- Monthly Economic Update - September 2024 DOWNLOAD THE FULL REVIEW | PDF 139 KB

Global economic activities steady

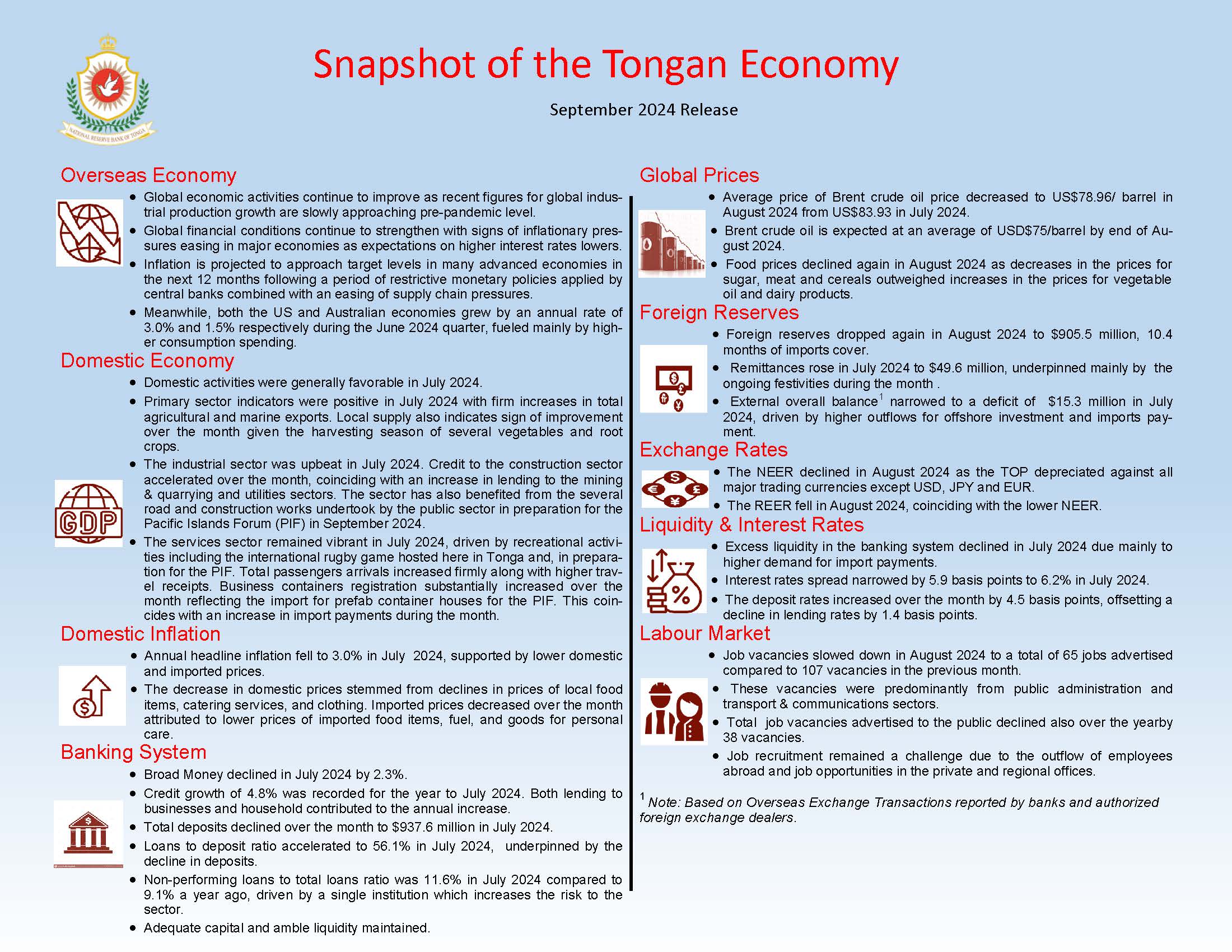

The World Bank Group in its July 2024 global monthly report shared that global economic activities continue to improve as recent figures for global industrial production growth are slowly approaching pre-pandemic levels. Indicators for Global goods trade has rebounded in April and May by 1.0% and 0.2% respectively, following a decline of 1.4% in March 2024. Demand for new exports both in manufacturing and services expanded since April 2024.This indicates a softer landing in June 2024 as industrial production in advanced economies is outpaced by growth within the EMDEs.

Inflation is projected to approach target levels in many advanced economies in the next 12 months following a period of restrictive monetrary policies applied by central banks combined with an easing of supply chain pressures.

Across Tonga’s trading partners, the US economy rose by an annual rate of 3.0% in the June 2024 quarter according to the US Bureau of Economic Analysis. Growth was largely driven by increased consumption spending with higher private investments. Real disposable income also rose by 1.0% from the previous quarter. Personal saving rates were recorded at 3.3%, which is lower than the previous quarter’s rate of 3.8% indicating higher consumption spending during the quarter. Meanwhile, the Australian economy’s GDP increased at an annual rate of 1.5% through the year to June 2024, largely supported by higher consumption spending.

Domestic economic activities trended favorably in July 2024

Indicators in the primary sector demonstrated favourable movements in July 2024. Total agricultural exports significantly increased over the month by 303.1 tonnes (82.2%), attributed largely to higher export volumes of root crops, coconut, and kava. The local supply has shown signs of improvement this month due to the ongoing harvest season for various vegetables and root crops. Coincidently, total agricultural export proceeds also increased by $0.3 million (308.8%). Total marine export volumes significantly increased by 114.6 metric tonnes (230.0%) due to higher tuna exports, while aquarium exports rose by 3,600 pieces (36.1%). This coincided with an increase of 17.2% ($0.03 million) in the total marine export receipts.

Credit to the industrial sector rose in July 2024, indicating active performances during the month. Lending to the construction sector rose by $0.9 million (4.6%) over the month, along with a slight increase observed in lending to the mining & quarrying and utilities sectors. The public sector undertook several road and construction projects in preparation for the Pacific Islands Forum (PIF) throughout August. Meanwhile, construction permits issued to businesses, residential dwellings, and churches increased compared to the previous month signalling promising growth for the sector.

The services sector continued to be vibrant in July 2024, driven by recreational activities hosted by local businesses and in preparation for the PIF. Over the month, total passenger arrivals increased by 2,683 passengers (24.3%), including travellers arriving via multiple cruise ships, whilst total passenger departures significantly rose by 7,889 passengers (106.7%). In addition, the increase in traveller arrivals/departures is reflective of multiple international rugby games that were held in Tonga throughout the month. Total travel receipts increased substantially by $4.0 million (27.3%). Meanwhile, total container registrations increased by 587 containers (79.6%). Business containers substantially increased by 537 containers, which also includes the import of prefab container houses for the PIF. In July 2024, total imports payment excluding oil increased by $4.0 million (8.1%), with an increase in the wholesale & retail imports payment of $1.5 million (4.3%).

Job vacancies slowed down in August 2024

The Reserve Bank’s survey for job advertisements indicates that there were 65 job vacancies advertised in August 2024. This is a decline from the 107 job vacancies advertised in July 2024. The total job vacancies advertised during the month were predominantly from public administration and transport & communications sectors. Over the year to August 2024, total job vacancies advertised to the public declined by 38 vacancies (3.9%). Total job vacancies over the year to August 2024 is attributed mostly to public administration, transport & communications, utilities, hotel & restaurants sectors, and financial intermediation.

Headline inflation fell to 3.0% in July 2024

The Consumer Price Index declined over the month by 2.9%, supported by lower domestic and imported prices in July 2024. The decrease in domestic prices was largely driven by lower prices of local food items (12.6% decline), catering services, and clothing. This reduction is reflective of the slowdown in demand and consumption as the festive season came to a close. The majority of other imported goods prices declined over the month including food items, and goods for personal care. Meanwhile, prices of construction materials, household items, and clothing took an increase over the month. Imported inflation has been highly prone to the war-induced disruptions, particularly on the energy markets and the shipping logistics and freights.

Over the year to July 2024, headline inflation declined to 3.0% in July 2024 from 5.4% in June 2024 and 4.6% in July 2023. This is the lowest rate since the 2.9% in August 2023. Imported inflation contributed around 0.4 percentage points (pps) to the headline inflation, stemmed mostly from fuel, goods for personal care, household items, and alcoholic beverages. The overall contribution from the imported inflation was offset by the lower prices of imported food items, non-alcoholic beverages, construction materials, and tobacco. On the contrary, domestic prices contributed 2.6 pps to the headline inflation. The main drivers were local food items, kava Tonga, electricity, transport services, and alcoholic beverages. Meanwhile prices of catering services, Tongan tobacco, tertiary education, clothing, and other labour costs declined over the year.

Core inflation slightly fell to 1.6% in July 2024 from 1.7% in June 2024. This is the lowest rate since 1.0% in October 2021. At the same time, non-core inflation declined to 4.2% in July 2024 from 8.0% in June 2024. This is indicative of the significant decline in food prices and a moderate reduction in the price of fuel over the month.

Effective exchange rates fell in August 2024

The Nominal Effective Exchange Rate (NEER) declined over the month by 1.6%, underpinned by the depreciation in the Tongan Pa’anga against all major trading currencies except the USD. Similarly, the Real Effective Exchange Rate (REER) fell in August 2024 by 2.1%, coinciding with the lower NEER.

On a year-end basis, the NEER weakened by 1.0% compared to the previous year as the TOP generally depreciated against all major currencies except USD, JPY and EUR. This depreciation will likely elevate imported inflation as overseas payments become more expensive. However, the REER continued to increase over the year by 1.2% in line with Tonga’s relatively higher inflation rate.

Foreign reserves continue declining in August 2024

Foreign reserves continued to decline by $3.6 million over the month of August, attributed to outflows for import payments. However, this remain sufficient to cover 10.4 months of imports, which is well above the 7.5 months recommended by the IMF. Similarly, twelve months prior, reserves were $14.5 million lower than current levels. The majority of the official foreign reserves are held in USD, NZD, and AUD.

Remittances remained elevated in July 2024

Remittance receipts have continued to record a rising trend since March 2024, with this upward trend persisting in July as total receipts increased by $3.0 million (6.5%). This is consistent with the festive events held throughout the month including the Heilala festival, annual churche conferences, as well as other private events which have historically attracted a lot of foreign fund donnations from Tongan diaspora abroad. Private transfers remained the dominant factor driving the overall increase in remittances, in line with the rise in both private capital transfers and social benefits.

The Australia labor market remained relatively strong due to ongoing shortages in specific sectors, helping to contribute to the 9.2% growth in remittances received inAUD for the month. Receipts in the New Zealand dollar continued to decline, reflecting oa weakening New Zealand economy. The ongoing depreciation of the Tongan pa’anga against the US dollar also contributed to the overall monthly growth.

However, total remittance receipts remain weakened over the year by $16.1 million (3.0%), reflecting a slow down in remittance for coping purposes following the HTHH Volcanic eruption disaster in January 2022

Broad money declined

Broad money decreased in July 2024, by $20.4 million (2.3%) over the month. However, annually an increase of $28.8 million (3.4%) to $885.6 million was observed. Net foreign assets fell over the month and year, in line with the declined in foreign reserves. Net domestic assets on the other hand, increased over the month and year, reflecting higher net credit (lower government deposits) to the Tongan government.

Reserve money decreased

Liquidity in the financial system also fell in July 2024, by $18.1 million (2.9%) over the month and $7.7 million (1.2%) over the year, to a total of $613.7 million. The Exchange Settlement Account’s (ESA) declined over the month and year. This decline was offset by increases in both the Currency in Circulation (CIC) and the Statutory Required Deposits (SRD). The decline in ESA was in line with the net sales of foreign currency to the commercial banks and the net withdrawals from the Reserve Bank vault.

Credit growth increased

The banks’ total lending rose over the month and year for July by $3.3 million (0.6%) and $24.5 million (4.8%) respectively, to $536.8 million.This reflected a continued improvement of consumer confidence and economic recovery following the ongoing effects of the HTHH Volcanic Disaster in January 2022.

Over the month, more loans were issued to public enterprises’ and businesses within the tourism, constructions and transport sectors as well as individual housing loans.

Similarly, over the year, lending to businesses within the tourism, distribution and professional & other service sectors’ increased, along with all categories of individual loans with housing loans contributing the most, followed by other personal loans and vehicles loans.

Total bank deposits fell by $23.3 million (2.4%) over the month, but rose annually by $15.9 million (1.7%) to $937.6 million. The lower deposit over the month was mostly driven by the declined demand deposits of the Retirement Funds. The increase in deposits over the year was predominantly contributed from private sectors, Private sector contributions made up the largely preportion of the increase, followed by the the Government and the Retirement Funds. Total loan to deposit ratio increased to 56.1% in July 2024 from 54.5% from the previous month due to both a fall in deposits and increase in total loans.

Interest rates narrowed

In July 2024, the weighted average interest rate spread narrowed by 5.9 basis points from the previous month but rose annually by 3.8 basis points to 6.2%. The deposit rates increased over the month by 4.5 basis points and offsets the fall in lending rates by 1.4 basis points. Both savings and demand deposit rates rose over the month and offset the decline in time deposit rates. Despite the rising deposit rates, the volume of deposits declined over the month by $23.3 million (2.4%), mainly driven by lower demand deposits from the Retirement Funds, Central Government and private businesses. The lower lending rates over the month attributed mainly to lower non-profit organisations’ rates, all household lending rates, other commercial loan rates and business rates offered to the tourism, utilities and agricultural sectors.

Over the year, the lending rates increased by 5.7 basis points whilst the deposit rates rose by 1.9 basis points. Lending rates offered to the entertainment & catering, agricultural and fisheries sectors increased over the month as well as the non-profit organisations and other commercial loan rates. Similarly, all deposit rates increased over the year, led by savings deposit rates, then followed by higher time and demand deposit rates. The rising deposits rates corresponds to the higher volume of deposits over the year, rising by $15.9 million (1.7%) driven mostly by higher demand and time deposits.

Financial Stability

The latest revised Aggregate Financial Stability Index (AFSI) for Tonga (December 23) indicates a slight quarter-on-quarter improvement of 0.72 index points to 0.67 since September 2023. The increase is predominantly attributed to improvements within the Financial Development (FDI) and World Economic Conditions (WECI) Indexes outpacing decreases in Tonga’s Financial Vulnerability (FVI) and Financial Soundness (FSI) Indexes. Key economic indicators causing this shift include improvements in Tonga’s Credit-to-GDP ratio as well a reduction in the Chicago Board Options Market Volitility Index. Annually the AFSI increased by 3.3 index points from 0.636 with the FSI being the only sub-index to experience a decline. Most notably, due to the significant deterioration of the domestic bank’s Non-Performing Loans (NPL) ratio. Tonga’s AFSI remains above the long-term average of 0.58.

Outlook

The overall economic outlook remains positive, supported by infrastructure projects, tourism, and domestic events. However, global geopolitical tensions and potential disruptions to trade could pose downside risks. Inflation has eased but a supply shock may elevate prices again. The NRBT will closely monitor the inflationary environment and implement appropriate monetary policy measure to maintain price stability. Collaborative efforts with the Government are essential to address underlying supply-demand issues and mitigate inflation pressures. Foreign reserves are expected to remain at comfortable levels, above the IMF’s prescribed level of 7.5 months of imports cover in the near to medium term. The financial system maintains stability with high liquidity and banks holding sufficient capital reserves. The Reserve Bank is currently reviewing its monetary policy tools in light of the current macro-economic conditions to continue and ensure both price and financial stability.