- Monthly Economic Update - November 2025 DOWNLOAD THE FULL UPDATE | PDF • 539 KB

Asia-Pacific region shows resilience

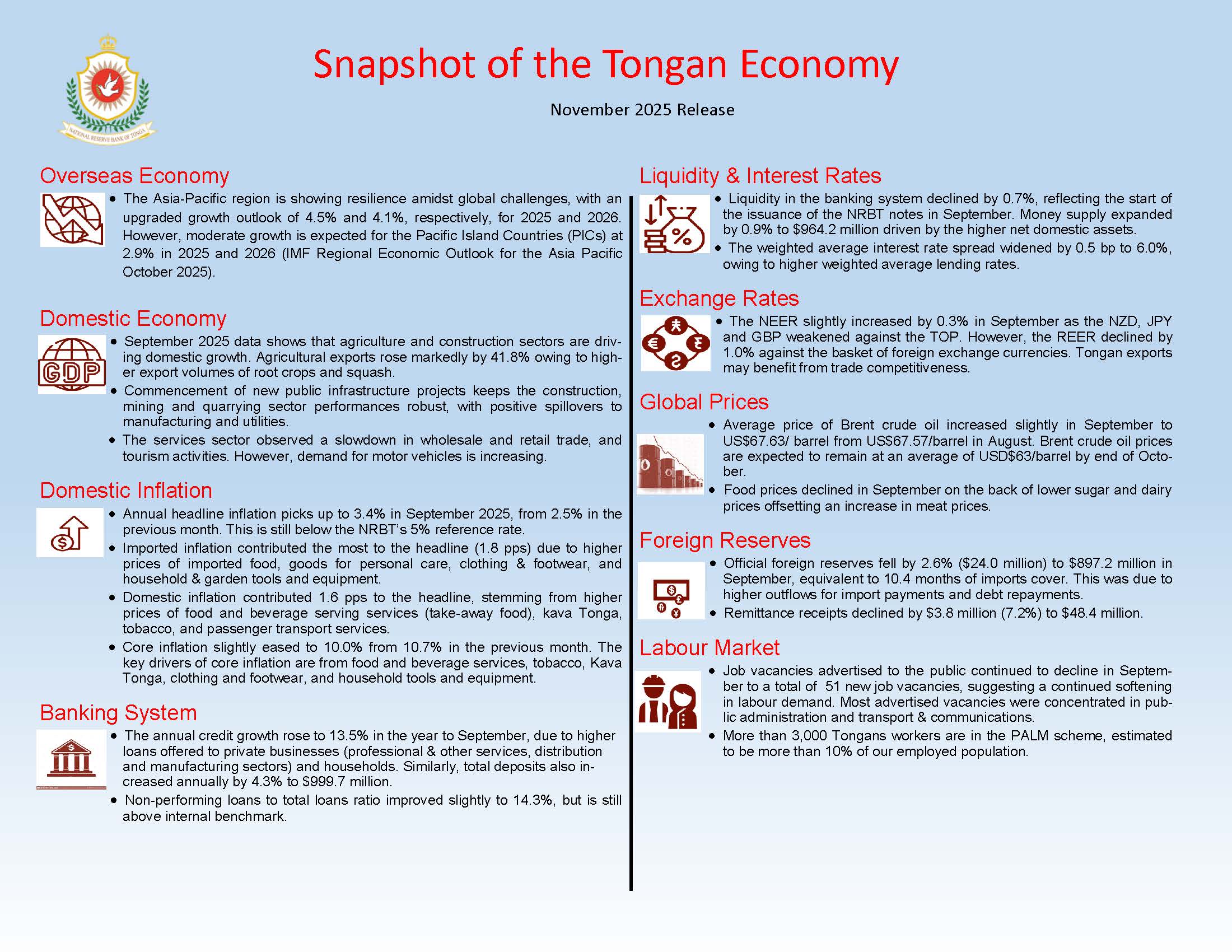

The IMF's Regional Economic Outlook (REO) for October 2025 reported that the Asia-Pacific region demonstrates resilience, having produced stronger-than-expected growth in the first half of 2025. The region’s growth outlook was revised up (since the April 2025 World Economic Outlook), by 0.6% and 0.1%, respectively, for 2025 and 2026, to 4.5% and 4.1%. The region benefitted from strong exports, partly due to frontloading in expectation of higher tariffs, and a buoyant tech cycle. Monetary and fiscal policy easing further supported domestic demand in the region, amid globally accommodative financial conditions and US dollar depreciation. However, moderate growth is expected for the Pacific Island Countries of 2.9% for both 2025 and 2026. This largely reflects tariff-related external demand shocks.

Agriculture and construction driving domestic growth

Positive outcomes in the primary sector are supported by agriculture growth. Agricultural exports markedly rose by 41.8% (274 tonnes) in September 2025 driven by higher exported volumes of cassava, taro, yams, and squash. Correspondingly, agricultural export proceeds also increased by 30.5% ($0.2 million). This is also a stronger turnout compared to the same month last year. By contrast, marine sector outcomes are deteriorating. Marine exports fell by 51.9% (42.9 metric tonnes) during the month, solely driven by lower tuna exports. Despite an increase in aquarium exports by 17.1% (in pieces), the overall marine export earnings still dropped by 84.0% ($0.2 million), indicating more low‑value sales. According to the latest

National Account report for FY2023-24, the agricultural sector accounts for 13.5% of Tonga’s real GDP, whereas the Fishing sector accounts for only 1.6%.

Public infrastructure projects keep the industry sector’s performance robust. Though the US$75 million Queen Salote International Wharf upgrade has been completed, the groundbreaking of the new Parliament Building, and the contract signing for the Fanga’uta Lagoon Bridge with approach roads, support positive demand for construction, mining and quarrying services, with positive spillovers to energy and manufacturing. This is evident in the increase in the payments for Government-related imports by 59.9% ($3.0 million) in September 2025, along with 34.0% ($2.9 million) and 0.9% ($0.5 million) increases in construction and oil import payments. Construction is one of the key drivers of economic growth in Tonga, holding more than

10% of real GDP.

The tertiary sector outcomes generally slowed. In September 2025, container registrations fell by 8.6% stemming from lower business containers. This coincides with a 0.2% decline in import payments for wholesale and retail goods. Travel receipts, an indicator of the tourism sector, also recorded a 0.9% decline. However, total vehicle registrations rose by 8.2%, corresponding to the 20.5% increase in vehicle import payments, and the 2.7% increase in motor vehicle loans by households. A shift in demand from non-durable to durable goods suggests an improvement in wealth.

Domestic labour demand remains subdued

Labour demand continued to soften in September 2025. Most openings were concentrated in public administration, transport, and communications, while fewer positions were advertised in utilities, hotels and restaurants, and financial services. It should be noted that this survey does not capture labour demand in the informal sector, which could be significant in Tonga’s context.

From the supply side, more than 3,000 of Tonga’s labour force are working in the Pacific Australian Labour Mobility (PALM) scheme, estimated to be more than 10% of our employed population. The Australian Department of Employment and Workplace Relations (DEWR) reported that there are 3,315 Tongan workers participating in the PALM scheme in September 2025, about 10.6% of the total PALM workers. This is slightly lower than the 3,441 monthly average for 2025. Tonga is the 5th largest supplier of PALM workers to Australia, of which more than 70% are in short-term employment (less than 9 months).

Annual headline inflation rose to 3.4%

The monthly growth in Consumer Price Index in September 2025 was 0.3%. Local food prices rose in September 2025 by 1.9%, due to higher prices for root crops (particularly taro, cassava, and yams), vegetables (i.e. lu, carrots, and capsicum), eggs, tuna, and stringed fish (mixed). At the same time, food and beverage serving services (take-away food) declined, offsetting some of the increases. Imported inflation also rose, driven by higher prices of imported food items.

Annually, headline inflation stood at 3.4%, higher than the 2.5% in August 2025 (revised down from 2.8% reported in MEU October 2025). Imported inflation contributed around 1.8 percentage points (pps) to the overall inflation, stemming from increasing prices of imported food items, goods for personal care, clothing and footwear, and household and garden tools and equipment. Similarly, domestic prices also rose and contributed around 1.6 pps to the headline inflation. The increase was mostly in prices of food and beverage serving services (take-away food), kava Tonga, tobacco, and passenger transport services.

Annual core inflation slightly fell to 10.0% from 10.7% in the previous month, reflecting an ease in prices of core items across the board. Domestic core prices are the largest contributor to core inflation of around 6.6 pps, specifically from food & beverage serving services, alcoholic beverages, tobacco & kava Tonga, and passenger transport services. Imported core prices contributed around 3.4 pps, mostly from personal care items, clothing & footwear, furnishings & household items, and the

purchasing of motor vehicles.

TOP strengthening in nominal terms

The Nominal Effective Exchange Rate (NEER) increased over the month and year to September 2025, by 0.3% and 1.4%, respectively. This was mostly on the back of a weaker NZD and AUD against the TOP. The Real Effective Exchange Rate (REER), however, declined by 1.0% during the month, depicting an overall weakening of the Tongan Pa’anga in real terms, and thereby gaining in trade competitiveness.

Import payments and foreign debt servicing weigh on foreign reserves

Higher foreign exchange payments for imports and debt services led to a 2.6% ($24.0 million) drop in foreign reserves in September 2025, to $897.2 million. Additionally, foreign exchange receipts declined by 8.1% from lower interbank transfers. The current level of foreign reserves is equivalent to 10.4 months of imports cover, down from 10.7 in the previous month. This is well above the minimum thresholds, allowing some capacity to absorb future foreign exchange shocks.

Remittance receipts fell

Remittance receipts fell by 7.2% ($3.8 million) in September 2025 to $48.4 million, across all categories. Despite the monthly decline, remittance receipts are still above the 12- month average of $46.1 million, hence growing strongly over the year by 6.3% ($32.6 million) to $553.1 million. The majority of remittances is from private transfers from family and friends abroad (88.4%), followed by compensation of temporary workers abroad (10.3%). Almost 40% of the receipts are denominated in AUD, followed by USD at 35%, and NZD at 21%. The NRBT estimates that remittance is around 37% of GDP, highlighting its significance to the Tongan economy and the welfare of its people.

Liquidity declines as NRBT issue Notes

The NRBT started issuing NRBT Notes in September 2025 to the commercial banks. As a result, the Exchange Settlement Accounts (ESA) declined sharply by 11.2% ($39.3 million) and outweighed the slight increases in Currency in circulation and the Statutory Reserve Deposits. Accordingly, liquidity in the banking system declined by 0.7% ($4.3 million) during the month.

The overall money supply still expanded by 0.9% ($8.8 million) over the month to $964.2 million, as the expanding net domestic assets more than offset the declining net foreign assets. The higher net domestic assets reflect the rising securities and credit to the private sector. At the same time, total bank deposits rose again by 0.4% ($4.0 million) to $999.7 million, mostly from higher savings and time deposits.

Persistent demand for banks’ credit

Demand for credit remains strong, reflected by the increase in the total banks’ lending by 0.1% ($0.8 million) over the month, and 13.5% ($72.9 million) over the year, to $611.5 million. Both business and household lending increased over the year, suggesting more business confidence and economic recovery. Businesses in professional and other services, wholesale and retail, and manufacturing showed notable increases in their borrowings. More individual housing and personal loans also supports the annual credit growth.

The non-performing loans (NPL) to total loans ratio however, is still high at 14.3%, despite a slight improvement from 14.4% from last month. Non-performing loans are mostly comprised of business loans.

Interest rate spread widened

The weighted average interest rate spread widened over the month by 0.5 basis points (bp) to 6.0%. The weighted average lending rate rose by 1.5 bp and outweighed the 1.0 bp increase in the weighted average deposit rate. Annually, the interest rate spread narrowed by 20.0 bp, driven mostly by the 21.7 bp decrease in the weighted average lending rate.

Outlook

Indicators of the domestic sector are largely supportive of a firmer economic recovery, in line with the NRBT projections. Both Fiscal and Monetary policies are supportive of private sector development and enabling access to finance for a stronger economic recovery. Implementing scheduled public infrastructure projects and rolling out more credit schemes will generate more economic activities in the near term.

Inflation is expected to fluctuate over the coming months, but remain below the 5% reference rate. Core inflation is also expected to converge back to the headline. However, downside risks from uncertainties in global trade policies persist, alongside more frequent disruptions in domestic energy supply persist.

Stable inflows of official grants and remittances will continue to sustain the high level of foreign reserves, despite the increasing import demand and foreign debt obligations.

The financial system remains sound, underpinned by high liquidity, adequate capital provisions, and profitability. Nonetheless, the high NPL ratio reasserts need for prudent lending management and stronger oversight, both on-site and off-site.

In light of these developments and outlook, the NRBT keeps its neutral policy stance unchanged. This entails continued mopping of excess liquidity to support strengthening of monetary policy transmission to the market interest rates.