- Monthly Economic Update - October 2025 DOWNLOAD THE FULL UPDATE | PDF • 945 KB

Global growth outlook remains subdued

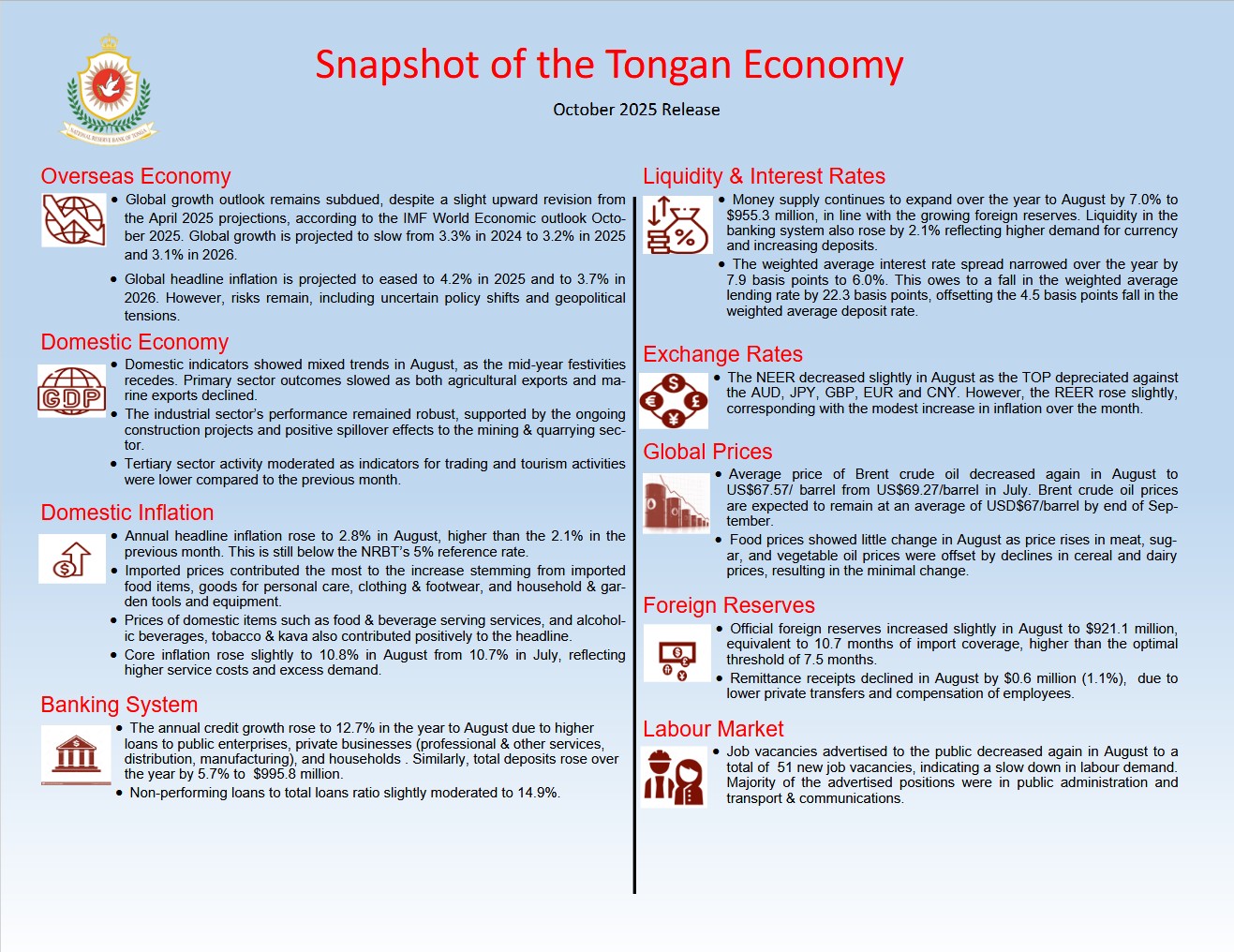

The IMF’s October 2025 World Economic Outlook (WEO), projects global growth to slow down from 3.3% in 2024, to 3.2% in 2025 and 3.1% in 2026. While this is a modest upward revision from the April 2025 WEO, it is still a markdown relative to the October 2024 WEO. The overall environment remains volatile due to policy shifts and surging uncertainties. Advanced economies are projected to grow by about 1.6% in 2025 and 2026. Meanwhile, the Emerging & Developing Asia region (Tonga included) is projected to moderate from 4.3% in 2024 to 4.2% in 2025 and 4.0% in 2026, reflecting downward revisions in China and India.

Global headline inflation is projected to ease to 4.2% in 2025 and further to 3.7% in 2026. Inflation is expected to remain above target in the United States, while it is projected to be more subdued elsewhere. However, low-income and commodity-importing countries like Tonga, are vulnerable to commodity price spikes stemming from climate shocks and trade policy shifts.

Mixed outcomes for the domestic economy, post-festive season

Indicators in the primary sector generally slowed in August. The agricultural export volumes declined by 18.9% over the month, owing to lower exports of cassava, sweet potatoes and yams. Squash exports is showing a modest start for the season, with a 48.0% increase from July. The outcomes for the fisheries sector are still weak, as total marine exports declined by 25.8% over the month, driven solely by the declining tuna catch. Total aquarium exports, on the other hand, slightly rose by 0.9%. Total export proceeds also fell in August by 9.7%.

The industry sector remains buoyant, boosted by ongoing construction activities. Import payments for construction materials increased by 37.7% during the month, while foreign receipts for construction and installation services rose by 27.0%. This corresponds to higher demand from both public and private construction projects. Higher lending to the mining and quarrying sector (80.2%), manufacturing sector (4.0%), and individual housing loans (0.3%) in August, reflects increased investment in these sectors. Although electricity consumption declined by 1.7% from the previous month, electricity production and consumers both increased by 4.1% and 0.2%, respectively.

The tertiary sector moderated in August as the mid-year celebrations recedes. Container registrations declined by 15.5% from July, mostly from business containers. Meanwhile, wholesale and retail import payments fell by 16.6% indicating softening trade activities. Similarly, air passenger arrivals also fell in August by 5.5%, alongside a decline in the number of international flights that arrived during the month. As a result, travel receipts dropped by 9.3%, mostly receipts from personal travel. Vehicle registrations, however, rose by 3.4% over the month, coinciding with the 4.1% increase in payments for imported vehicles.

Demand for jobs slowed in September

Demand for labour continues to soften in September. The NRBT’s job advertisement survey recorded lower advertised vacancies, bringing down the 12-month average to 67 from 79 (14.1% drop) in the same time last year. Most advertised positions during the month were for public administration, transport, and communications. On the other hand, the decline in job vacancies was seen in public administration, utilities, hotels and restaurants, transport & communication, business services, and financial intermediation jobs.

Headline inflation rose to 2.8%

Monthly prices declined by 0.8% in August, driven by a drop in domestic prices. Local food prices fell by 4.8% over the month, reflecting a slowdown in demand coupled with favorable harvests. In contrast, import prices edged up by 0.5%, mainly driven by higher prices of imported food and fuel. Both petrol and diesel rose by 10 seniti/litre during the month.

Annual headline inflation rose to 2.8% in August, from 2.1% in July. Import prices contributed around 2.3 percentage points (pps) to the overall inflation, with increases observed in imported food, goods for personal care, clothing and footwear, and household and garden tools and equipment. Imported food prices rose by 4.5% over the year, majority of which were imported from source countries such as New Zealand, who also observed higher prices for food items such as dairy products and meat. On the other hand, domestic prices contributed 0.5 pps to the headline inflation, due to higher cost of food and beverage serving services (take-away food), kava Tonga, and tobacco. Local food and electricity prices continued to decline on an annual basis, partially offsetting the overall increase.

Core inflation rose slightly to 10.8% in August, from 10.7% in the previous month. The overall index of core prices remained relatively stable over the month. Domestic core items contributed around 7.0 pps to the core inflation, mainly from higher prices in food and beverage services (take-away food), kava Tonga, tobacco, and domestic passenger transport services. At the same time, imported core prices contributed 3.8 pps, stemming from goods for personal care, clothing and footwear, household items, and purchase of vehicles. Contrastingly, non-core prices fell by 3.6%, supported mainly by lower prices for local food items and energy prices.

Nominal effective exchange rate declined slightly

The Nominal Effective Exchange Rate (NEER) declined marginally by 0.1% in August, but increased over the year by 0.7% as the TOP strengthened against the AUD, NZD and FJD. This may assist in offsetting imported inflation. The Real Effective Exchange Rate (REER) increased over the month and year by 0.6% and 1.4%, respectively. This aligns with Tonga’s inflation rising faster than its major trading partners, which can result in a decline in Tonga’s trade competitiveness.

Foreign Reserves marginally increased

Foreign reserves increased slightly by 0.01% in August to $921.1 million, equivalent to 10.7 months of import coverage, well above the optimal threshold of 7.5 months. Similarly, foreign reserves increased by 1.7% ($15.6 million) over the year owing to inflows of budget support, official grants, and remittance receipts. The majority of official foreign reserves are held in USD, NZD, and AUD.

Foreign exchange transactions between Tonga and the rest of the world indicates an improvement of the current account balance. Despite the widening trade deficit driven by increasing import payments, net service receipts is supported by higher travel receipts. Additionally, income receipts has been increasing both from compensation of employees or Tongans working abroad, and diaspora.

Remittance remains above average

Remittance receipts remained high at $52.2 million, despite a slight decrease of 1.1% ($0.6 million) from the July record. This level is higher than the 12 months average of $45.6 million. Annually, remittances rose by 4.9% ($25.4 million) representing more than 30% of GDP. Remittance receipts is a key contributor to the Tongan economy and a major source of foreign exchange inflows (39% of foreign exchange receipts). Remittance receipts are mostly denominated in AUD (39.5%), followed by USD (35.5%) and NZD (20.6%).

Money supply and Liquidity continues to expand

The overall money supply expanded again by 7.0% ($62.2 million) in the year to August, to $955.3 million, owing mostly to the expanding net foreign assets. Liquidity in the banking system also rose by 2.1% ($13.3 million) in the same period, in line with the increases in currency in circulation and statutory reserves deposits. Total bank deposits rose by 5.7% ($53.6 million) over the year, mostly from government accounts, retirement funds, private businesses, and non-profit organisations. The Reserve Bank estimates that there is more than $300 million of excess liquidity in the banking system by the end of August.

Positive demand for credit

The banks’ total lending recorded an increase of 0.8% ($4.7 million) over the month, and 12.7% ($68.7 million) over the year to $610.7 million. This marks 9 consecutive months of double digit annual credit growth, indicating more investment appetite as the economy recovers. Majority of the increase in lending were to public enterprises, private businesses, and individual households. Businesses in professional and other services, wholesale and retail, and manufacturing, showed notable increases in their borrowings. Meanwhile, the higher individual household loans were mostly for housing and personal loans.

The non-performing loans to total loans ratio is still high at 14.9% in August 2025, despite a slight improvement from 15.0% last month. This is also higher than the 12.1% recorded a year ago raising concerns over asset quality and indebtedness. Non-performing loans are mostly comprised of business loans.

Total loan to deposit ratio increased to 60.2% in August from 59.9% in the previous month, and from 56.4% recorded in August last year, attributed to the strong credit growth relative to deposits.

Interest rates spread narrowed

The weighted average interest rate spread narrowed over the month and over the year to August by 1.5 and 17.9 basis points, respectively, to 6.0%. While there was some fluctuations in the monthly movements, over the year the weighted average lending rate decreased by 22.3 basis points, offsetting the 4.5 basis points fall in the weighted average deposit rate.

Outlook

Overall, indicators of the real, external, fiscal, and monetary sectors supports a stronger growth outlook for the Tongan economy. Inflation remains below the 5% reference rate, foreign reserves is at sufficient levels, and the financial system is supportive of investment activities. However, the NRBT is mindful of potential downside risks from the volatile global economy that could disrupt price stability.

The financial system remains stable, however, the NRBT is doubling down on its prudential supervisory roles to address concerns over asset quality and ensure systemic risks are mitigated. The NRBT started its issuance of NRBT notes in September, with the aim of mopping up some of the excess liquidity in the financial system and reactivate the interbank market for trading.

The NRBT is progressing with its efforts in strengthening its policy tools to enhance the effectiveness of its monetary policy decisions in the domestic financial market and the economy, while being resilient to risks in the financial system.