financial stability is maintained and support economic growth.

Total bank deposits increased by $5.9 million (0.6%) over the month, and over the year by $85.8 million (9.6%) to $978.4 million. Both demand and saving deposits increased over the month and offsets the declined time deposits. The rising deposits were mostly contributed by private businesses, non-resident banks, microfinance businesses and public enterprises. Annually, both demand and time deposits increased, mainly from private sectors, government, microfinance businesses, retirement funds and non-profit organisations (churches). Total loan to deposit ratio increased to 60.3% in March 2025 from 59.9% in the previous month, mainly due to higher loans offsetting the rise in deposits.

Interest rates spread widened

The weighted average interest rate spread widened over the month, but narrowed annually in March 2025 by 0.2 basis points and 7.3 basis points respectively, to 6.10%.

The monthly rise was due to a 0.9 basis point decrease in weighted average deposit rate, which outweighed a 0.7 basis points decline in weighted average lending rate. The lower deposit rates over the month was solely driven by lower demand deposit rates. Lending rates also decreased over the month, mainly for public enterprises and businesses within the fisheries, distribution and utilities sectors, as well as household loan rates.

Annually, the weighted average lending rate decreased by 21.4 basis points and outweighed the 14.0 basis points fall in weighted average deposit rate. The decline in lending rates was observed in loans offered to non-profit organization, public enterprises, and businesses in sectors such as mining/quarrying, utilities and fisheries, as well as for household loan rates. Similarly, the time and demand deposit rates fell over the year and offset the rise in saving deposit rates. The increasing volume of deposits over the month and over the year may have contributed to the lower deposit rates both monthly and annually.

Outlook

While the current domestic economic growth forecasts indicate lower than expected growth in key sectors, the slow improvement in agriculture supports the expected recovery. Government’s initiatives to expedite infrastructure projects and Public-Private Partnerships are expected to stimulate economic activities in the private sector. At the same time, capital investments in resilient and sustainable infrastructure are vital to mitigate Tonga’s climate-related risks.

Inflation is projected to rise gradually, but still remain below the NRBT’s reference rate. However, the inflation trajectory indicates persisting risks including the volatility of food prices and the lingering mismatch between demand and domestic supply. At the same time, the outlook remains prone to natural disasters, uncertainties associated with US tariffs retaliation, and escalating geopolitical tensions. Despite the easing inflation, the high cost of living strains household purchasing power. The uptick in core inflation warrants supply-side intervention to reduce business cost structures.

Foreign reserves is projected to remain comfortable above the optimal level of 7.5 months of imports with higher probability to absorb shocks in the medium term. However, the anticipated increase in import outflows and scheduled debt repayments, coupled with the return of official receipts and remittances to normal growth rates, will exert pressure on the level of foreign reserves. Credit growth is projected to expand further in the near term increasing banks’ vulnerabilities to asset quality. This warrants ongoing oversight and closer supervision of banks to mitigate risks to the financial system, while non-performing loans also remain high.

In view of the above developments and outlook, the NRBT will continue strengthening its monetary policy tools to enhance the effectiveness of its monetary policy decisions and overall contribution to price stability and macroeconomic growth.