- Monthly Economic Update - September 2025 DOWNLOAD THE FULL UPDATE | PDF • 984 KB

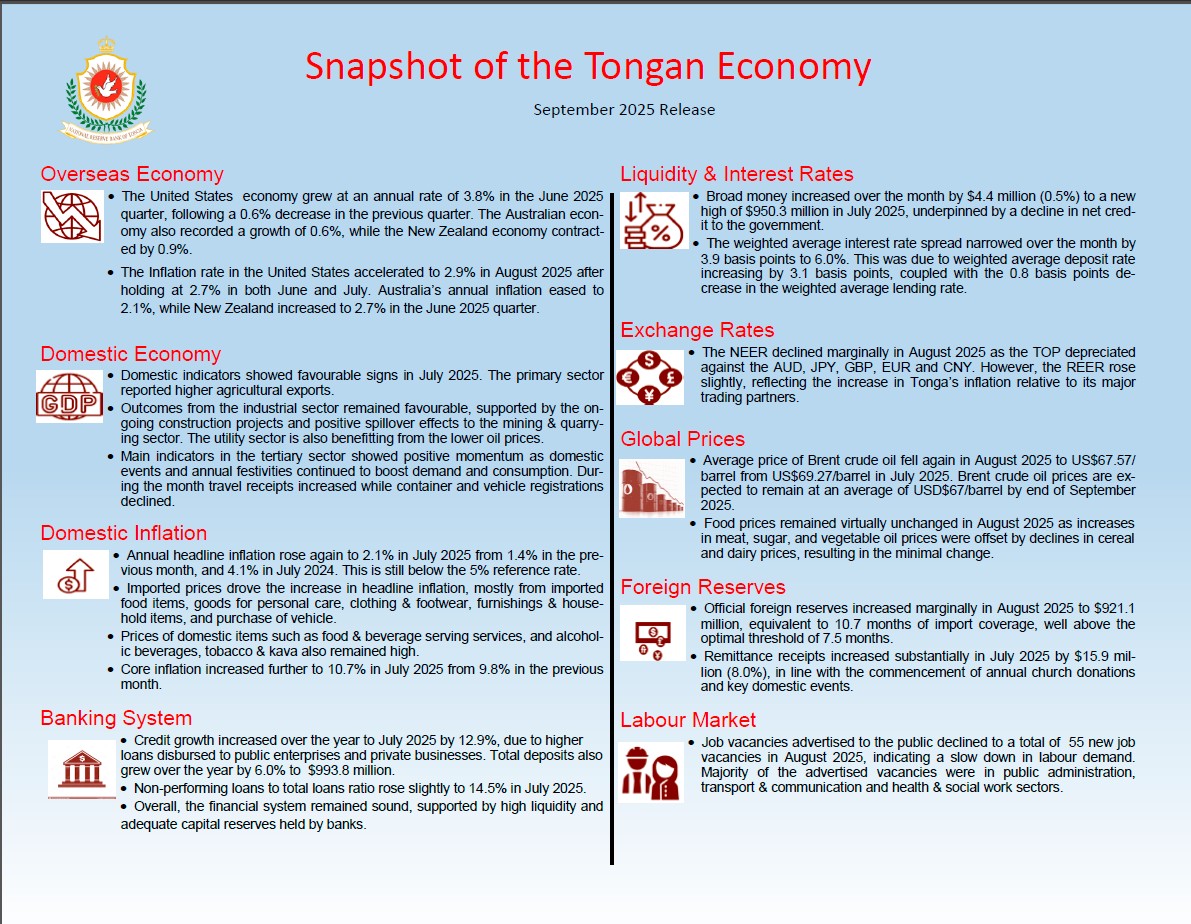

Mixed outcomes in major trading partner economies

The United States (US) Bureau of Economic Analysis reported that the US economy grew by 3.8% in the June quarter of 2025, after a contraction of 0.6% in the previous quarter. This stemmed from higher consumer spending and lower imports, which offset the decreases in investment and exports. Australia also recorded a growth of 0.6% in the second quarter of 2025, marking the fastest pace of growth in two years. This was driven by increases in household and government consumption. The New Zealand economy, however, contracted by 0.9% during the same period due to slow activities in the manufacturing, construction, and agricultural sectors.

Meanwhile, the annual inflation in the US accelerated to 2.9% in August 2025, after holding at 2.7% in June and July. This reflects pass-through of trade tariffs into consumer prices. For Australia, annual inflation rate eased to 2.1% in the June 2025 quarter from 2.4% in the last quarter, due to a significant fall in automotive fuel prices. In New Zealand, the annual headline inflation rose to 2.7% in the June 2025 quarter, higher than the 2.5% in the previous quarter. This increase was driven by higher local authority rates and payments.

Most indicators remained favourable as domestic events continues

Indicators in the primary sector showed mixed results in July 2025. Total agricultural export volumes improved by 48.7 tonnes (6.4%) compared to June 2025, driven largely by higher exports of cassava, yam, and squash. At the same time, total agricultural export receipts recorded a slight increase of $0.03 million (3.8%). Meanwhile, total marine export receipts declined over the month by $0.2 million (57.5%).

Partial indicators of the industry sector are mostly positive. Loans to the construction sector recorded an increase of $0.9 million (4.3%), while lending to the utilities sector rose by $0.06 million (18.8%). These positive credit trends reflect the ongoing construction activities associated with the Tonga Climate Resilient Transport Project II (TCRTP II), Upgrade of Queen Salote Wharf, the new parliament house, and other private projects. At the same time, construction import payments also showed an increase of $0.2 million (4.4%) in July 2025.

Main indicators in the tertiary sector showed positive momentum at the end of the festive period. Domestic events such as the Heilala Festival and church conferences attracted more remittances in July, fuelling aggregate demand and consumption. Despite a decline in container registrations by 316 containers (24.3%), total import payments excluding oil, rose over the month by $5.1 million (10.7%), including higher wholesale & retail import payments of $2.5 million (7.2%). This could be from advance import payments which will be coming into Tonga in the upcoming months. Travel receipts also increased by $4.7 million (32.5%) supported by both business and personal travels and corresponding to the local events. On the other hand, total vehicle registrations decreased by 54 vehicles (15.5%).

Fewer job vacancies advertised during August 2025

The NRBT’s job advertisement survey recorded 55 job vacancies in August 2025, a decline from 82 job vacancies in the previous month. Most of the advertised vacancies were in public administration, transport & communication, and health & social work sectors. Over the year to August 2025, the total number of job vacancies advertised declined by 129 (13.6%), suggesting a slowdown in labour demand. Majority of the advertised vacancies were in public administration, transport & communication, business services, and financial intermediation sectors.

Annual headline inflation further rose to 2.1% in July 2025

The monthly Consumer Price Index declined by 2.0% in July 2025, owing primarily to a decrease in domestic prices. The decline was largely driven by lower local food prices and electricity tariffs. Domestic demand corresponds to the ongoing festive season while local supply conditions remained favorable. Electricity tariffs declined by $0.13/kWh to $0.85/kWh, reflecting the pass-through of the lower global oil prices to domestic prices. Higher prices of imported food items and goods for personal care pushed up import prices during the month, but were largely offset by the declining domestic prices.

Headline inflation picked up to 2.1% in July 2025 from 1.4% in June 2025, but still lower than the 4.1% in July 2024. The uptick in headline inflation reflects base effects from July 2024, despite a month-on-month slowdown. In other words, although prices in July were generally lower than that in June, they were higher when compared to the same month last year. The key contributor to the headline was from import prices of food items, goods for personal care, clothing & footwear, furnishings & household items, and purchase of vehicle. Meanwhile, prices of domestic items such as food & beverage serving services, and alcoholic beverages, tobacco & kava still remains high. On the other hand, local food prices and electricity tariffs declined on annual basis, partially offsetting some of the increases.

Core inflation rose again to 10.7% in July 2025 from 9.8% in the previous month. Among imported components, personal care items, clothing & footwear, furnishings & household items, and purchase of vehicles were key contributors to the core inflation. Domestically, notable drivers included food & beverage serving services, alcoholic beverages, tobacco & kava, and passenger transport services. Contrarily, non-core inflation recorded a decline of 4.4% as a result of favourable prices of local food and energy commodity. This suggests excess demand in the market keeping core prices high, despite the decline in the non-core prices.

Nominal Effective exchange rate declined slightly in August 2025

The Nominal Effective Exchange Rate (NEER) recorded a marginal decline of 0.1% in August, reflecting the depreciation of the TOP against the AUD, JPY, GBP, EUR and CNY. Over the year, however, the NEER recorded a 0.7% increase. On the other hand, the Real Effective Exchange Rate (REER) is expected to increased by 1.1% during the month, and 2.1% over the year. This aligns with the modest rise in inflation in Tonga, and thereby reduce Tonga’s trade competitiveness.

Foreign Reserves increased marginally in August 2025

Foreign reserves increased slightly by $0.1 million to $921.1 million in August 2025, attributed to higher official receipts. This is equivalent to 10.7 months of import coverage, well above the optimal threshold of 7.5 months. Foreign reserves saw a larger increase over the year by $15.6 million, stemming from inflow of foreign aid and remittances. The majority of official foreign reserves are held in USD, NZD, and AUD.

Remittances on a new record high in July 2025

Remittance receipts increased substantially by $15.9 million (8.0%) in July 2025 to a new high of $52.8 million, coinciding with some major local events. Additionally, an increase in employee compensation and private capital transfers contributed to the higher inflow. Remittance receipts from Australia recorded the largest increase of $5.4 million, followed by $0.9 million from New Zealand and $0.4 million from the United States, respectively. This also reflects Tonga’s participation in seasonal labour mobility schemes in Australia and New Zealand. Over the year, total remittances continued to increase by $23.0 million (4.4%), reflecting continued support from the Tongan diaspora and active participation in the labour mobility schemes.

Money supply expanded whilst Reserve money declined in July 2025

Broad money increased over the month and over the year to July 2025 by $4.4 million (0.5%) and $64.7 million (7.3%) respectively, to a new high level of $950.3 million. The monthly increase was driven mostly by an increase in net domestic assets by $8.5 million (48.2%) underpinned by lower net credit to the central government, which more than offset the $4.0 million (0.4%) decline in net foreign assets. Over the year, both the net domestic assets and net foreign assets increased by $49.3 million (212.2%) and $15.6 million (1.7%), respectively, pushing broad money higher. Net domestic assets increased on the back of higher lending to the private sectors along with lower net credit to the central government. The net foreign assets increased annually in line with the higher foreign reserves.

Liquidity in the banking system decreased over the month but increased annually in July 2025, by $0.9 million (0.1%) and $16.4 million (2.7%), respectively. The monthly decline was attributed to a drop in the Exchange Settlement Accounts (ESA) outweighing the increase in Statutory Required Deposits (SRD) and Currency in Circulation (CIC). Annually, all the ESA, SRD, and CIC increased, contributing to the excess liquidity in the banking system.

Positive monthly credit growth returns

The banks’ total lending rose by $0.8 million (0.1%) over the month and $69.2 million (12.9%) annually, to $606.0 million in July 2025. Over the month, lending to businesses within the distribution, constructions and professional & other services sectors increased. Annually, more loans were issued to public enterprises and private businesses such as professional & other services, distribution and tourism sectors. Household loans however, declined over the month mainly for housing and vehicles loans. Nonetheless total household loans increased over the year.

The non-performing loans to total loans ratio slightly rose to 14.5% in July 2025, from 14.2% in June 2025, and remained higher compared to 11.6% a year ago. This reflect rising arrears from both private businesses and household loans during the month. Historically, problem loans are comprised mainly of business loans.

Total bank deposits declined over the month by $8.3 million (0.8%), however increased annually in July-25 by $56.2 million (6.0%) to $993.8 million. The demand deposits fell over the month by $13.3 million (2.6%), and offsets the increased time and saving deposits, reflecting lower deposits from the central government and overseas banks. Annually, both demand and time deposits increased by $94.7 million (22.9%) and $34.5 million (12.4%) respectively, and outweighed the lower saving deposits. The higher demand and time deposits were mainly from the central government, retirement funds, non-profit organisations, public enterprises, microfinance businesses and private businesses. The total loan to deposit ratio increased to 59.9% in July 2025, from 59.3% in the previous month and from 56.2% recorded in July last year. This stemmed from deposits declining at a faster pace, offsetting the margingal increase in lending.

Interest rates spread narrowed in July 2025

The weighted average interest rate spread narrowed over the month and over the year to July 2025 by 3.9 basis points and 18.4 basis points respectively, to 6.0%. The monthly decline was attributed to the weighted average deposit rate increasing by 3.1 basis points, coupled with the 0.8 basis points decrease in the weighted average lending rate. Annually, the weighted average lending rate decreased again by 23.4 basis points, and offset the 5.0 basis points fall in weighted average deposit rate. The favourable movement in weighted average lending rates corresponds with the pick-up in credit growth at a lower interest rate, while the increasing deposit volumes at lower interest rate continues to weigh down on the weighted average deposit rates.

Outlook

The NRBT’s latest projection paints a more favourable outlook for the Tongan economy, driven by the implementation of several infrastructure projects already in the pipeline, and supported by the recovery in tourism and agriculture. However, downside risks such as the weakening global growth and elevated uncertainties on trade policies remains.

While there are some fluctuations projected for inflation over the coming months, headline inflation is anticipated not to rise above the 5% reference rate. Domestic supply and demand mismatches will keep core inflation high, although partially offset by the declining oil prices. Core inflation is expected to converge back to the headline once supply catches up with demand. Foreign reserves will remain at sufficient levels above the minimum thresholds to cater for the expected pick-up in Tonga’s foreign obligations, particularly import payments and foreign debt servicing.

The financial system is well capitalised with stable liquidity to sustain its soundness in the near term. Positive credit growth is expected in line with the economic recovery and new financing initiatives, while systemic risks from deteriorating asset quality continued to be closely monitored. The expected issuance of NRBT notes will assist in mopping the excess liquidity in the system, and over time the returns may be passed through to deposit interest rates.

Given the state of the economy and the outlook, the NRBT maintains its neutral stance as stated in its August 2025 Monetary Statement, to ensure the resilience of the financial system in the face of elevated risks. The NRBT will also start issuing NRBT notes in September 2025 at the new 2% mid-rate, to mop up some of the excess liquidity in the banking system and to support its effort in strengthening the monetary policy transmission.